Region:Asia

Author(s):Shubham

Product Code:KRAA1705

Pages:85

Published On:August 2025

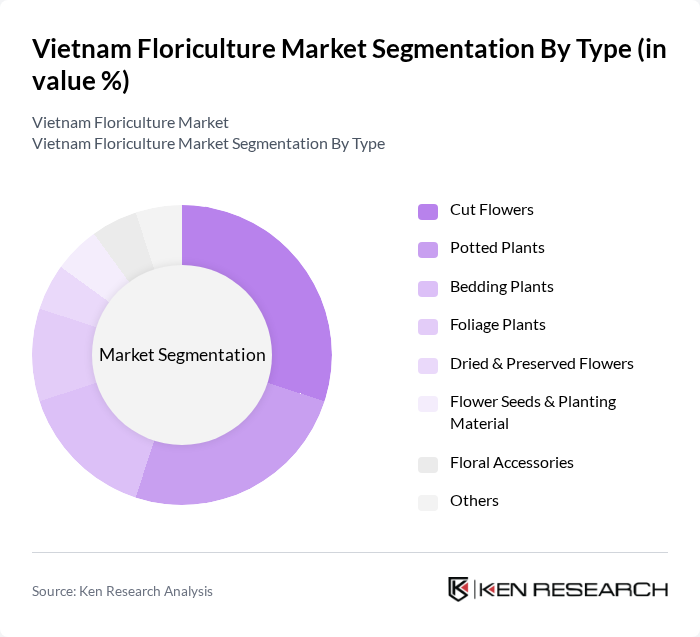

By Type:The floriculture market can be segmented into various types, including cut flowers, potted plants, bedding plants, foliage plants, dried & preserved flowers, flower seeds & planting material, floral accessories, and others. Each sub-segment caters to different consumer preferences and occasions, contributing to the overall market dynamics.

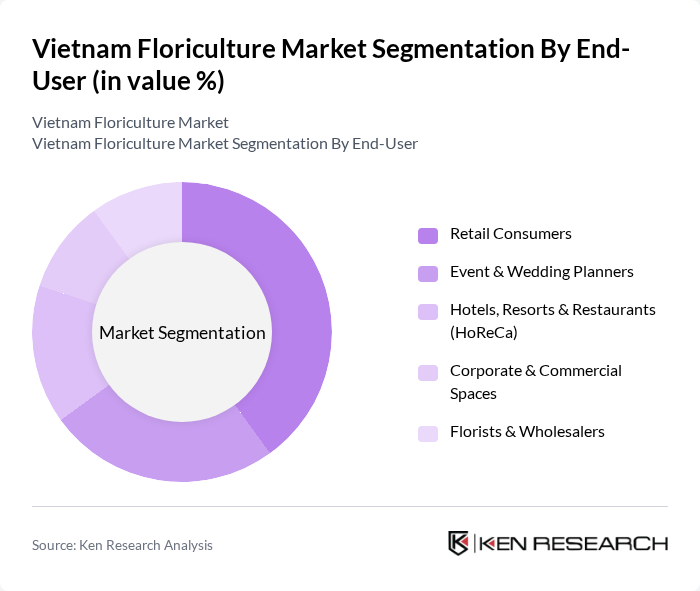

By End-User:The end-user segmentation includes retail consumers, event & wedding planners, hotels, resorts & restaurants (HoReCa), corporate & commercial spaces, and florists & wholesalers. Each segment has unique requirements and purchasing behaviors that influence the overall floriculture market.

The Vietnam Floriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dalat Hasfarm Co., Ltd., Fresh Flower World Joint Stock Company (Th? Gi?i Hoa T??i), Vietnam Floriculture Corporation (VFC), Flower Corner (Ho Chi Minh City), Ho Chi Minh City Flower Wholesale Market (Th? ??c), Dalat Flower Association (Hi?p h?i Hoa ?à L?t), Kingdom of Orchid (V??ng Qu?c Lan), Ha Noi Flower Market (Ch? Hoa Qu?ng Bá), Hoa Yeu Thuong (hoayeuthuong.com), Dalat GAP Flower Farms (VietGAP-certified growers), Dummen Orange Vietnam, Syngenta Flowers Vietnam, Royal Base Corporation (Vietnam operations), Flora Vietnam Co., Ltd. (online retailer), FlowerStore.vn (Philippines-based brand with Vietnam ops) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam floriculture market is poised for significant growth, driven by urbanization, rising incomes, and e-commerce expansion. As consumers increasingly prioritize sustainability, floriculture businesses are likely to adopt eco-friendly practices. Additionally, the integration of technology in production and distribution will enhance efficiency and product quality. The market's adaptability to changing consumer preferences will be crucial in navigating challenges and seizing growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cut Flowers Potted Plants Bedding Plants Foliage Plants Dried & Preserved Flowers Flower Seeds & Planting Material Floral Accessories Others |

| By End-User | Retail Consumers Event & Wedding Planners Hotels, Resorts & Restaurants (HoReCa) Corporate & Commercial Spaces Florists & Wholesalers |

| By Distribution Channel | Traditional Flower Markets & Wholesalers Florists & Kiosks Specialty Stores & Franchises Supermarkets/Hypermarkets Independent Small Stores Online Retailers Direct Sales (Farm-gate/Contract) Others |

| By Occasion | Weddings Funerals Corporate Events & Conferences Festivals & Tet (Lunar New Year) Personal Gifting & Home Decoration |

| By Price Range | Economy Standard/Mid-range Premium |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Floral Type | Roses Chrysanthemums Orchids Lilies Carnations Others (e.g., Gerbera, Sunflower, Peony) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wholesale Flower Distribution | 90 | Wholesale Managers, Supply Chain Coordinators |

| Retail Flower Sales | 80 | Store Owners, Retail Managers |

| Floriculture Export Market | 60 | Export Managers, Trade Compliance Officers |

| Floriculture Production Techniques | 70 | Agronomists, Farm Managers |

| Consumer Preferences in Floriculture | 90 | End Consumers, Event Planners |

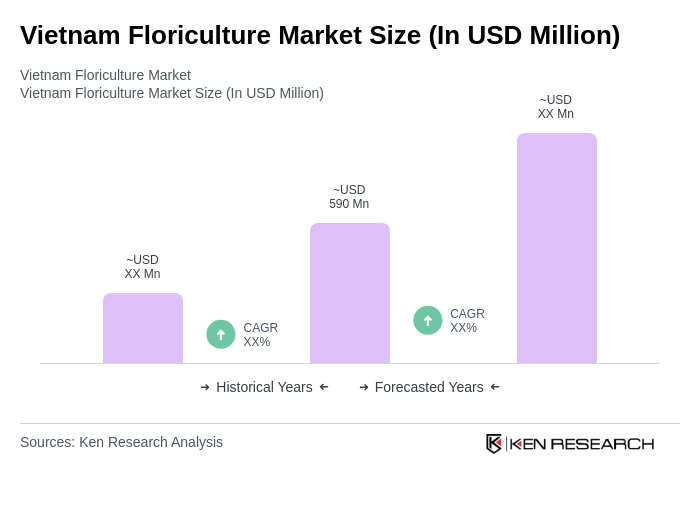

The Vietnam Floriculture Market is valued at approximately USD 590 million, driven by increasing consumer demand for ornamental plants and flowers, as well as the rise of e-commerce platforms facilitating online sales.