Region:Asia

Author(s):Dev

Product Code:KRAA1536

Pages:80

Published On:August 2025

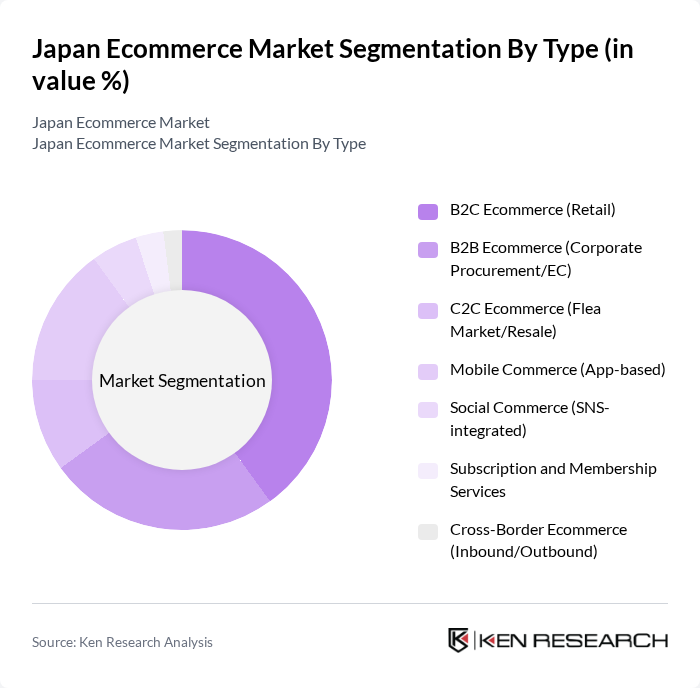

By Type:This segmentation includes various forms of ecommerce transactions, each catering to different consumer needs and preferences. The subsegments are B2C Ecommerce (Retail), B2B Ecommerce (Corporate Procurement/EC), C2C Ecommerce (Flea Market/Resale), Mobile Commerce (App-based), Social Commerce (SNS-integrated), Subscription and Membership Services, and Cross-Border Ecommerce (Inbound/Outbound). Each of these subsegments plays a crucial role in shaping the overall ecommerce landscape in Japan.

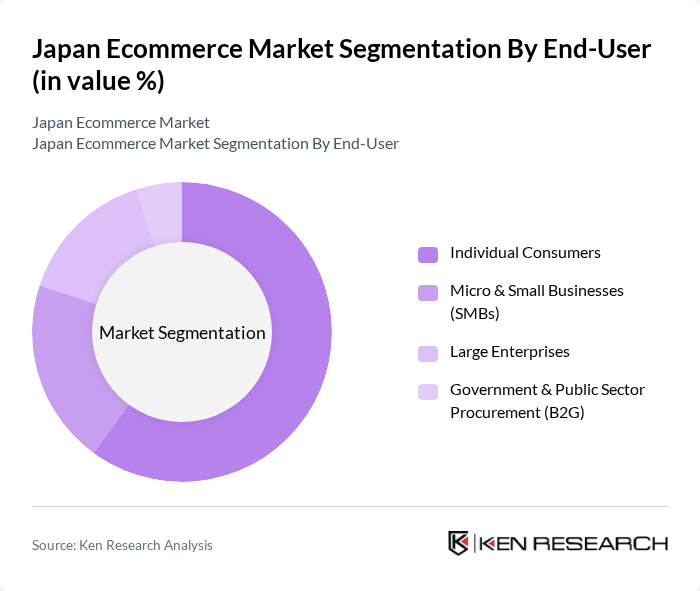

By End-User:This segmentation focuses on the different types of users engaging in ecommerce activities. The subsegments include Individual Consumers, Micro & Small Businesses (SMBs), Large Enterprises, and Government & Public Sector Procurement (B2G). Each end-user category has distinct purchasing behaviors and requirements, influencing the overall dynamics of the ecommerce market.

The Japan Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rakuten Group, Inc. (Rakuten Ichiba, Rakuten Pay), Amazon Japan G.K. (Amazon.co.jp, Amazon Prime), ZOZO, Inc. (ZOZOTOWN), LY Corporation (Yahoo! Shopping, PayPay Mall, Yahoo! Auctions), Mercari, Inc. (Mercari, Merpay), DMM.com LLC (DMM Online, DMM Books), Kakaku.com, Inc. (Kakaku.com, Tabelog), NTT DOCOMO, INC. (d Shopping, d Barai), AEON Co., Ltd. (AEON Net Super), Seven & i Holdings Co., Ltd. (Omni7, Ito-Yokado Net Super), Fast Retailing Co., Ltd. (Uniqlo.com, GU), SoftBank Group Corp. (PayPay, PayPay Mall legacy), Lawson, Inc. (Lawson Fresh/Smart Kitchen, Lawson Pickup), FamilyMart Co., Ltd. (Famima Net, In-store Pickup Network), KDDI Corporation (au PAY Market, au PAY) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's ecommerce market appears promising, driven by technological advancements and evolving consumer preferences. As artificial intelligence and data analytics become integral to retail strategies, businesses will enhance personalization and customer engagement. Furthermore, the rise of social commerce and sustainable shopping trends will shape the market landscape. Companies that adapt to these changes and invest in innovative solutions will likely thrive, ensuring continued growth in the dynamic ecommerce environment of Japan.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Ecommerce (Retail) B2B Ecommerce (Corporate Procurement/EC) C2C Ecommerce (Flea Market/Resale) Mobile Commerce (App-based) Social Commerce (SNS-integrated) Subscription and Membership Services Cross-Border Ecommerce (Inbound/Outbound) |

| By End-User | Individual Consumers Micro & Small Businesses (SMBs) Large Enterprises Government & Public Sector Procurement (B2G) |

| By Product Category | Consumer Electronics & Appliances Fashion, Apparel & Footwear Home & Living (Furniture, Decor) Health, Beauty & Personal Care Grocery & FMCG (incl. Fresh/Convenience) Digital Goods & Services (Games, Tickets, eBooks) Luxury & Secondhand (Resale/Authenticated) |

| By Sales Channel | Online Marketplaces (e.g., Rakuten, Amazon, Yahoo! Shopping) Brand.com & D2C Websites Social Commerce & Live Commerce Platforms Mobile Apps (Retailer & Marketplace Apps) |

| By Payment Method | Credit/Debit Cards Digital Wallets (Rakuten Pay, PayPay, d Barai, LINE Pay) Bank Transfers & Konbini Payments Cash on Delivery |

| By Delivery Method | Standard Home Delivery Express/Next-Day Delivery Click-and-Collect (Konbini/Store Pickup) Same-Day & Time-Slot Delivery |

| By Customer Demographics | Age Groups (Gen Z, Millennials, Gen X, Seniors) Income Levels Geographic Tiers (Major Metros vs Regional) Lifestyle & Interest Segments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General E-commerce Consumers | 150 | Online Shoppers, Frequent Buyers |

| Small Business E-commerce Users | 100 | Small Business Owners, Entrepreneurs |

| Logistics and Supply Chain Professionals | 80 | Logistics Managers, Supply Chain Analysts |

| Digital Marketing Experts | 70 | Marketing Managers, E-commerce Strategists |

| Technology Providers in E-commerce | 60 | IT Managers, Software Developers |

The Japan Ecommerce Market is valued at approximately USD 195 billion, reflecting significant growth driven by increased internet and smartphone penetration, along with a consumer preference for the convenience of online shopping.