Japan Calcined Shale Market Overview

- The Japan Calcined Shale Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for high-performance construction materials and the rising trend of sustainable building practices. The market is also supported by advancements in calcination technology, which enhance the quality and application of calcined shale in various industries.

- Key players in this market include Tokyo, Osaka, and Nagoya, which dominate due to their robust industrial infrastructure and high construction activity. These cities are central to Japan's economic activities, leading to a higher demand for calcined shale in construction and other applications, thus driving market growth.

- In 2023, the Japanese government implemented regulations aimed at promoting the use of eco-friendly materials in construction. This includes incentives for using calcined shale, which is recognized for its lower environmental impact compared to traditional materials. The initiative is part of a broader strategy to achieve sustainability in the construction sector.

Japan Calcined Shale Market Segmentation

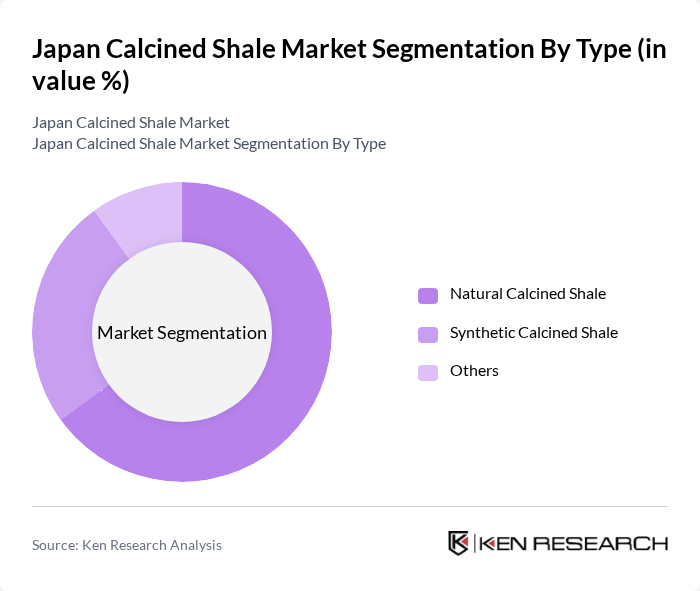

By Type:

The calcined shale market is segmented into three main types: Natural Calcined Shale, Synthetic Calcined Shale, and Others. Among these, Natural Calcined Shale is the leading sub-segment, primarily due to its widespread use in construction and landscaping applications. The preference for natural materials, driven by consumer awareness of sustainability, has significantly boosted its demand. Synthetic Calcined Shale, while growing, is often used in specialized applications, making it less dominant compared to its natural counterpart.

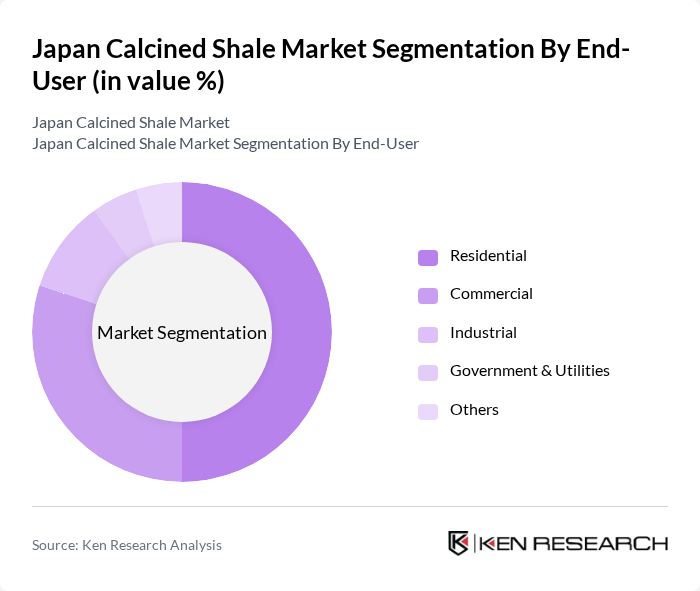

By End-User:

The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment is the most significant contributor to the market, driven by the increasing construction of residential buildings and the growing trend of home renovations. The demand for high-quality materials in residential projects has led to a surge in the use of calcined shale, making it the leading end-user segment. Commercial and Industrial segments follow, with steady growth due to ongoing infrastructure projects.

