Region:Middle East

Author(s):Shubham

Product Code:KRAB7129

Pages:98

Published On:October 2025

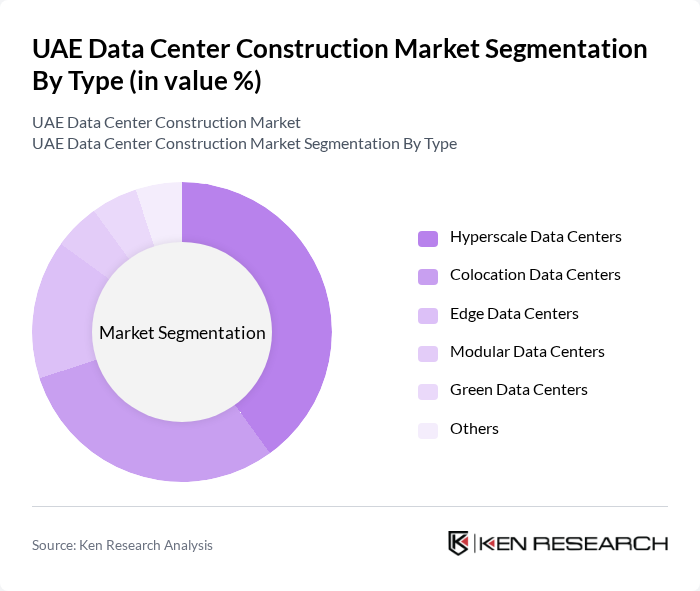

By Type:The market is segmented into various types, including Hyperscale Data Centers, Colocation Data Centers, Edge Data Centers, Modular Data Centers, Green Data Centers, and Others. Hyperscale Data Centers are currently leading the market due to their ability to support large-scale operations and provide cost-effective solutions for cloud service providers. The demand for Colocation Data Centers is also significant, driven by businesses seeking to reduce operational costs while maintaining high levels of security and reliability.

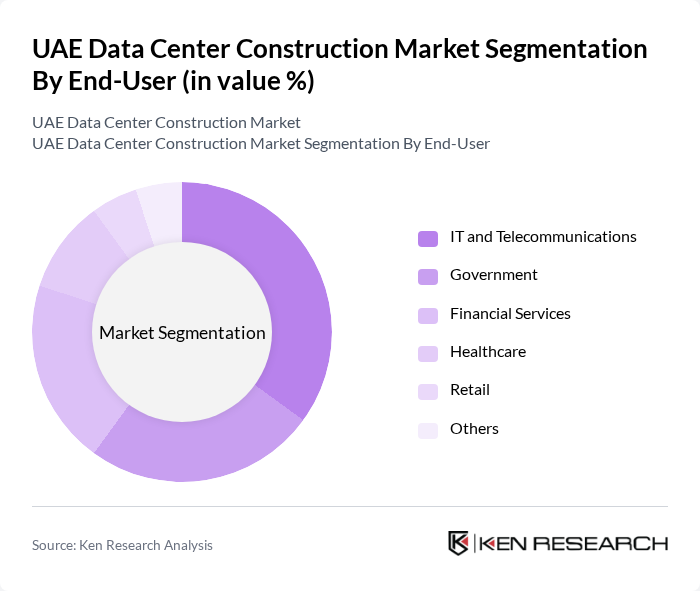

By End-User:The end-user segmentation includes IT and Telecommunications, Government, Financial Services, Healthcare, Retail, and Others. The IT and Telecommunications sector is the dominant end-user, driven by the increasing reliance on data-driven solutions and cloud computing. The Financial Services sector is also significant, as banks and financial institutions invest in secure and efficient data management systems to enhance customer service and comply with regulatory requirements.

The UAE Data Center Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Etisalat, du, Gulf Data Hub, Khazna Data Centers, NTT Global Data Centers, Equinix, Digital Realty, Alibaba Cloud, Microsoft Azure, Amazon Web Services (AWS), Ooredoo, Interxion, Rackspace Technology, Iron Mountain, Telehouse contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE data center construction market appears promising, driven by technological advancements and increasing digitalization across sectors. The integration of AI and machine learning into data center operations is expected to enhance efficiency and security. Additionally, the shift towards renewable energy sources will likely gain momentum, aligning with global sustainability goals. As the demand for data storage and processing continues to rise, the market is poised for significant growth, attracting both local and international investments.

| Segment | Sub-Segments |

|---|---|

| By Type | Hyperscale Data Centers Colocation Data Centers Edge Data Centers Modular Data Centers Green Data Centers Others |

| By End-User | IT and Telecommunications Government Financial Services Healthcare Retail Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Capacity | Small Scale (up to 1 MW) Medium Scale (1 MW to 5 MW) Large Scale (above 5 MW) Others |

| By Service Type | Design and Construction Maintenance and Support Consulting Services Others |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hyperscale Data Center Projects | 100 | Project Managers, Construction Engineers |

| Colocation Facility Developments | 80 | Facility Managers, IT Directors |

| Government Infrastructure Initiatives | 60 | Policy Makers, Urban Planners |

| Telecommunications Data Center Needs | 70 | Network Engineers, Operations Managers |

| Energy Efficiency in Data Centers | 50 | Sustainability Officers, Energy Managers |

The UAE Data Center Construction Market is valued at approximately USD 3.5 billion, driven by the increasing demand for cloud services, digital transformation initiatives, and the rise of big data analytics across various sectors.