Region:Asia

Author(s):Rebecca

Product Code:KRAE3322

Pages:93

Published On:February 2026

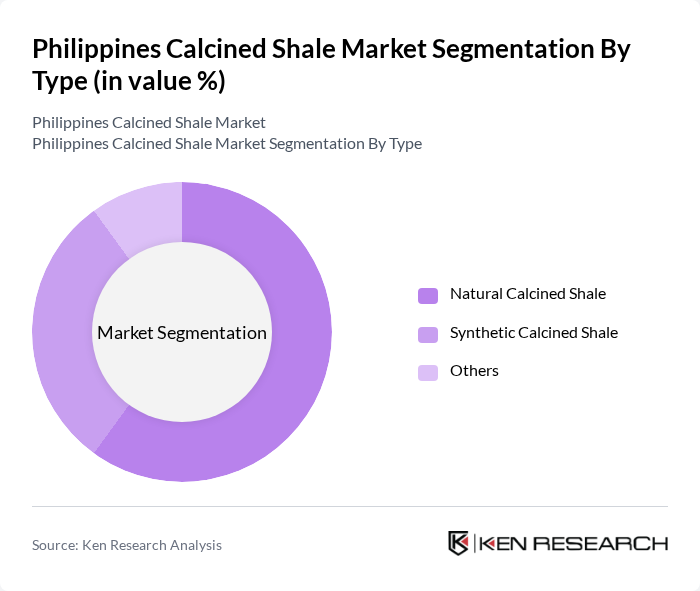

By Type:The market is segmented into Natural Calcined Shale, Synthetic Calcined Shale, and Others. Natural Calcined Shale is primarily used due to its availability and cost-effectiveness, while Synthetic Calcined Shale is gaining traction for specialized applications.

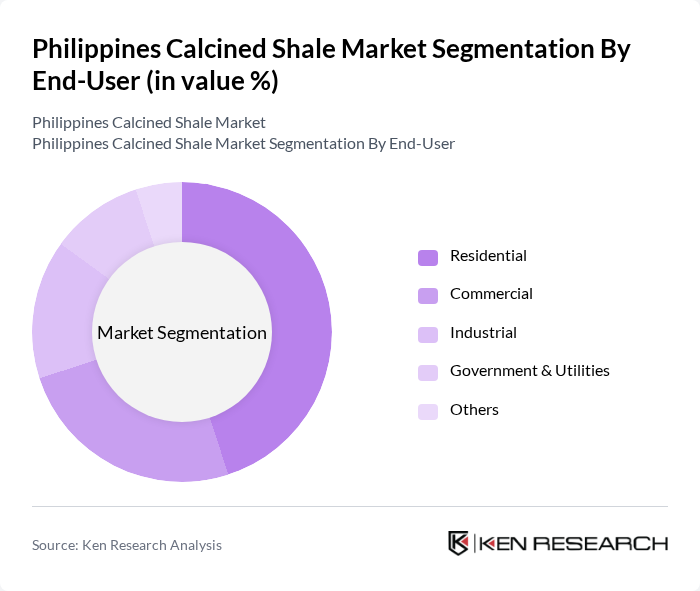

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment is the largest due to the ongoing housing projects and urbanization trends in the Philippines.

The Philippines Calcined Shale Market is characterized by a dynamic mix of regional and international players. Leading participants such as Holcim Philippines, Inc., Eagle Cement Corporation, Republic Cement & Building Materials, Inc., Lafarge Republic, Inc., Cemex Holdings Philippines, Inc., Northern Cement Corporation, Philcement Corporation, Davao Oriental Cement Corporation, Solid Cement Corporation, Mindanao Cement Corporation, First Philippine Holdings Corporation, San Miguel Corporation, Aboitiz InfraCapital, Inc., DMCI Holdings, Inc., JG Summit Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the calcined shale market in the Philippines appears promising, driven by increasing urbanization and a strong push for sustainable construction practices. As the government continues to invest in infrastructure, the demand for calcined shale is expected to rise significantly. Additionally, advancements in production technologies will likely enhance efficiency and reduce costs, making calcined shale more competitive against alternative materials. The market is poised for growth, with opportunities for innovation and collaboration within the construction sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Calcined Shale Synthetic Calcined Shale Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Luzon Visayas Mindanao |

| By Application | Construction Roadworks Landscaping Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Product Form | Powdered Calcined Shale Granulated Calcined Shale Others |

| By Market Segment | Large Enterprises SMEs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Utilization | 100 | Project Managers, Site Engineers |

| Cement Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Road Construction Applications | 70 | Infrastructure Planners, Civil Engineers |

| Research & Development in Ceramics | 60 | R&D Managers, Product Development Specialists |

| Environmental Impact Assessments | 50 | Sustainability Consultants, Environmental Engineers |

The Philippines Calcined Shale Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing demand for construction materials, particularly in the infrastructure sector as the country urbanizes and develops economically.