Region:Middle East

Author(s):Rebecca

Product Code:KRAE3323

Pages:84

Published On:February 2026

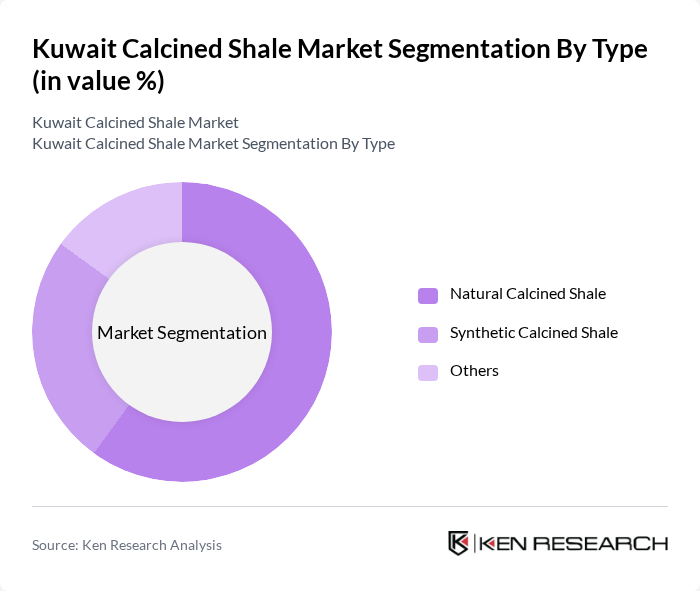

By Type:The market is segmented into three types: Natural Calcined Shale, Synthetic Calcined Shale, and Others. Natural Calcined Shale is gaining traction due to its eco-friendly properties and suitability for various applications. Synthetic Calcined Shale, while less common, is utilized in specialized applications where specific properties are required. The "Others" category includes alternative materials that are emerging in the market.

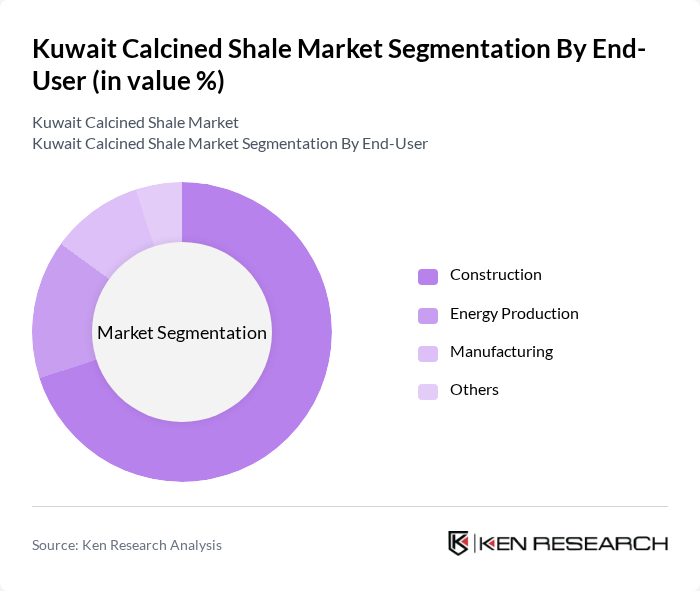

By End-User:The end-user segmentation includes Construction, Energy Production, Manufacturing, and Others. The construction sector is the largest consumer of calcined shale, driven by the increasing demand for sustainable building materials. Energy production also plays a significant role, as calcined shale is used in various energy generation processes. Manufacturing and other sectors are gradually adopting calcined shale for its beneficial properties.

The Kuwait Calcined Shale Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Cement Company, Gulf Cement Company, Al-Qatami Global for General Trading & Contracting, United Cement Company, Kuwait Oil Company, National Industries Company, Alghanim Industries, KGL Holding, Boubyan Petrochemical Company, Al-Mansouria Group, Al-Futtaim Group, Al-Sayer Group, Al-Mazaya Holding, Al-Dhow Company, Al-Bahar Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait calcined shale market appears promising, driven by increasing demand for sustainable construction materials and government support for local production. As infrastructure investments rise, the market is expected to witness a shift towards innovative applications of calcined shale, particularly in energy-efficient building projects. Furthermore, the integration of advanced technologies in calcination processes will likely enhance product quality and reduce environmental impact, positioning the industry for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Calcined Shale Synthetic Calcined Shale Others |

| By End-User | Construction Energy Production Manufacturing Others |

| By Application | Cement Production Insulation Materials Road Construction Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Others |

| By Product Form | Powdered Calcined Shale Granular Calcined Shale Others |

| By Market Segment | Residential Commercial Industrial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Utilization | 100 | Project Managers, Procurement Specialists |

| Energy Sector Applications | 80 | Energy Analysts, Operations Managers |

| Manufacturing Insights | 70 | Production Managers, Quality Control Officers |

| Environmental Impact Assessments | 60 | Environmental Consultants, Regulatory Affairs Managers |

| Market Trends and Forecasts | 90 | Market Analysts, Business Development Managers |

The Kuwait Calcined Shale Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing demand in construction and energy sectors, as well as a shift towards sustainable building materials.