Region:North America

Author(s):Rebecca

Product Code:KRAA1447

Pages:86

Published On:August 2025

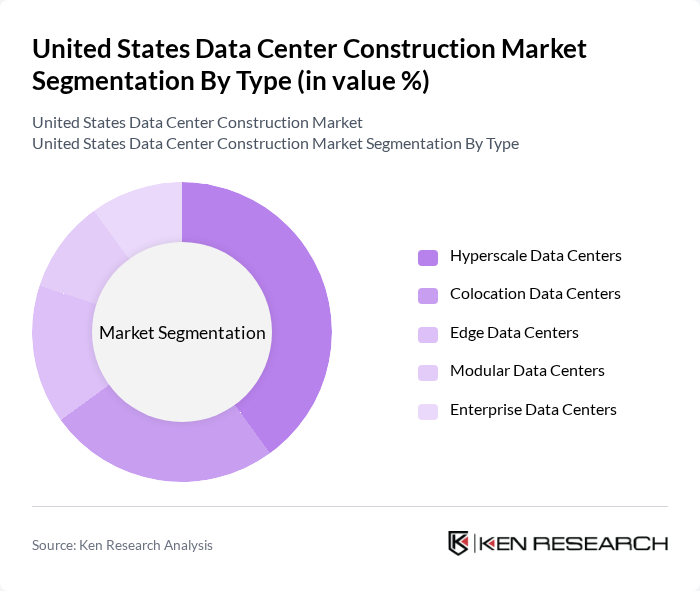

By Type:The data center construction market can be segmented into Hyperscale Data Centers, Colocation Data Centers, Edge Data Centers, Modular Data Centers, and Enterprise Data Centers. Each type addresses distinct operational needs: Hyperscale Data Centers support massive cloud and AI workloads; Colocation Data Centers provide shared infrastructure for multiple tenants; Edge Data Centers enable low-latency processing closer to end-users; Modular Data Centers offer rapid deployment and scalability; and Enterprise Data Centers serve the dedicated needs of large organizations .

The Hyperscale Data Centers segment is currently dominating the market, driven by the exponential growth in cloud computing, artificial intelligence, and large-scale data processing. These facilities are engineered for scalability and high efficiency, making them the preferred choice for major technology companies and cloud service providers. The ongoing digital transformation and the need for robust, cost-effective data management solutions continue to accelerate the expansion of hyperscale data centers .

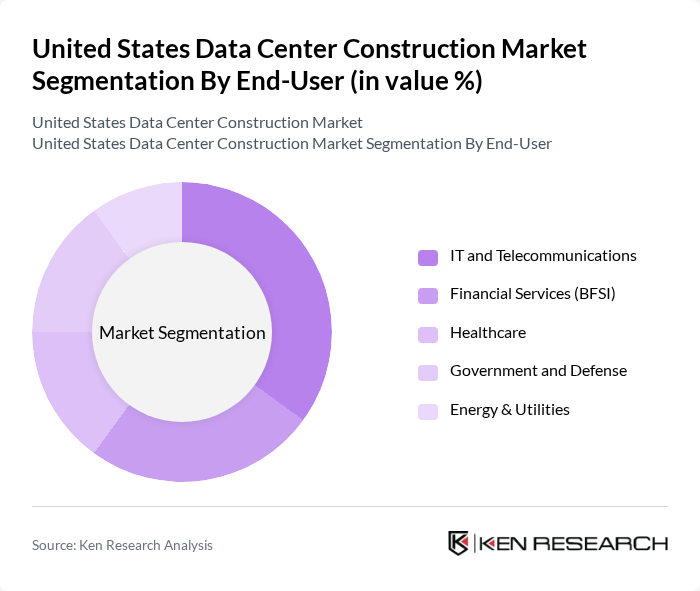

By End-User:The end-user segmentation includes IT and Telecommunications, Financial Services (BFSI), Healthcare, Government and Defense, and Energy & Utilities. Each sector has unique operational and regulatory requirements that drive the demand for specialized data center construction: IT and Telecommunications require high-availability and scalable infrastructure; BFSI demands stringent security and compliance; Healthcare prioritizes data privacy and uptime; Government and Defense focus on security and resilience; and Energy & Utilities seek reliable, distributed processing capabilities .

The IT and Telecommunications sector leads the end-user market, propelled by the rapid expansion of cloud services, AI-driven applications, and the growing reliance on data-intensive solutions. Organizations in this sector require resilient, high-capacity data center infrastructure to support mission-critical operations, manage vast data volumes, and ensure uninterrupted service delivery. The digital transformation across all industries further amplifies demand, solidifying IT and Telecommunications as the primary end-user segment .

The United States Data Center Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Digital Realty, Equinix, CyrusOne, NTT Global Data Centers Americas, CoreSite Realty Corporation, Iron Mountain Data Centers, QTS Realty Trust, Switch, Inc., STACK Infrastructure, Vantage Data Centers, Flexential, TierPoint, DataBank, 365 Data Centers, T5 Data Centers, DPR Construction, Turner Construction Company, Holder Construction, HITT Contracting, Clayco, Corgan (Design/Architecture), Jacobs (Engineering/Project Management), Schneider Electric (Power Infrastructure), Vertiv (Critical Infrastructure), ABB (Power Infrastructure) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. data center construction market appears promising, driven by technological advancements and increasing digital demands. As businesses continue to embrace cloud computing and edge solutions, the need for innovative data center designs will grow. Additionally, sustainability initiatives will shape construction practices, with a focus on energy-efficient designs and renewable energy integration. This evolving landscape will create opportunities for companies that adapt to these trends and invest in cutting-edge technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Hyperscale Data Centers Colocation Data Centers Edge Data Centers Modular Data Centers Enterprise Data Centers |

| By End-User | IT and Telecommunications Financial Services (BFSI) Healthcare Government and Defense Energy & Utilities |

| By Application | Cloud Computing Big Data Analytics Disaster Recovery & Business Continuity Content Delivery & Streaming Internet of Things (IoT) |

| By Investment Source | Private Investments Public Funding Joint Ventures Real Estate Investment Trusts (REITs) Others |

| By Location | Urban Areas Suburban Areas Rural Areas Secondary Markets (e.g., Hillsboro, Phoenix, Atlanta) |

| By Size | Small Data Centers (<5 MW) Medium Data Centers (5–20 MW) Large Data Centers (>20 MW) Mega Data Centers (>50 MW) |

| By Policy Support | Tax Incentives Subsidies Regulatory Support Energy Efficiency Mandates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hyperscale Data Centers | 100 | Data Center Managers, Infrastructure Architects |

| Colocation Facilities | 80 | Operations Directors, Facility Managers |

| Enterprise Data Center Projects | 70 | IT Managers, Project Coordinators |

| Green Data Center Initiatives | 50 | Sustainability Officers, Energy Managers |

| Data Center Construction Trends | 60 | Construction Managers, Real Estate Developers |

The United States Data Center Construction Market is valued at approximately USD 48 billion, reflecting significant growth driven by the increasing demand for cloud services, artificial intelligence workloads, and big data analytics.