Region:Asia

Author(s):Dev

Product Code:KRAB0374

Pages:90

Published On:August 2025

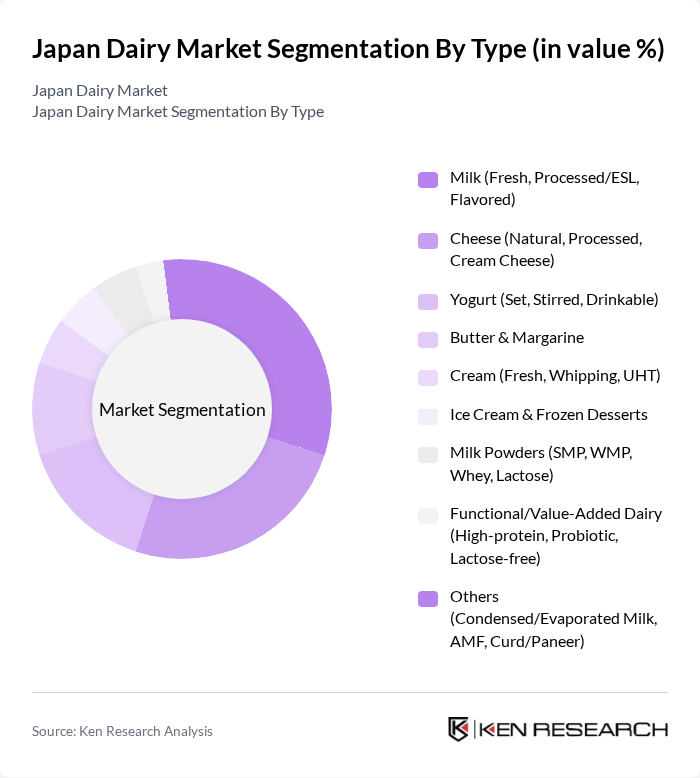

By Type:The dairy market can be segmented into various types, including milk, cheese, yogurt, butter & margarine, cream, ice cream & frozen desserts, milk powders, functional/value-added dairy, and others. Each sub-segment caters to different consumer preferences and dietary needs, with specific trends influencing their growth.

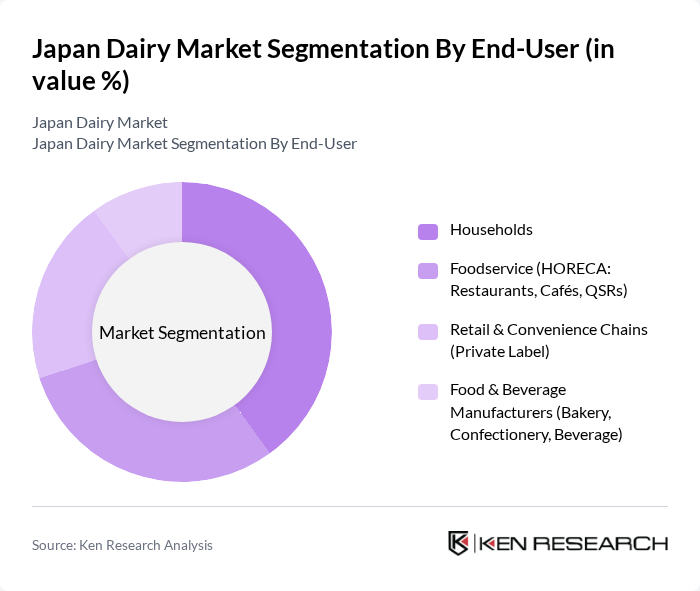

By End-User:The end-user segmentation includes households, foodservice (HORECA: Restaurants, Cafés, QSRs), retail & convenience chains (private label), and food & beverage manufacturers (bakery, confectionery, beverage). Each segment has distinct purchasing behaviors and preferences that influence the overall market dynamics.

The Japan Dairy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meiji Holdings Co., Ltd. (Meiji Co., Ltd.), Morinaga Milk Industry Co., Ltd., Yakult Honsha Co., Ltd., Megmilk Snow Brand Co., Ltd., Hokkaido Milk Products Co., Ltd. (Hokunyu), Glico Dairy Products Co., Ltd. (Ezaki Glico Co., Ltd.), Nippon Milk Community Co., Ltd. (Megmilk Snow Brand Group), Calpis Co., Ltd. (Asahi Group), Asahi Group Holdings, Ltd. (Asahi Beverages), Kirin Holdings Company, Limited (Kirin Beverage/Monozukuri), Morinaga & Co., Ltd. (distinct from Morinaga Milk), Fujiya Co., Ltd., Lawson, Inc. (Private Label Dairy), Aeon Co., Ltd. (Topvalu Private Label Dairy), Lactalis Group (Japan) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan dairy market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, dairy producers are likely to focus on developing functional and organic products. Additionally, the expansion of e-commerce platforms will facilitate greater access to dairy products, enhancing consumer convenience. With ongoing investments in sustainable practices and technology, the industry is poised for growth, adapting to meet the demands of a changing market landscape while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk (Fresh, Processed/ESL, Flavored) Cheese (Natural, Processed, Cream Cheese) Yogurt (Set, Stirred, Drinkable) Butter & Margarine Cream (Fresh, Whipping, UHT) Ice Cream & Frozen Desserts Milk Powders (SMP, WMP, Whey, Lactose) Functional/Value-Added Dairy (High-protein, Probiotic, Lactose-free) Others (Condensed/Evaporated Milk, AMF, Curd/Paneer) |

| By End-User | Households Foodservice (HORECA: Restaurants, Cafés, QSRs) Retail & Convenience Chains (Private Label) Food & Beverage Manufacturers (Bakery, Confectionery, Beverage) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Grocery/E-commerce Direct-to-Consumer (Milk delivery, Subscription) Foodservice/On-trade |

| By Product Form | Liquid Solid/Semi-solid Powdered |

| By Packaging Type | Cartons (Aseptic/Tetra Pak) Bottles (HDPE/PET/Glass) Pouches Cups/Tubs Cans |

| By Price Range | Premium Mid-Range Economy |

| By Region | Hokkaido Tohoku Kanto Chubu Kansai Chugoku Shikoku Kyushu & Okinawa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Farmers | 90 | Farm Owners, Production Managers |

| Retail Sector Insights | 80 | Store Managers, Category Buyers |

| Consumer Preferences | 140 | Health-Conscious Consumers, Families |

| Dairy Product Distributors | 70 | Logistics Coordinators, Sales Representatives |

| Industry Experts | 50 | Market Analysts, Academic Researchers |

The Japan Dairy Market is valued at approximately USD 32.5 billion, reflecting a robust growth driven by increasing consumer demand for dairy products, particularly through off-trade channels and the rising popularity of functional dairy items like yogurt and probiotic drinks.