Region:Asia

Author(s):Dev

Product Code:KRAB0586

Pages:99

Published On:August 2025

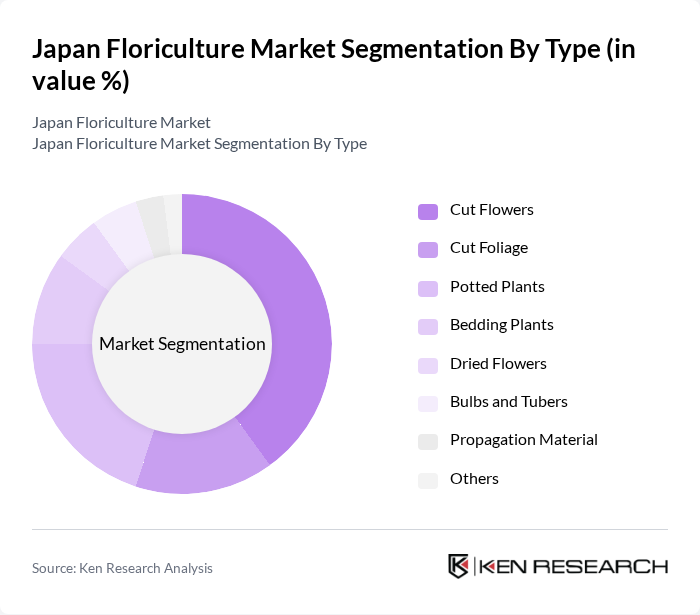

By Type:The floriculture market can be segmented into various types, including cut flowers, cut foliage, potted plants, bedding plants, dried flowers, bulbs and tubers, propagation material, and others. Among these, cut flowers dominate the market due to their widespread use in events, gifting, and home decoration. The growing trend of floral arrangements for personal and corporate events, as well as the increasing popularity of sustainable and biodegradable floral products, has further solidified the position of cut flowers as a leading segment .

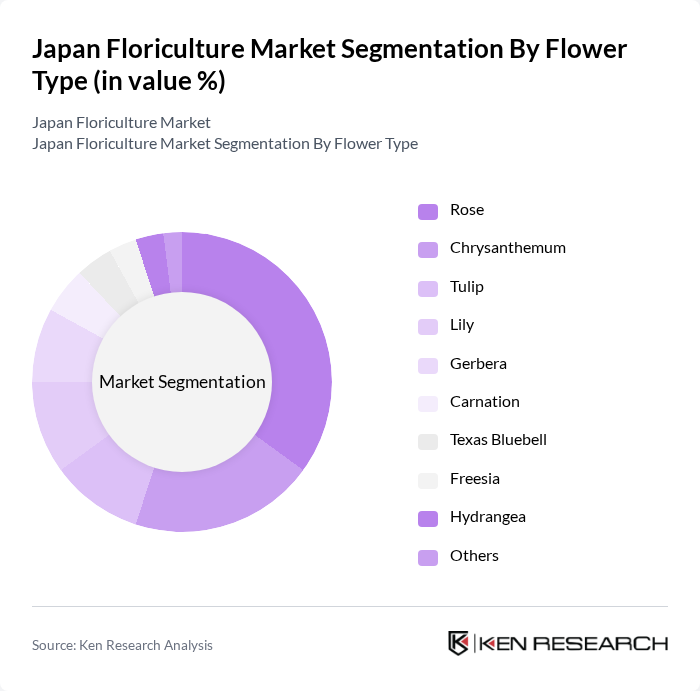

By Flower Type:The market can also be categorized by flower type, including roses, chrysanthemums, tulips, lilies, gerberas, carnations, Texas bluebells, freesias, hydrangeas, and others. Roses are the most popular flower type, favored for their versatility in arrangements and gifting. The cultural significance of roses in Japan, combined with their aesthetic appeal and frequent use in festivals and ceremonies, ensures their dominance in the market .

The Japan Floriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as FS-Bloom, MIYOSHI & CO., LTD, Forest Produce Ltd., Selecta Cut Flowers SAU, Native Floral Group, Tropical Foliage Plants, Inc., Oserian Group, Esmeralda Farms, Marginpar BV, DOS GRINGOS, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan floriculture market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in cultivation techniques, such as hydroponics and vertical farming, are expected to enhance production efficiency. Additionally, the increasing consumer preference for organic and locally sourced flowers will likely shape market dynamics. As e-commerce continues to expand, floriculture businesses can leverage online platforms to reach broader audiences, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cut Flowers Cut Foliage Potted Plants Bedding Plants Dried Flowers Bulbs and Tubers Propagation Material Others |

| By Flower Type | Rose Chrysanthemum Tulip Lily Gerbera Carnation Texas Bluebell Freesia Hydrangea Others |

| By End-User | Personal Use Institutions/Events Industrial |

| By Distribution Channel | Direct Sales Specialty Stores Supermarkets Online Retailers Others |

| By Price Range | Premium Mid-Range Budget |

| By Occasion | Weddings Funerals Corporate Events Festivals |

| By Geographic Distribution | Kanto Chubu Kinki Kyushu & Okinawa Tohoku Rest of Japan |

| By Sustainability Practices | Organic Cultivation Conventional Cultivation Eco-Friendly Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Florists | 100 | Shop Owners, Managers |

| Wholesale Flower Distributors | 60 | Distribution Managers, Sales Representatives |

| Flower Growers | 50 | Farm Owners, Agricultural Managers |

| Garden Centers | 40 | Store Managers, Product Buyers |

| Event Planners | 40 | Wedding Coordinators, Corporate Event Managers |

The Japan Floriculture Market is valued at approximately USD 1.6 billion, reflecting a robust growth trajectory driven by increasing consumer interest in gardening, floral decoration, and sustainable practices.