Region:Asia

Author(s):Rebecca

Product Code:KRAA6206

Pages:85

Published On:January 2026

Market.png)

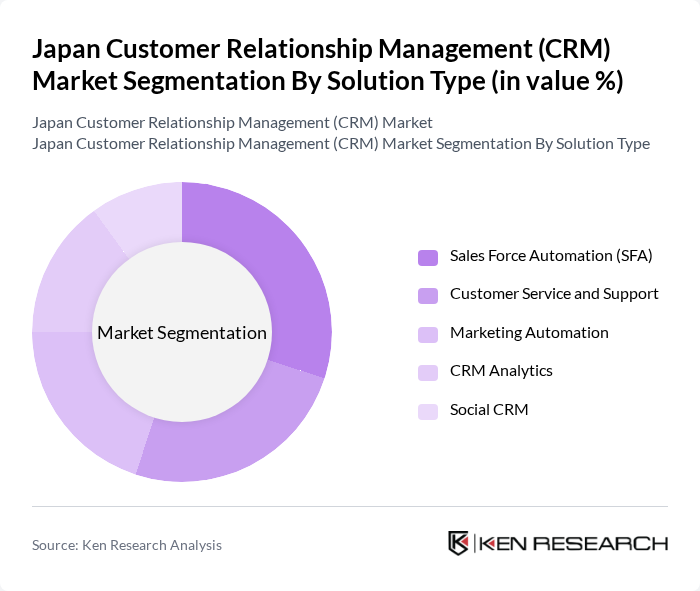

By Solution Type:The CRM market can be segmented into various solution types, including Sales Force Automation (SFA), Customer Service and Support, Marketing Automation, CRM Analytics, and Social CRM. Each of these solutions plays a crucial role in enhancing customer interactions and improving business processes.

The Sales Force Automation (SFA) segment is currently leading the market due to its ability to streamline sales processes, enhance productivity, and improve sales forecasting. Businesses are increasingly recognizing the importance of automating sales tasks to focus on strategic activities, which drives the demand for SFA solutions. The growing trend of remote work and digital sales channels has further accelerated the adoption of SFA tools, making it a critical component of CRM strategies.

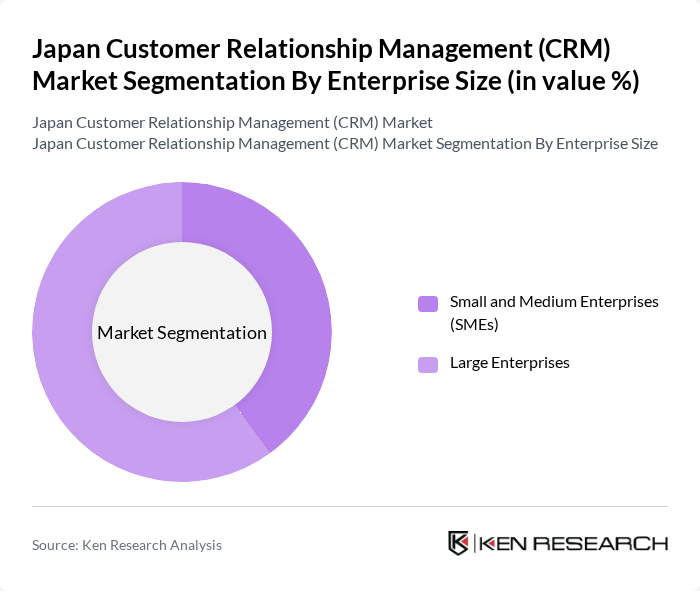

By Enterprise Size:The CRM market is also segmented by enterprise size, which includes Small and Medium Enterprises (SMEs) and Large Enterprises. Each segment has distinct needs and approaches to CRM implementation.

Large Enterprises dominate the CRM market due to their extensive customer bases and complex operational needs. These organizations often require advanced CRM solutions that can integrate with existing systems and provide comprehensive analytics. The significant investment capacity of large enterprises allows them to adopt sophisticated CRM technologies, which enhances their customer engagement strategies and operational efficiencies.

The Japan Customer Relationship Management (CRM) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, SAP, Adobe, Oracle, Microsoft Dynamics 365, HubSpot, Zoho CRM, Fujitsu, NEC Corporation, NTT Data, and Cybozu contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CRM market in Japan is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt AI and machine learning, CRM systems will become more sophisticated, enabling predictive analytics and enhanced customer insights. Furthermore, the rise of mobile CRM solutions will facilitate real-time engagement, allowing companies to connect with customers seamlessly across various platforms. This evolution will create a more dynamic and responsive market landscape, fostering innovation and improved customer relationships.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Sales Force Automation (SFA) Customer Service and Support Marketing Automation CRM Analytics Social CRM |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Deployment Mode | On-Premises Cloud-Based |

| By Industry Vertical | Retail & E-commerce BFSI (Banking, Financial Services & Insurance) Healthcare IT & Telecom Media & Entertainment Manufacturing Government & Public Sector Others |

| By End Use | B2B B2C B2B2C Others |

| By Geographic Region | Kanto Region Kansai/Kinki Region Chubu/Central Region Kyushu-Okinawa Region Tohoku Region Chugoku Region Hokkaido Region Shikoku Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail CRM Solutions | 120 | Marketing Managers, Customer Experience Directors |

| Financial Services CRM Adoption | 100 | Product Managers, IT Directors |

| Healthcare CRM Implementation | 80 | Operations Managers, Patient Relations Officers |

| Manufacturing CRM Strategies | 70 | Sales Managers, Supply Chain Coordinators |

| Technology Sector CRM Trends | 90 | Business Development Managers, Customer Success Leaders |

The Japan Customer Relationship Management (CRM) market is valued at approximately USD 1.4 billion. This growth is driven by the increasing adoption of digital transformation strategies, e-commerce expansion, and the demand for personalized customer experiences.