Region:Europe

Author(s):Dev

Product Code:KRAC0406

Pages:89

Published On:August 2025

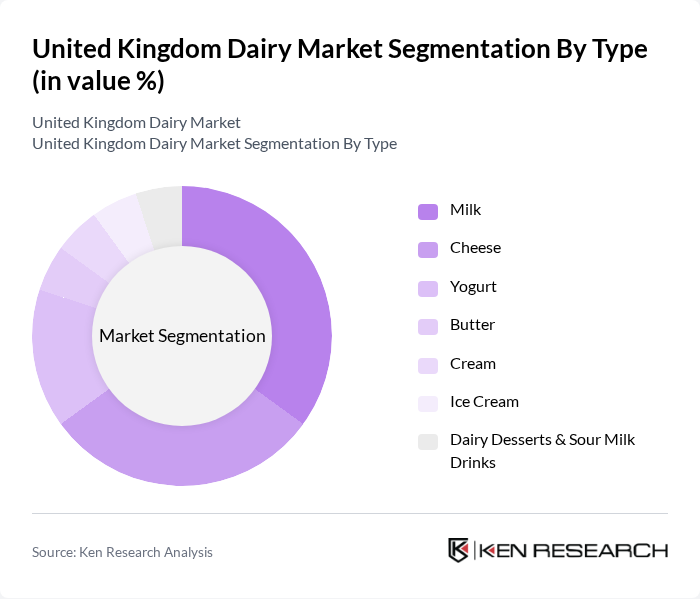

By Type:The dairy market can be segmented into various types, including milk, cheese, yogurt, butter, cream, ice cream, and dairy desserts & sour milk drinks. Among these, milk and cheese are the most significant contributors to market revenue, driven by their essential role in daily diets and culinary applications. The increasing popularity of cheese varieties and flavored/functional yogurts, including high-protein and fortified launches, has also contributed to the growth of these segments.

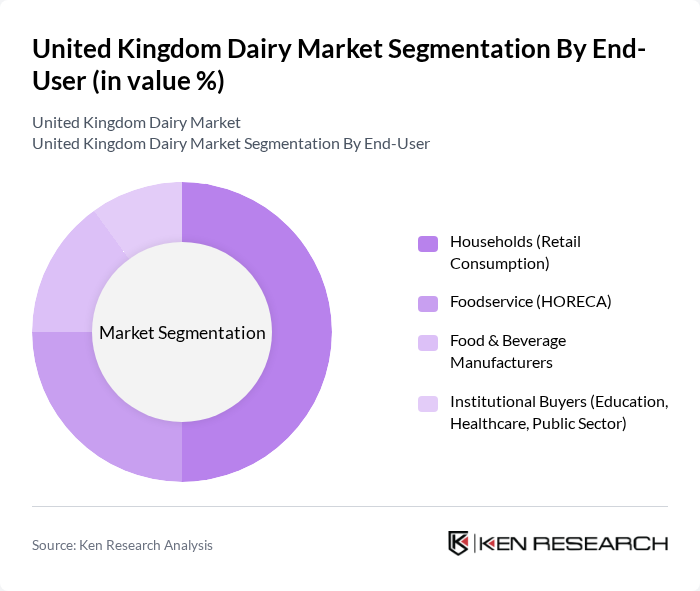

By End-User:The end-user segmentation includes households (retail consumption), foodservice (HORECA), food & beverage manufacturers, and institutional buyers (education, healthcare, public sector). Households represent the largest segment, driven by the consistent demand for dairy products in everyday meals. The foodservice sector is also growing, fueled by the increasing number of restaurants and cafes offering dairy-based dishes.

The United Kingdom Dairy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saputo Dairy UK (Cathedral City, Dairy Crest legacy), Arla Foods UK plc, Müller UK & Ireland Group LLP, Nestlé UK Ltd., Danone UK & Ireland, Lactalis UK & Ireland, FrieslandCampina UK, Yeo Valley Organic, Ornua Foods UK (Kerrygold, Pilgrims Choice), OMSCo – Organic Milk Suppliers Cooperative, Cotteswold Dairy, Graham’s The Family Dairy, Wyke Farms, St Helen’s Farm (Goat’s Milk), Dale Farm Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK dairy market appears promising, with a strong focus on sustainability and innovation. As consumers increasingly demand environmentally friendly practices, dairy producers are likely to adopt more sustainable farming methods. Additionally, the integration of technology in production processes will enhance efficiency and product quality. Collaborations with health and wellness brands will further drive market growth, as consumers seek functional dairy products that align with their health goals. Overall, the market is poised for transformation, adapting to evolving consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk Cheese Yogurt Butter Cream Ice Cream Dairy Desserts & Sour Milk Drinks |

| By End-User | Households (Retail Consumption) Foodservice (HORECA) Food & Beverage Manufacturers Institutional Buyers (Education, Healthcare, Public Sector) |

| By Distribution Channel | Supermarkets/Hypermarkets (Off-Trade) Convenience & Specialist Dairy Stores Online Retail & Direct-to-Consumer Foodservice/On-Trade |

| By Product Form | Liquid Powdered & Concentrated Solid/Semi-solid |

| By Packaging Type | Bottles (HDPE/PET/Glass) Cartons (Aseptic/Tetra Pak) Pouches & Sachets Tubs & Cups |

| By Price Range | Economy Mid-Range Premium |

| By Category | Conventional Organic Lactose-Free/Functional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Farmers | 90 | Farm Owners, Production Managers |

| Dairy Product Retailers | 80 | Store Managers, Category Buyers |

| Consumers of Dairy Products | 140 | Household Decision Makers, Health-Conscious Consumers |

| Dairy Industry Experts | 40 | Market Analysts, Industry Consultants |

| Food and Beverage Manufacturers | 70 | Product Development Managers, Procurement Officers |

The United Kingdom Dairy Market is valued at approximately USD 17.6 billion, reflecting a steady growth driven by increasing consumer demand for convenient, higher-protein dairy products, premium cheeses, and innovative yogurts.