Region:Global

Author(s):Shubham

Product Code:KRAD0785

Pages:90

Published On:August 2025

By Type:The dairy market can be segmented into various types, including milk, cheese, yogurt and fermented milk, butter and spreads, cream, powdered milk, and dairy desserts. Each of these subsegments caters to different consumer preferences and dietary needs. Milk, particularly fresh and UHT, remains a staple, while cheese and yogurt are gaining popularity due to their versatility and health benefits.

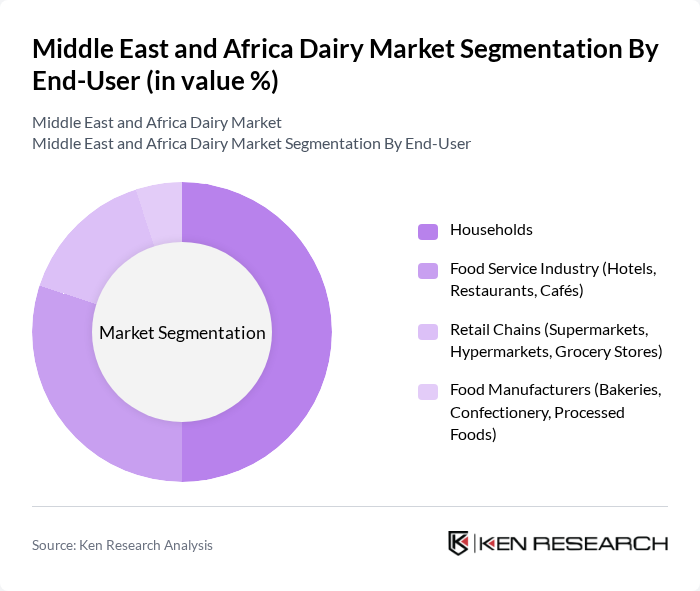

By End-User:The dairy market serves various end-users, including households, the food service industry, retail chains, and food manufacturers. Households are the largest consumers, driven by the need for daily nutrition. The food service industry, including hotels and restaurants, is also a significant contributor, as it incorporates dairy products into diverse culinary offerings.

The Middle East and Africa Dairy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Danone S.A., Nestlé S.A., FrieslandCampina, Lactalis Group, Arla Foods, Al Ain Dairy, Pinar Süt, Al Safi Danone, Clover Industries Limited, Tetra Pak International S.A., Fonterra Co-operative Group Limited, Saudia Dairy & Foodstuff Company (SADAFCO), Parmalat South Africa (a Lactalis company), Juhayna Food Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dairy market in the Middle East and Africa appears promising, driven by increasing consumer demand for diverse dairy products and a growing focus on health and nutrition. Innovations in dairy processing and technology are expected to enhance product quality and shelf life, while e-commerce growth will facilitate wider distribution. As governments continue to support the dairy sector through subsidies and infrastructure improvements, the market is poised for sustainable growth, adapting to changing consumer preferences and environmental considerations.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk (Fresh, UHT, Flavored, Organic, Fortified) Cheese (Processed, Unprocessed, Local Varieties, Imported) Yogurt and Fermented Milk (Yogurt, Laban, Buttermilk, Probiotic Drinks) Butter and Spreads (Butter, Ghee, Dairy Spreads) Cream (Fresh Cream, Whipping Cream, Sour Cream) Powdered Milk (Whole, Skimmed, Infant Formula) Dairy Desserts (Ice Cream, Puddings, Frozen Dairy Treats) |

| By End-User | Households Food Service Industry (Hotels, Restaurants, Cafés) Retail Chains (Supermarkets, Hypermarkets, Grocery Stores) Food Manufacturers (Bakeries, Confectionery, Processed Foods) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Direct Sales (Farmers, Cooperatives) |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) North Africa (Egypt, Algeria, Morocco, Tunisia, Libya) Sub-Saharan Africa (South Africa, Nigeria, Kenya, Ethiopia, Others) Others (Levant, Iran, Israel) |

| By Product Form | Liquid Solid/Semi-solid Powdered |

| By Packaging Type | Bottles Tetra Packs/Cartons Cans Pouches Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dairy Farm Operations | 60 | Farm Owners, Production Managers |

| Retail Dairy Sales | 70 | Store Managers, Category Buyers |

| Dairy Product Distribution | 50 | Logistics Coordinators, Distribution Managers |

| Consumer Dairy Preferences | 100 | Household Decision Makers, Health-Conscious Consumers |

| Food Service Sector Insights | 40 | Restaurant Owners, Catering Managers |

The Middle East and Africa Dairy Market is valued at approximately USD 44 billion, driven by increasing consumer demand for dairy products, rising health consciousness, and the expansion of the food service industry.