Region:Global

Author(s):Rebecca

Product Code:KRAA5541

Pages:88

Published On:January 2026

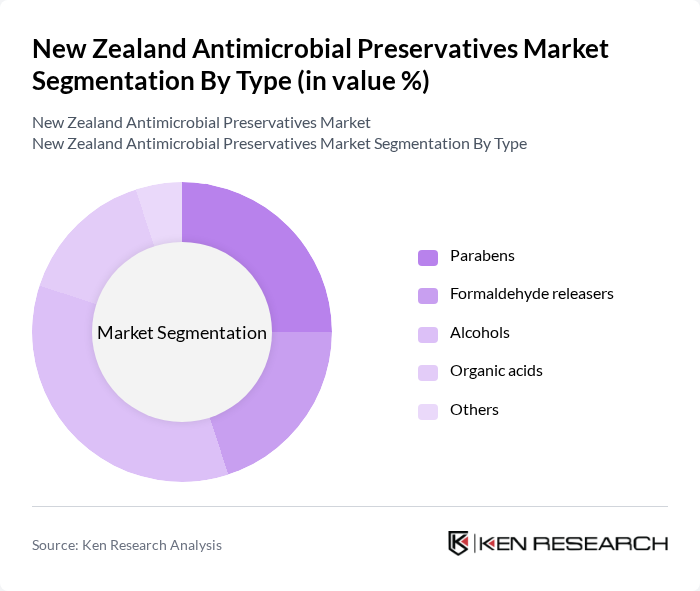

By Type:

The market is segmented by type into Parabens, Formaldehyde releasers, Alcohols, Organic acids, and Others. Among these, Alcohols are the leading sub-segment due to their widespread use in personal care products and household cleaners. The increasing consumer preference for alcohol-based sanitizers, especially post-pandemic, has significantly boosted the demand for this category. Parabens and Formaldehyde releasers also hold substantial market shares, driven by their effectiveness as preservatives in cosmetics and pharmaceuticals.

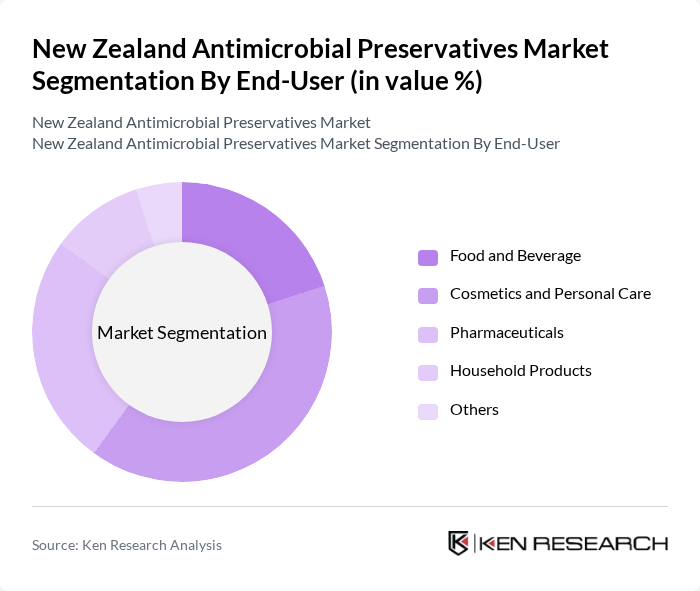

By End-User:

The end-user segmentation includes Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Household Products, and Others. The Cosmetics and Personal Care segment dominates the market, driven by the increasing demand for skincare and beauty products that require effective preservation. The Food and Beverage sector also plays a significant role, as manufacturers seek to extend shelf life and ensure product safety. The Pharmaceuticals segment is growing steadily, reflecting the need for safe and effective preservatives in medicinal products.

The New Zealand Antimicrobial Preservatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Lonza Group AG, AkzoNobel N.V., Clariant AG, Eastman Chemical Company, Ashland Global Holdings Inc., Croda International Plc, Solvay S.A., Symrise AG, Evonik Industries AG, Huntsman Corporation, Wacker Chemie AG, Seppic S.A., Kemin Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand antimicrobial preservatives market appears promising, driven by increasing consumer demand for safety and quality in food and personal care products. Innovations in bio-based preservatives and sustainable practices are expected to gain traction, aligning with global trends towards environmentally friendly solutions. Additionally, the rise of e-commerce platforms is likely to enhance product accessibility, allowing manufacturers to reach a broader audience and adapt to changing consumer preferences more effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Parabens Formaldehyde releasers Alcohols Organic acids Others |

| By End-User | Food and Beverage Cosmetics and Personal Care Pharmaceuticals Household Products Others |

| By Application | Food Preservation Cosmetic Formulations Pharmaceutical Products Industrial Applications Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Region | North Island South Island |

| By Regulatory Compliance | FSANZ Compliance TGA Compliance Others |

| By Product Formulation | Liquid Formulations Powder Formulations Gel Formulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 45 | Quality Assurance Managers, Product Development Leads |

| Cosmetics and Personal Care | 38 | Formulation Chemists, Regulatory Affairs Specialists |

| Pharmaceutical Sector Insights | 35 | Production Managers, Compliance Officers |

| Market Trends and Innovations | 28 | Industry Analysts, Research Scientists |

| Regulatory Compliance and Standards | 24 | Regulatory Consultants, Legal Advisors |

The New Zealand Antimicrobial Preservatives Market is valued at approximately USD 155 million, reflecting a five-year historical analysis. This growth is driven by increasing consumer awareness of product safety and the demand for preserved products across various sectors.