Region:Asia

Author(s):Shubham

Product Code:KRAC0817

Pages:81

Published On:August 2025

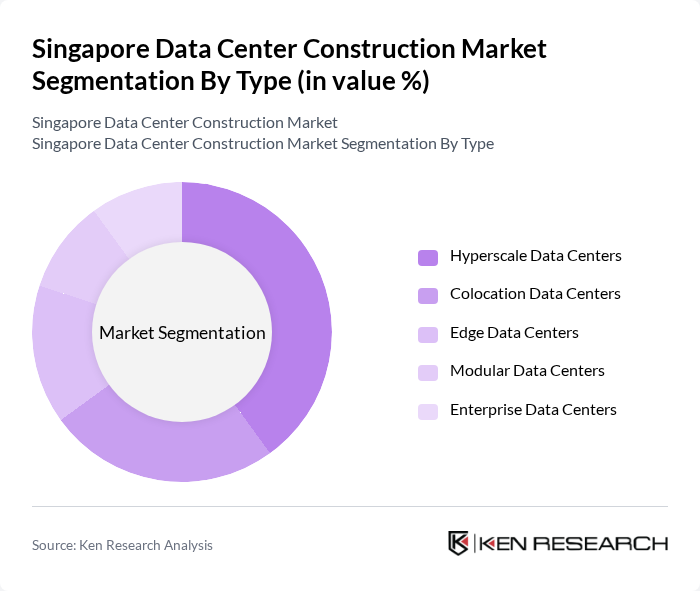

By Type:The data center construction market can be segmented into various types, including Hyperscale Data Centers, Colocation Data Centers, Edge Data Centers, Modular Data Centers, and Enterprise Data Centers. Each type serves different needs and scales of operation, catering to a diverse range of clients from large enterprises to smaller businesses. Hyperscale and colocation facilities are seeing the fastest growth due to cloud adoption and demand for scalable infrastructure .

The Hyperscale Data Centers segment dominates the market due to the increasing demand for large-scale data processing and storage capabilities. These facilities are designed to support massive workloads and are often utilized by major cloud service providers and tech companies. The trend towards digital transformation, AI-driven workloads, and the need for scalable solutions have led to significant investments in hyperscale facilities, making them a critical component of the data center landscape .

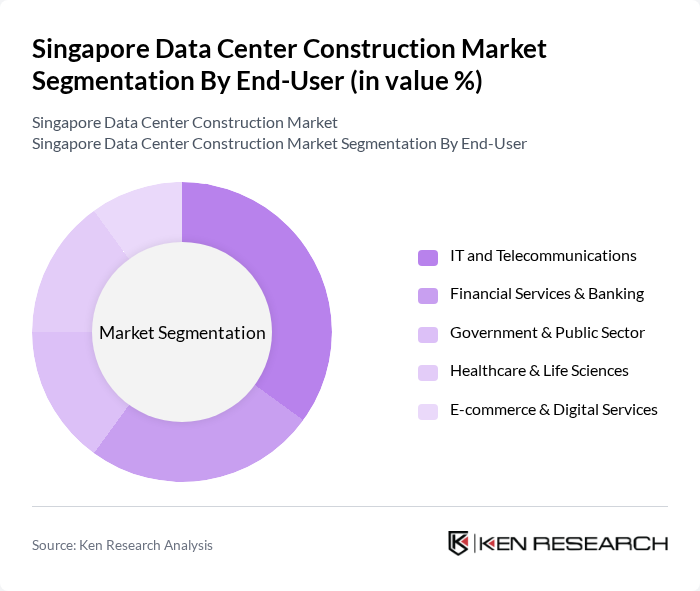

By End-User:The end-user segmentation includes IT and Telecommunications, Financial Services & Banking, Government & Public Sector, Healthcare & Life Sciences, and E-commerce & Digital Services. Each sector has unique requirements and drives demand for data center construction based on its operational needs. The financial sector and digital services are experiencing heightened demand due to regulatory requirements and increased digital transactions .

The IT and Telecommunications sector is the leading end-user of data center construction, driven by the rapid growth of cloud computing, big data analytics, and the increasing need for reliable connectivity. As businesses continue to migrate to digital platforms, the demand for robust data center infrastructure in this sector remains strong, making it a key driver of market growth .

The Singapore Data Center Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as ST Telemedia Global Data Centres, Digital Realty, Equinix, NTT Communications, Keppel Data Centres, Singtel, 1-Net Singapore, AirTrunk, Global Switch, Huawei Technologies, Microsoft Azure, Amazon Web Services, Alibaba Cloud, Vantage Data Centers, Iron Mountain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Singapore data center construction market appears promising, driven by technological advancements and increasing digitalization. As businesses continue to embrace cloud computing and IoT, the demand for data centers is expected to rise significantly. Furthermore, the focus on sustainability and energy efficiency will shape construction practices, leading to the adoption of innovative designs and renewable energy solutions. Overall, the market is poised for robust growth, supported by government initiatives and private sector investments.

| Segment | Sub-Segments |

|---|---|

| By Type | Hyperscale Data Centers Colocation Data Centers Edge Data Centers Modular Data Centers Enterprise Data Centers |

| By End-User | IT and Telecommunications Financial Services & Banking Government & Public Sector Healthcare & Life Sciences E-commerce & Digital Services |

| By Application | Cloud Services Big Data Analytics Disaster Recovery & Business Continuity Content Delivery & Streaming Internet of Things (IoT) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants & Incentives |

| By Policy Support | Tax Incentives Subsidies for Renewable Energy Regulatory Support for Infrastructure Development Green Building Certifications |

| By Location | Central Business Districts Suburban Areas Industrial Zones Data Center Parks |

| By Size | Small Data Centers (<5 MW) Medium Data Centers (5–20 MW) Large Data Centers (>20 MW) Mega Data Centers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hyperscale Data Center Projects | 60 | Project Managers, Construction Engineers |

| Colocation Facility Developments | 50 | Facility Managers, Operations Directors |

| Enterprise Data Center Upgrades | 40 | IT Managers, Infrastructure Architects |

| Regulatory Compliance in Data Center Construction | 45 | Compliance Officers, Legal Advisors |

| Energy Efficiency Initiatives in Data Centers | 55 | Sustainability Managers, Energy Consultants |

The Singapore Data Center Construction Market is valued at approximately USD 3.1 billion, driven by the increasing demand for cloud services, data storage, and digital transformation initiatives across various sectors.