Region:Asia

Author(s):Rebecca

Product Code:KRAA5536

Pages:93

Published On:January 2026

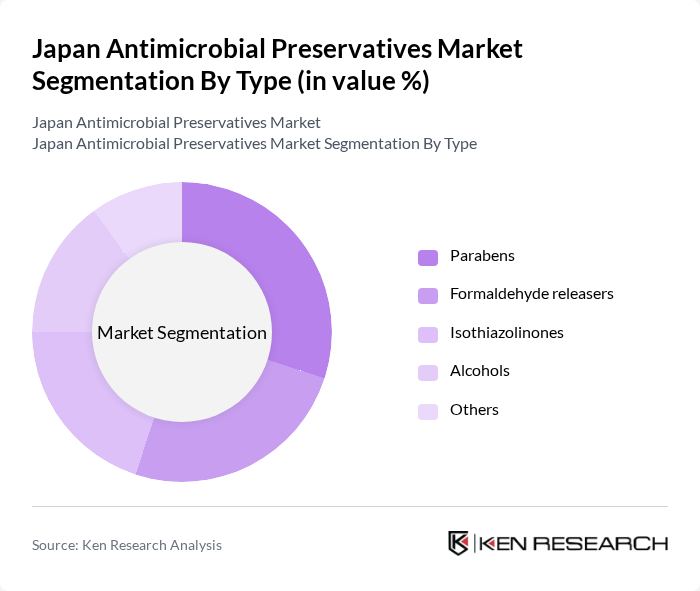

By Type:

The dominant subsegment in the Type category is Parabens, which are widely used in personal care products due to their effective antimicrobial properties and cost-effectiveness. Consumer preference for products with proven safety and efficacy has led to a sustained demand for Parabens, despite some concerns regarding their safety. The versatility of Parabens in various formulations, including creams and lotions, further solidifies their market leadership.

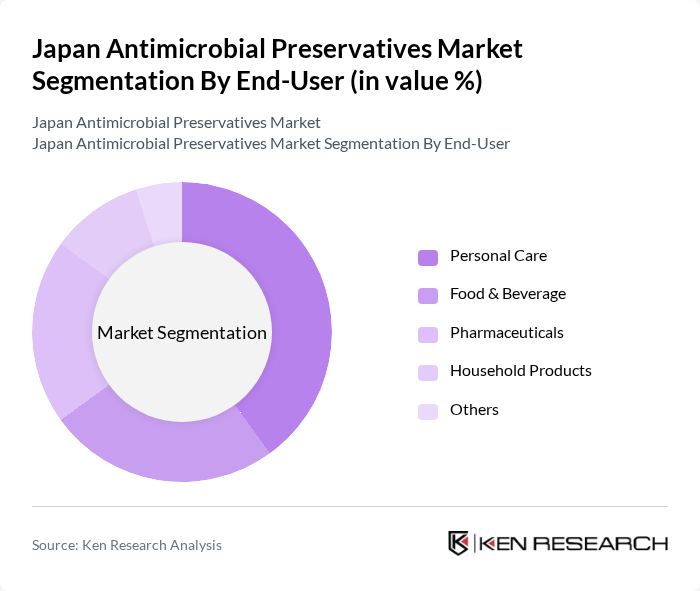

By End-User:

In the End-User category, the Personal Care segment leads the market, driven by the increasing consumer focus on skincare and hygiene products. The rise in disposable income and changing lifestyles have led to higher spending on personal care items, which often require antimicrobial preservatives to ensure product safety and longevity. This trend is further supported by the growing awareness of health and wellness among consumers.

The Japan Antimicrobial Preservatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Lonza Group AG, AkzoNobel N.V., Clariant AG, Eastman Chemical Company, Ashland Global Holdings Inc., Solvay S.A., Croda International Plc, Mitsubishi Gas Chemical Company, Inc., KAO Corporation, Shiseido Company, Limited, Fancl Corporation, Nihon Nohyaku Co., Ltd., Toho Chemical Industry Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan antimicrobial preservatives market appears promising, driven by ongoing innovations and a shift towards sustainability. As consumer preferences evolve, manufacturers are likely to invest in research and development to create eco-friendly preservatives that align with market trends. Additionally, the expansion of e-commerce platforms will facilitate greater access to personal care and food products, further enhancing market growth. The focus on product safety and quality will continue to shape the landscape of this industry in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Parabens Formaldehyde releasers Isothiazolinones Alcohols Others |

| By End-User | Personal Care Food & Beverage Pharmaceuticals Household Products Others |

| By Application | Skin Care Products Hair Care Products Oral Care Products Food Preservation Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Others |

| By Region | Kanto Kansai Chubu Kyushu Others |

| By Regulatory Compliance | Food Safety Compliance Cosmetic Safety Compliance Environmental Compliance Others |

| By Product Formulation | Liquid Formulations Solid Formulations Gel Formulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetics Industry | 45 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceuticals Sector | 40 | Regulatory Affairs Managers, R&D Directors |

| Food & Beverage Sector | 50 | Food Safety Officers, Production Managers |

| Household Products | 35 | Marketing Managers, Product Line Managers |

| Industrial Applications | 30 | Procurement Managers, Technical Sales Representatives |

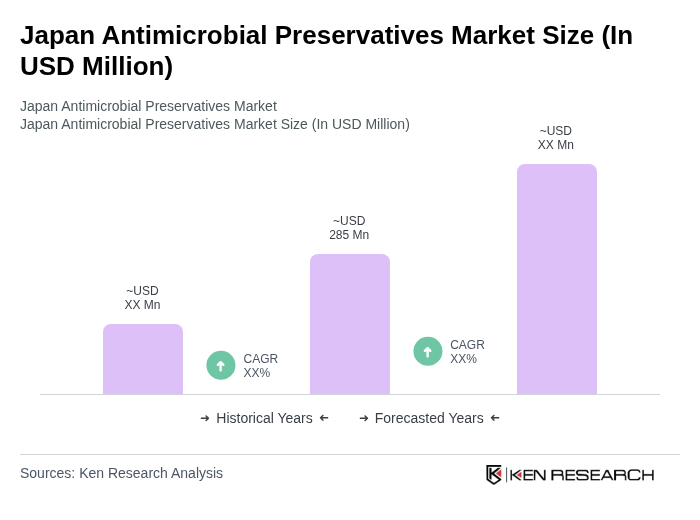

The Japan Antimicrobial Preservatives Market is valued at approximately USD 285 million, reflecting a robust growth driven by increasing demand in personal care products, food safety regulations, and heightened consumer awareness regarding health and hygiene.