Region:Middle East

Author(s):Rebecca

Product Code:KRAA5523

Pages:88

Published On:January 2026

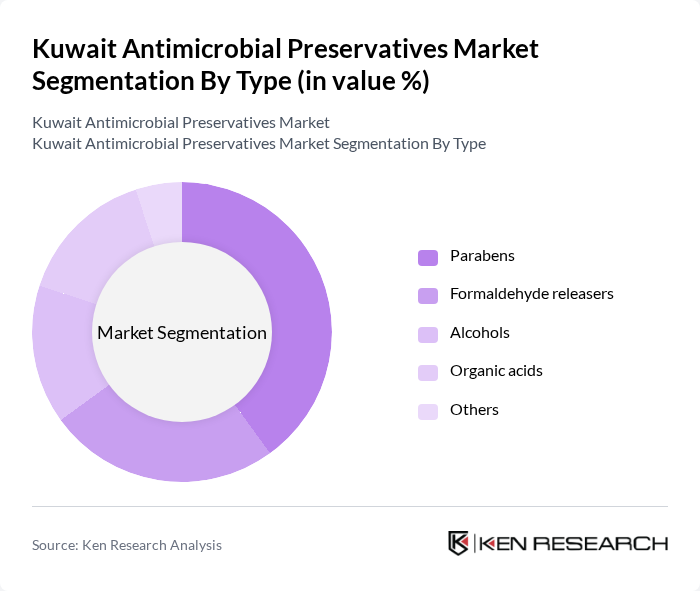

By Type:The market is segmented into various types of antimicrobial preservatives, including Parabens, Formaldehyde releasers, Alcohols, Organic acids, and Others. Among these, Parabens are the most widely used due to their effectiveness and cost-efficiency in personal care products. The growing consumer preference for natural and organic products is gradually shifting the focus towards organic acids, which are gaining traction in the market.

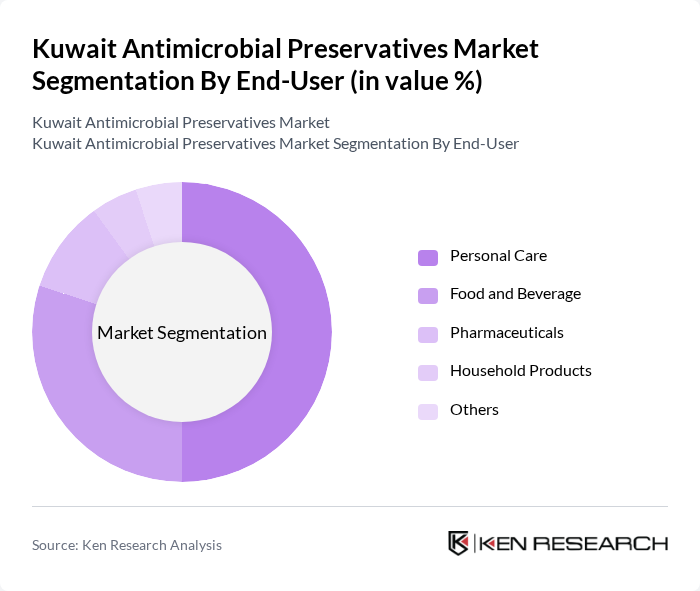

By End-User:The end-user segmentation includes Personal Care, Food and Beverage, Pharmaceuticals, Household Products, and Others. The Personal Care segment dominates the market, driven by the high demand for skincare and cosmetic products that require effective preservatives. The Food and Beverage sector is also significant, as manufacturers seek to enhance product shelf life and safety through the use of antimicrobial agents.

The Kuwait Antimicrobial Preservatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Lonza Group AG, AkzoNobel N.V., Clariant AG, Eastman Chemical Company, Ashland Global Holdings Inc., Croda International Plc, Solvay S.A., Symrise AG, Evonik Industries AG, Huntsman Corporation, Wacker Chemie AG, Mitsubishi Chemical Corporation, Kemin Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait antimicrobial preservatives market appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly seek natural and organic products, manufacturers are likely to innovate in developing eco-friendly preservatives. Additionally, the expansion of e-commerce platforms is expected to facilitate greater access to personal care and food products, further driving demand. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Parabens Formaldehyde releasers Alcohols Organic acids Others |

| By End-User | Personal Care Food and Beverage Pharmaceuticals Household Products Others |

| By Application | Skin Care Products Hair Care Products Oral Care Products Food Preservation Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Others |

| By Regulatory Compliance | GSO Compliance International Standards Compliance Local Health Regulations Others |

| By Product Formulation | Liquid Formulations Powder Formulations Gel Formulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Quality Assurance Managers, Production Supervisors |

| Cosmetics and Personal Care Producers | 80 | Product Development Managers, Regulatory Affairs Specialists |

| Pharmaceutical Companies | 70 | Research and Development Heads, Compliance Officers |

| Retail Sector Stakeholders | 60 | Procurement Managers, Category Managers |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Health Inspectors |

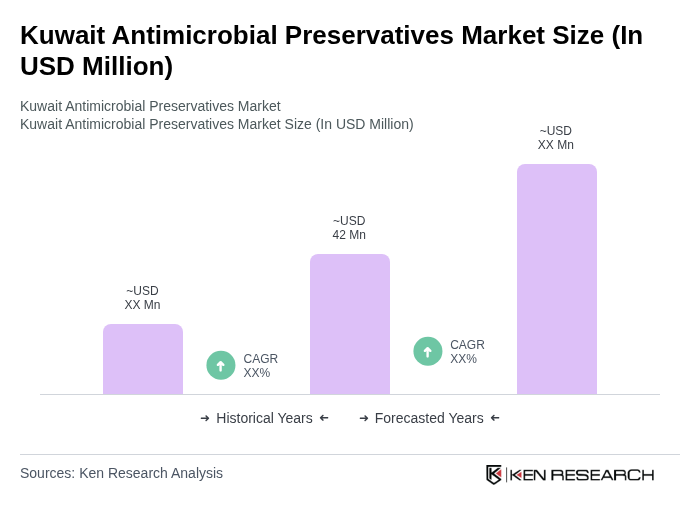

The Kuwait Antimicrobial Preservatives Market is valued at approximately USD 42 million, reflecting a five-year historical analysis. This growth is driven by increasing demand in personal care, food, and pharmaceutical sectors for effective preservatives that enhance product shelf life and safety.