Region:North America

Author(s):Dev

Product Code:KRAC0451

Pages:84

Published On:August 2025

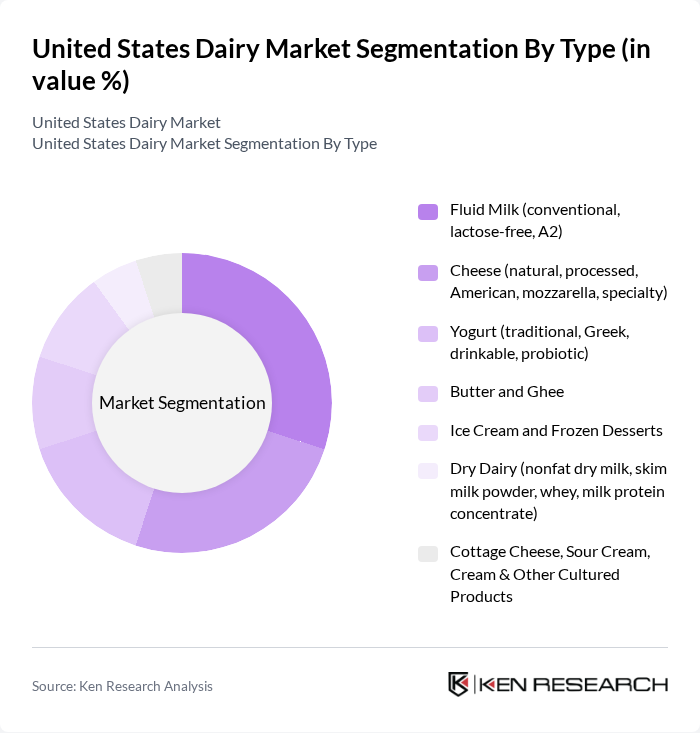

By Type:The dairy market can be segmented into various types, including fluid milk, cheese, yogurt, butter and ghee, ice cream and frozen desserts, dry dairy, and cottage cheese, sour cream, cream, and other cultured products. Each sub-segment caters to different consumer preferences and dietary needs, with fluid milk and cheese being the most popular choices among consumers. Recent demand trends favor value-added varieties such as lactose-free and ultra-filtered milk, high-protein Greek and probiotic yogurts, specialty and natural cheeses, and functional whey and milk powders used in nutrition and food manufacturing.

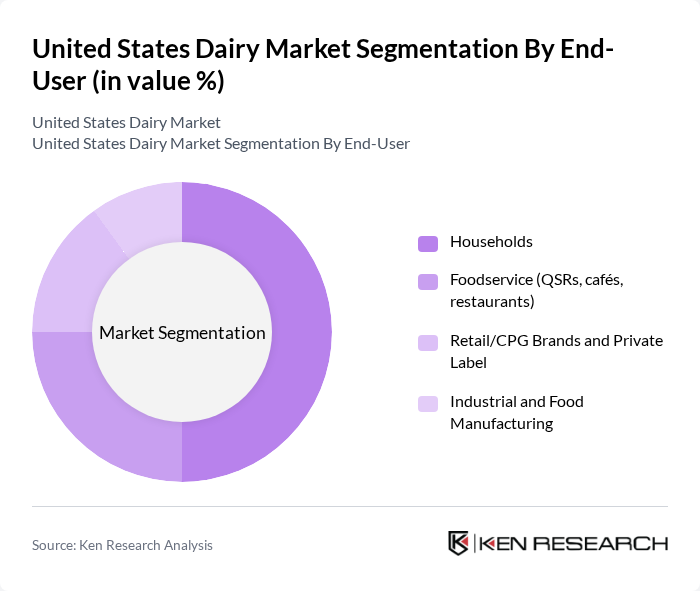

By End-User:The dairy market is segmented by end-user into households, foodservice (QSRs, cafés, restaurants), retail/CPG brands and private label, and industrial and food manufacturing. Each segment has unique demands, with households being the largest consumer group, driven by the need for everyday dairy products.

The United States Dairy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dairy Farmers of America, Inc., Land O'Lakes, Inc., Dairy Farmers of Wisconsin (for checkoff/marketing), Prairie Farms Dairy, Inc., Saputo Inc. (Saputo Cheese USA Inc.), Nestlé USA, Inc., The Kraft Heinz Company, Chobani, LLC, Borden Dairy Company (New Borden LLC), Agri-Mark, Inc. (Cabot Creamery Cooperative), Stonyfield Farm, Inc., Horizon Organic (Danone North America), Organic Valley (CROPP Cooperative), Prairie Farms Dairy, Inc., Blue Bell Creameries, L.P., fairlife, LLC (a Coca?Cola Company) contribute to innovation, geographic expansion, and service delivery in this space. Recent industry dynamics also include significant investment in new and expanded dairy processing capacity, particularly in cheese, ESL/UF milk, and cultured products, enhancing domestic availability and supporting export competitiveness.

The future of the U.S. dairy market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, dairy producers are likely to innovate and diversify their product offerings, including functional and organic options. Additionally, the expansion of e-commerce platforms will facilitate direct-to-consumer sales, enhancing market accessibility. These trends indicate a dynamic landscape where traditional dairy products can thrive alongside emerging alternatives, fostering a resilient market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Fluid Milk (conventional, lactose-free, A2) Cheese (natural, processed, American, mozzarella, specialty) Yogurt (traditional, Greek, drinkable, probiotic) Butter and Ghee Ice Cream and Frozen Desserts Dry Dairy (nonfat dry milk, skim milk powder, whey, milk protein concentrate) Cottage Cheese, Sour Cream, Cream & Other Cultured Products |

| By End-User | Households Foodservice (QSRs, cafés, restaurants) Retail/CPG Brands and Private Label Industrial and Food Manufacturing |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail and DTC Foodservice Distributors and Direct Sales |

| By Packaging Type | Cartons and Gable-Top Bottles and Jugs (HDPE, PET, glass) Aseptic Cartons (Tetra Pak) Bulk Packaging (pails, bags, totes) |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Liquid Solid/Semi-solid Powdered |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Farmers | 100 | Farm Owners, Production Managers |

| Retail Grocery Chains | 80 | Category Managers, Purchasing Agents |

| Food Service Providers | 70 | Restaurant Owners, Menu Planners |

| Consumers of Dairy Products | 140 | Household Decision Makers, Health-Conscious Consumers |

| Dairy Industry Experts | 40 | Market Analysts, Academic Researchers |

The United States Dairy Market is valued at approximately USD 120 billion, reflecting a five-year historical analysis. This growth is driven by increasing consumer demand for dairy products, health consciousness, and the rise of plant-based alternatives.