Japan Calcined Shale Market Competitive Landscape

The Japan Calcined Shale Market is characterized by a dynamic mix of regional and international players. Leading participants such as ShaleTech Corporation, Japan Calcined Shale Co., Ltd., Nihon Calcined Shale Inc., Sumitomo Chemical Co., Ltd., Mitsubishi Materials Corporation, Asahi Glass Co., Ltd., Tokuyama Corporation, JFE Holdings, Inc., Nippon Shokubai Co., Ltd., Daikin Industries, Ltd., Showa Denko K.K., Kuraray Co., Ltd., Chuo Kagaku Co., Ltd., Krosaki Harima Corporation, Tohoku Electric Power Co., Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Japan Calcined Shale Market Industry Analysis

Growth Drivers

- Increasing Demand for Lightweight Construction Materials:The Japanese construction sector is projected to grow significantly, with a focus on lightweight materials. In future, the construction industry is expected to reach ¥20 trillion, driven by urbanization and infrastructure projects. Calcined shale, known for its lightweight properties, is increasingly favored, as it reduces transportation costs and enhances energy efficiency in buildings. This trend aligns with Japan's commitment to sustainable development, further boosting demand for calcined shale in construction applications.

- Rising Environmental Concerns and Sustainability Initiatives:Japan's commitment to reducing carbon emissions by 46% in future has spurred interest in eco-friendly materials. The government has allocated ¥2 trillion for green initiatives, promoting the use of sustainable construction materials like calcined shale. This material's lower environmental impact compared to traditional options positions it favorably in a market increasingly focused on sustainability. As awareness of environmental issues grows, the demand for calcined shale is expected to rise significantly in the coming years.

- Technological Advancements in Calcination Processes:Innovations in calcination technology are enhancing the efficiency and quality of calcined shale production. In future, investments in R&D are projected to exceed ¥500 billion, focusing on energy-efficient processes that reduce production costs. These advancements not only improve product quality but also lower the environmental footprint of calcined shale. As manufacturers adopt these technologies, the market is likely to see increased production capacity and a broader application range, driving growth in the sector.

Market Challenges

- High Production Costs Associated with Calcined Shale:The production of calcined shale involves significant energy consumption, leading to high operational costs. In future, energy prices in Japan are expected to rise by 10%, further straining profit margins for manufacturers. This financial burden can deter potential entrants into the market and limit the expansion of existing players. Consequently, the high production costs pose a substantial challenge to the widespread adoption of calcined shale in construction projects.

- Limited Awareness Among Potential End-Users:Despite its benefits, calcined shale remains relatively unknown among many construction professionals and end-users. A survey conducted in future indicated that only 30% of construction firms were aware of calcined shale's advantages. This lack of awareness hampers market penetration and adoption rates. To overcome this challenge, targeted educational initiatives and marketing strategies are essential to inform stakeholders about the benefits and applications of calcined shale in construction.

Japan Calcined Shale Market Future Outlook

As Japan continues to prioritize sustainable construction practices, the calcined shale market is poised for growth. The increasing focus on lightweight materials and eco-friendly solutions will drive demand, supported by government incentives and technological advancements. Additionally, the expansion of the construction sector, particularly in urban areas, will create new opportunities for calcined shale applications. In future, the market is expected to witness significant developments, with a shift towards innovative production methods and increased collaboration among industry stakeholders.

Market Opportunities

- Growing Interest in Eco-Friendly Building Materials:The rising consumer preference for sustainable construction materials presents a significant opportunity for calcined shale. With the Japanese government promoting green building certifications, manufacturers can capitalize on this trend by positioning calcined shale as a viable alternative to traditional materials, potentially increasing market share and driving sales.

- Potential for Export to Neighboring Countries:Japan's calcined shale industry has the potential to expand its market reach beyond domestic borders. Neighboring countries, such as South Korea and China, are increasingly seeking sustainable construction materials. By leveraging Japan's advanced production techniques and quality standards, manufacturers can explore export opportunities, enhancing revenue streams and market presence in the Asia-Pacific region.