Region:Africa

Author(s):Dev

Product Code:KRAB5525

Pages:85

Published On:October 2025

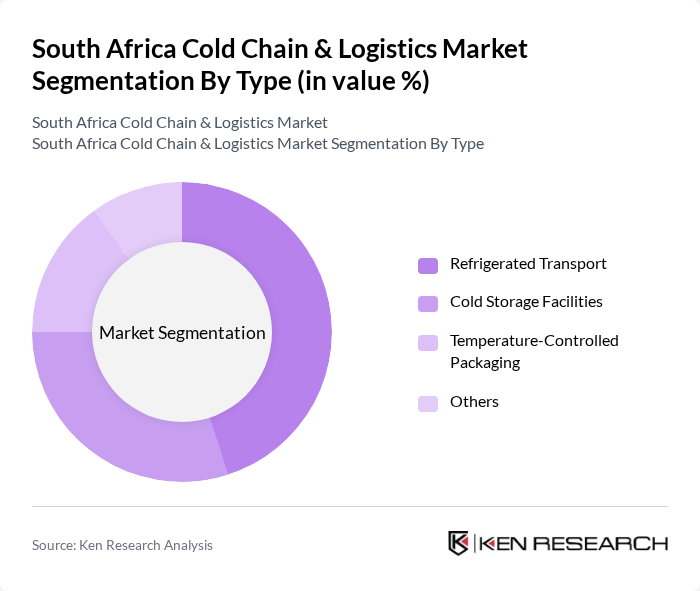

By Type:

The major subsegments under this category include Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, and Others. Among these, Refrigerated Transport is the leading subsegment, driven by the rising demand for fresh produce and perishable goods. The growth of e-commerce has further accelerated the need for efficient refrigerated transport solutions, as consumers increasingly expect quick delivery of temperature-sensitive items. Cold Storage Facilities also play a crucial role, particularly in preserving the quality of food and pharmaceuticals, but the dynamic nature of consumer preferences has positioned Refrigerated Transport as the dominant force in the market.

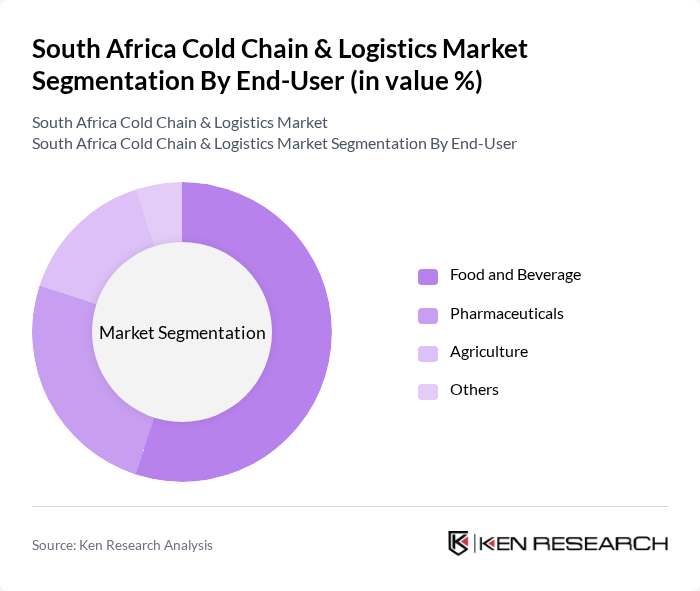

By End-User:

This segmentation includes Food and Beverage, Pharmaceuticals, Agriculture, and Others. The Food and Beverage sector is the most significant contributor, driven by the increasing demand for fresh and frozen products. The rise in health consciousness among consumers has led to a surge in demand for organic and perishable food items, necessitating robust cold chain logistics. Pharmaceuticals also represent a critical segment due to the stringent requirements for temperature control in drug storage and transportation, but the Food and Beverage sector's larger market size positions it as the leading end-user.

The South Africa Cold Chain & Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bidvest Group Limited, Imperial Logistics Limited, Cold Chain Solutions, Kuehne + Nagel South Africa, DSV South Africa, Transnet Freight Rail, RCL Foods, Africold Logistics, Bidvest Waltons, SAA Cargo, Imperial Cold Logistics, TFG Logistics, DHL Supply Chain South Africa, MDS Logistics, AFS Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African cold chain logistics market appears promising, driven by technological innovations and increasing consumer demand for fresh products. As the e-commerce sector continues to expand, logistics providers are likely to invest in automated solutions and IoT technologies to enhance efficiency. Furthermore, the government's commitment to improving infrastructure will play a crucial role in addressing current challenges, enabling better access to rural markets and supporting the growth of the cold chain sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Others |

| By End-User | Food and Beverage Pharmaceuticals Agriculture Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Distribution Others |

| By Application | Fresh Produce Frozen Foods Pharmaceuticals Others |

| By Sales Channel | Retail Wholesale Online Sales Others |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Cold Storage Facilities Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 100 | Supply Chain Managers, Quality Assurance Officers |

| Food & Beverage Temperature Control | 120 | Logistics Coordinators, Operations Managers |

| Chemical Product Distribution | 80 | Procurement Managers, Safety Compliance Officers |

| Retail Cold Chain Logistics | 90 | Warehouse Managers, Inventory Control Specialists |

| Cold Chain Technology Adoption | 70 | IT Managers, Technology Implementation Leads |

The South Africa Cold Chain & Logistics Market is valued at approximately USD 1.2 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and retail channels.