Region:Global

Author(s):Rebecca

Product Code:KRAA5533

Pages:83

Published On:January 2026

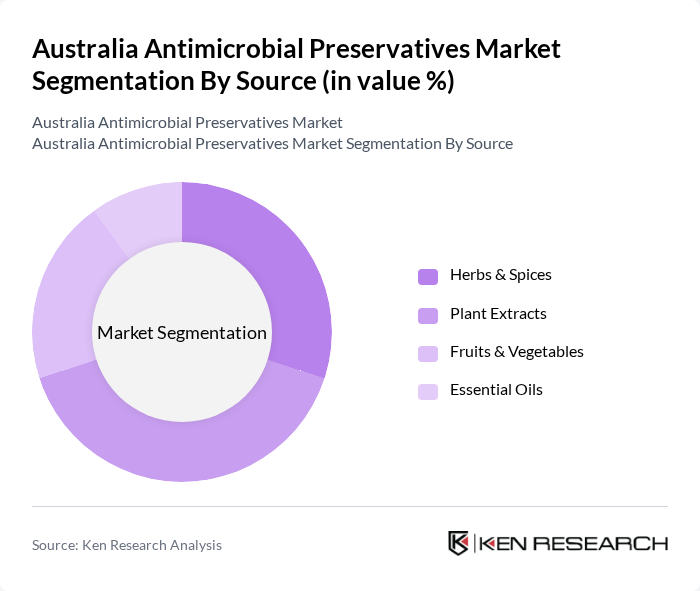

By Source:The market is segmented into four primary sources: Herbs & Spices, Plant Extracts, Fruits & Vegetables, and Essential Oils. Among these, Plant Extracts are leading the market due to their natural origin and consumer preference for clean-label products. The trend towards organic and natural ingredients has significantly boosted the demand for plant-based preservatives, making them a popular choice among manufacturers. Herbs & Spices also hold a substantial share, driven by their multifunctional properties and traditional usage in food preservation.

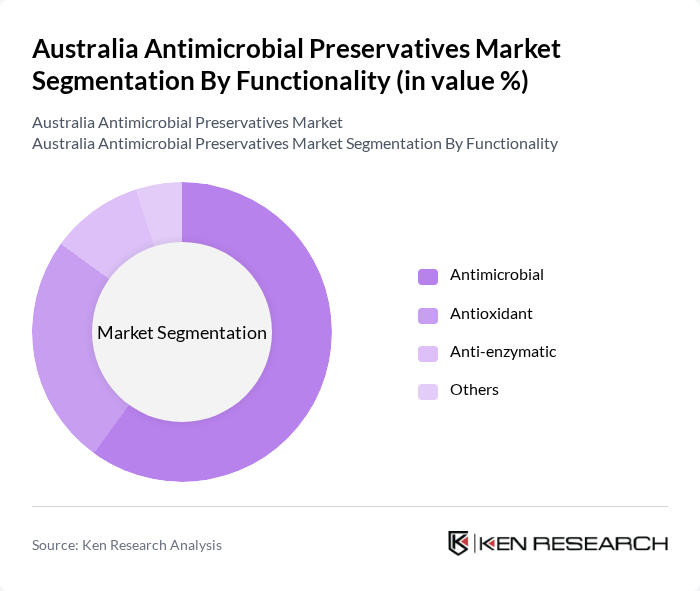

By Functionality:The market is categorized into Antimicrobial, Antioxidant, Anti-enzymatic, and Others. The Antimicrobial segment dominates the market, driven by the increasing need for food safety and preservation. Consumers are becoming more health-conscious, leading to a higher demand for products that can inhibit microbial growth. Antioxidants are also gaining traction, particularly in the food and beverage sector, as they help in maintaining product quality and extending shelf life. Powder formulations currently lead the market due to superior handling, flexible formulation, and enhanced storage stability, with applications in processed cheese, baked goods, and cured meats.

The Australia Antimicrobial Preservatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Lonza Group, Cargill, Kemin Industries, Evonik Industries, Tate & Lyle PLC, The Health Ingredients Co., New Directions Australia, N-essentials, Botanic Inspiration, Chemiplas Australia, Croda International Plc, Solvay S.A., Symrise AG, Ashland Global Holdings Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia antimicrobial preservatives market appears promising, driven by ongoing innovations and a shift towards sustainable practices. As manufacturers invest in research and development, the introduction of novel formulations that meet consumer demands for safety and efficacy is expected to gain traction. Additionally, the expansion into emerging markets presents significant growth potential, allowing companies to diversify their product offerings and enhance their competitive edge in the global landscape.

| Segment | Sub-Segments |

|---|---|

| By Source | Herbs & Spices Plant Extracts Fruits & Vegetables Essential Oils |

| By Functionality | Antimicrobial Antioxidant Anti-enzymatic Others |

| By Application | Bakery & Confectionery Dairy & Frozen Products Snacks & Beverages Meat & Poultry Sauces & Dressings Personal Care Pharmaceuticals |

| By Product Form | Powder Liquid Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetics Industry | 100 | Product Development Managers, Regulatory Affairs Specialists |

| Food and Beverage Sector | 80 | Quality Assurance Managers, Food Safety Officers |

| Pharmaceuticals | 70 | Research Scientists, Compliance Managers |

| Household Products | 60 | Marketing Managers, Product Safety Experts |

| Industrial Applications | 50 | Procurement Managers, Technical Sales Representatives |

The Australia Antimicrobial Preservatives Market is valued at approximately USD 69 million, reflecting a significant focus on food safety and shelf-life extension across various industries, including food and beverages, personal care, and pharmaceuticals.