Region:Middle East

Author(s):Rebecca

Product Code:KRAA6202

Pages:100

Published On:January 2026

Market.png)

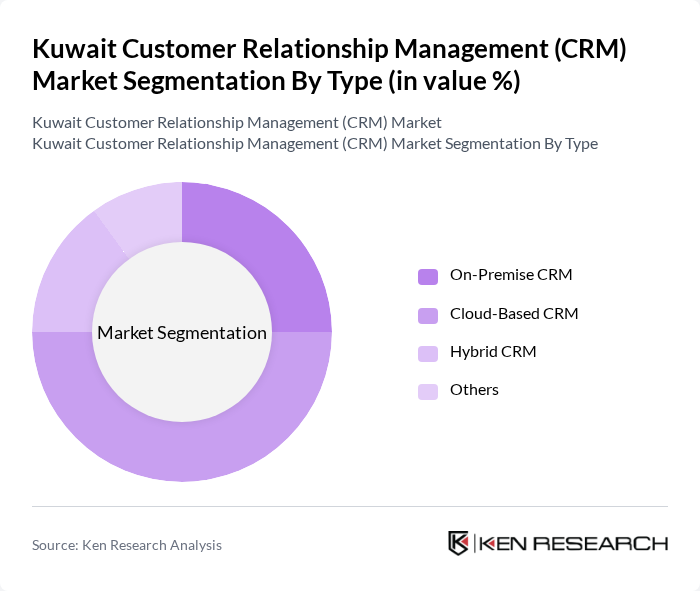

By Type:The CRM market can be segmented into On-Premise CRM, Cloud-Based CRM, Hybrid CRM, and Others. Among these, Cloud-Based CRM is gaining significant traction due to its flexibility, scalability, and cost-effectiveness. Businesses are increasingly opting for cloud solutions to enhance collaboration and access customer data from anywhere, which is crucial in today's remote working environment. On-Premise CRM, while still relevant, is witnessing a decline as companies shift towards more agile cloud solutions.

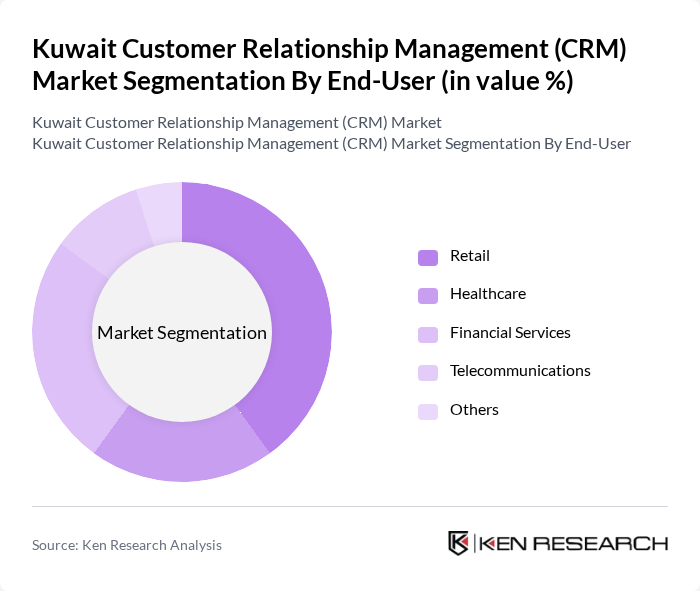

By End-User:The end-user segmentation includes Retail, Healthcare, Financial Services, Telecommunications, and Others. The Retail sector is the leading end-user of CRM solutions, driven by the need for personalized customer interactions and effective management of customer relationships. Retailers are leveraging CRM systems to analyze consumer behavior, optimize marketing strategies, and enhance customer loyalty, making it a critical component of their business strategy.

The Kuwait Customer Relationship Management (CRM) Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP, Salesforce, Microsoft Dynamics 365, Oracle CRM, Zoho CRM, HubSpot, Freshworks, Pipedrive, SugarCRM, Insightly, Nimble, Bitrix24, Keap, Monday.com, Odoo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CRM market in Kuwait appears promising, driven by ongoing digital transformation and increasing consumer expectations. As businesses prioritize customer-centric strategies, the integration of advanced technologies such as AI and machine learning will become essential. Furthermore, the rise of mobile CRM solutions is expected to enhance accessibility and user engagement. With government support for digital initiatives, the market is poised for significant growth, fostering innovation and improved customer experiences across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise CRM Cloud-Based CRM Hybrid CRM Others |

| By End-User | Retail Healthcare Financial Services Telecommunications Others |

| By Industry Vertical | Banking and Financial Services Travel and Hospitality Education Manufacturing Others |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud Others |

| By Functionality | Sales Management Marketing Automation Customer Service Analytics Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail CRM Usage | 100 | Marketing Managers, Customer Experience Directors |

| Financial Services CRM Implementation | 80 | Sales Executives, IT Managers |

| Telecommunications Customer Engagement | 70 | Customer Service Managers, Product Managers |

| Hospitality Sector CRM Strategies | 60 | Operations Managers, Guest Relations Officers |

| Healthcare CRM Adoption | 50 | Practice Managers, IT Directors |

The Kuwait Customer Relationship Management (CRM) market is valued at approximately USD 32 million, reflecting a significant growth trend driven by digital transformation and the demand for personalized customer experiences among businesses in the region.