Region:Asia

Author(s):Shubham

Product Code:KRAB0708

Pages:87

Published On:August 2025

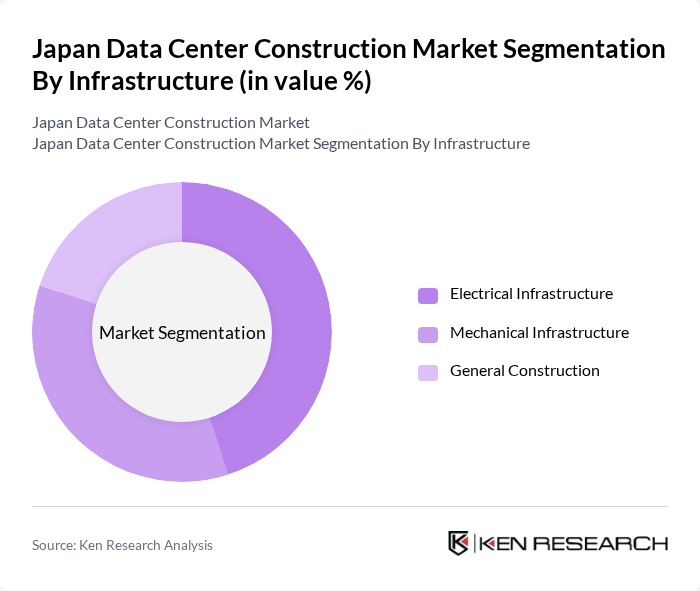

By Infrastructure:The infrastructure segment encompasses various components essential for data center construction, including electrical, mechanical, and general construction elements. The electrical infrastructure is crucial for ensuring reliable power supply, while mechanical infrastructure focuses on cooling systems and racks. General construction involves the physical building of data centers, integrating all necessary systems for optimal performance.

The electrical infrastructure segment is currently dominating the market due to the increasing demand for reliable power distribution and backup solutions. As data centers require uninterrupted power supply to maintain operations, investments in power distribution units, transfer switches, and uninterruptible power supplies (UPS) have surged. This trend is driven by the growing reliance on cloud computing, artificial intelligence workloads, and the need for high availability in data services, making electrical infrastructure a critical focus for data center developers.

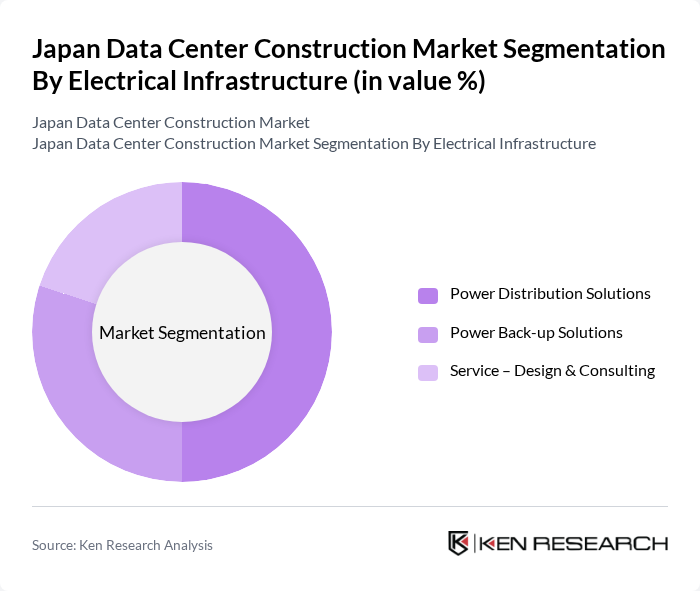

By Electrical Infrastructure:This segment includes various components that ensure the efficient distribution and backup of power within data centers. Key sub-segments include power distribution solutions, which manage the flow of electricity, power backup solutions that provide emergency power during outages, and design and consulting services that help optimize electrical systems.

The power distribution solutions sub-segment is leading the market, driven by the necessity for efficient and reliable power management in data centers. As the demand for data processing and storage increases, the need for advanced power distribution systems that can handle high loads and ensure redundancy has become paramount. This trend is further supported by the growing adoption of cloud services and the expansion of data center facilities across Japan.

By Mechanical Infrastructure:This segment focuses on the physical systems that support the operation of data centers, including cooling systems, racks, and other mechanical components. Effective cooling is essential for maintaining optimal operating temperatures, while racks provide the necessary structure for housing servers and networking equipment.

The cooling systems sub-segment is the most significant contributor to the mechanical infrastructure market, driven by the increasing heat generated by high-density server configurations. As data centers expand and adopt more powerful computing technologies, the demand for advanced cooling solutions, such as immersion cooling and in-row cooling, has surged. This trend is essential for ensuring operational efficiency and reliability in data center environments.

The Japan Data Center Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as NTT Communications Corporation, Fujitsu Limited, NEC Corporation, SoftBank Group Corp., KDDI Corporation, Colt Technology Services, Digital Realty Trust, Inc., Equinix, Inc., Mitsubishi Electric Corporation, Hitachi, Ltd., SCSK Corporation, Daiwa House Industry Co., Ltd., Obayashi Corporation, Hibiya Engineering, Ltd., CSF Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's data center construction market appears promising, driven by technological advancements and increasing digitalization. As companies continue to embrace cloud computing and AI technologies, the demand for robust data infrastructure will grow. Additionally, the focus on sustainability will lead to innovations in energy-efficient designs and renewable energy integration. Collaborations between tech firms and data center operators are expected to enhance infrastructure capabilities, ensuring that the market remains competitive and responsive to evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Infrastructure | Electrical Infrastructure Mechanical Infrastructure General Construction |

| By Electrical Infrastructure | Power Distribution Solutions (PDU, transfer switches, switchgear, power panels and components, others) Power Back-up Solutions (UPS, generators) Service – Design & Consulting, Integration, Support & Maintenance |

| By Mechanical Infrastructure | Cooling Systems (immersion cooling, direct-to-chip cooling, rear door heat exchanger, in-row and in-rack cooling) Racks Other Mechanical Infrastructure |

| By Tier Type | Tier I and II Tier III Tier IV |

| By End User | Banking, Financial Services, and Insurance (BFSI) IT and Telecommunications Government and Defense Healthcare Other End Users |

| By Application | Cloud Computing Big Data Analytics Disaster Recovery Content Delivery Others |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Joint Ventures |

| By Policy Support | Government Subsidies Tax Incentives Grants for Renewable Energy Others |

| By Location | Tokyo Metropolitan Area Osaka/Kansai Region Other Regions |

| By Size | Small Data Centers Medium Data Centers Large Data Centers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hyperscale Data Centers | 100 | Project Managers, Construction Engineers |

| Colocation Facilities | 80 | Facility Managers, IT Directors |

| Enterprise Data Center Projects | 70 | Procurement Officers, Operations Managers |

| Regulatory Compliance in Construction | 40 | Legal Advisors, Compliance Officers |

| Energy Efficiency Initiatives | 60 | Sustainability Managers, Energy Consultants |

The Japan Data Center Construction Market is valued at approximately USD 18 billion, driven by the increasing demand for cloud services, AI workloads, and enhanced data security, reflecting significant growth in the technological landscape of Japan.