Region:Europe

Author(s):Dev

Product Code:KRAA1485

Pages:94

Published On:August 2025

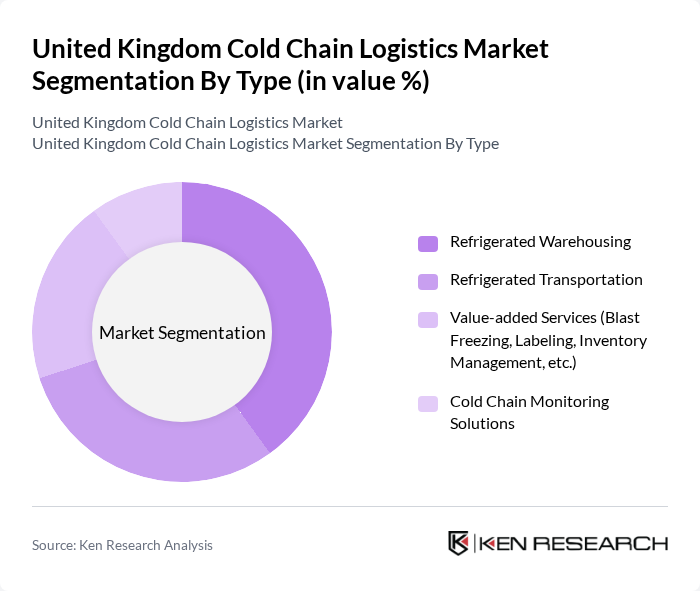

By Type:The cold chain logistics market is segmented into four main types: Refrigerated Warehousing, Refrigerated Transportation, Value-added Services (such as Blast Freezing, Labeling, Inventory Management, etc.), and Cold Chain Monitoring Solutions. Each segment is essential for maintaining the integrity and quality of temperature-sensitive products throughout the supply chain, with increasing emphasis on digital monitoring and automation for improved traceability and compliance.

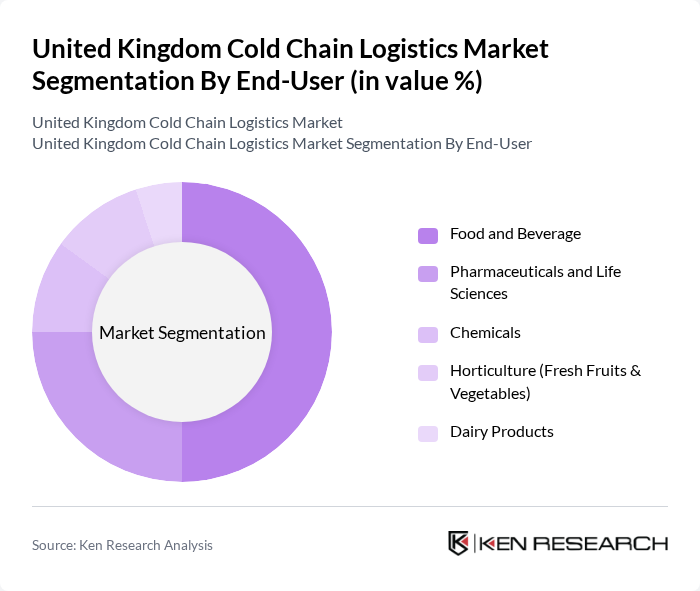

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals and Life Sciences, Chemicals, Horticulture (Fresh Fruits & Vegetables), Dairy Products, and Others. The food and beverage sector remains the largest end-user, driven by the rising demand for fresh and frozen products, while the pharmaceutical sector is expanding due to the need for temperature-controlled storage and transportation of sensitive medications, including biologics and vaccines. The horticulture segment is also growing, supported by increasing consumer preference for fresh produce and strict regulatory standards.

The United Kingdom Cold Chain Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Kuehne + Nagel, Lineage Logistics, Americold Logistics, Magnavale Ltd, Reed Boardall Cold Storage Ltd., NewCold Cooperatief UA, AGRO Merchants Group, Chiltern Cold Storage Group Ltd., Seafast Logistics Ltd., Kerry Logistics Network Ltd., Gist Limited, Fowler Welch, NFT Distribution Operations Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK cold chain logistics market appears promising, driven by technological innovations and evolving consumer preferences. As the demand for perishable goods continues to rise, companies are expected to invest in automation and sustainable practices. Furthermore, the integration of IoT technologies will enhance operational efficiency, enabling real-time monitoring and improved compliance with food safety regulations. This dynamic environment will likely foster collaboration between logistics providers and local producers, ensuring a more resilient supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehousing Refrigerated Transportation Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.) Cold Chain Monitoring Solutions |

| By End-User | Food and Beverage Pharmaceuticals and Life Sciences Chemicals Horticulture (Fresh Fruits & Vegetables) Dairy Products Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Application | Fresh Produce (Fruits & Vegetables) Dairy & Frozen Desserts Meats, Fish, Poultry & Seafood Beverages Pharmaceuticals, Life Sciences & Chemicals Bakery & Confectionery Processed Food Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Ambient (15°C to 25°C) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 120 | Supply Chain Managers, Quality Control Officers |

| Pharmaceutical Cold Storage | 80 | Logistics Coordinators, Compliance Managers |

| Biotechnology Product Distribution | 60 | Operations Directors, Regulatory Affairs Specialists |

| Retail Cold Chain Management | 70 | Warehouse Managers, Inventory Control Analysts |

| Temperature-Controlled Transportation | 50 | Fleet Managers, Logistics Analysts |

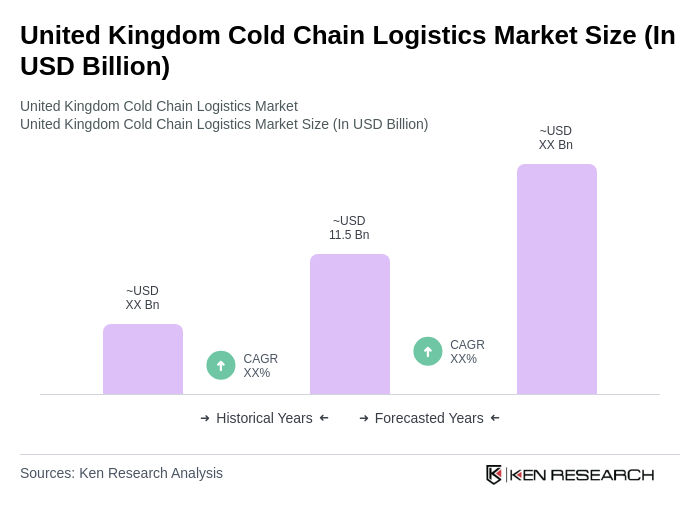

The United Kingdom Cold Chain Logistics Market is valued at approximately USD 11.5 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with advancements in logistics technology and infrastructure.