Region:Europe

Author(s):Geetanshi

Product Code:KRAB0162

Pages:94

Published On:August 2025

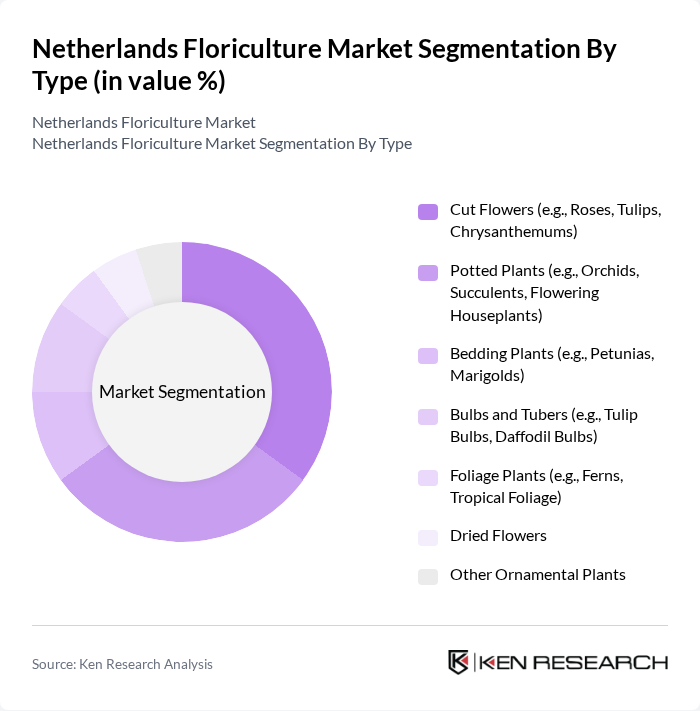

By Type:The floriculture market can be segmented into various types, including cut flowers, potted plants, bedding plants, bulbs and tubers, foliage plants, dried flowers, and other ornamental plants. Each of these subsegments caters to different consumer preferences and market demands. Cut flowers, such as roses, tulips, and chrysanthemums, and potted plants, including orchids and succulents, are particularly popular due to their aesthetic appeal, versatility, and suitability for both domestic and export markets. Bedding plants and bulbs are also significant, especially in seasonal and landscaping applications. Foliage plants and dried flowers are gaining traction as consumers seek low-maintenance and sustainable decorative options .

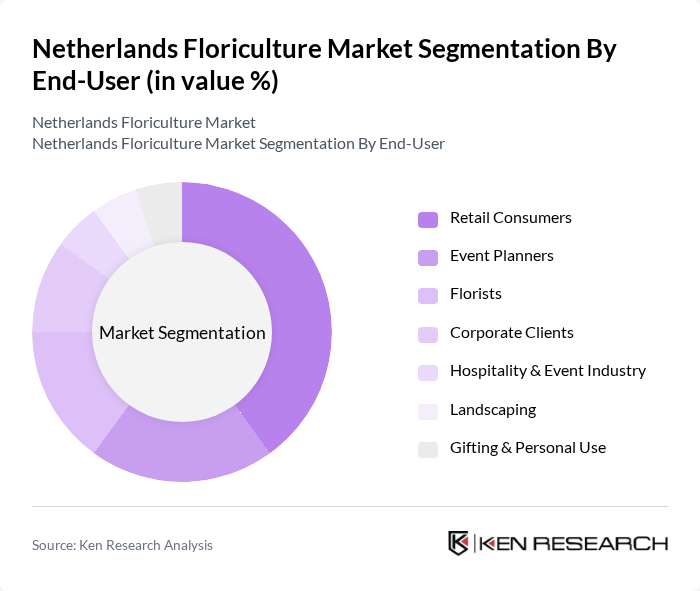

By End-User:The end-user segmentation includes retail consumers, event planners, florists, corporate clients, the hospitality and event industry, landscaping services, and gifting and personal use. Each segment has unique requirements and purchasing behaviors. Florists and retail consumers are the largest contributors to market demand, driven by frequent purchases for occasions, home decoration, and gifting. Event planners and the hospitality sector increasingly seek customized floral solutions, while landscaping and corporate clients focus on long-term contracts and sustainable plant selections .

The Netherlands Floriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Royal FloraHolland, Dümmen Orange, Dutch Flower Group, Florensis, Anthura, Van der Ende Group, HilverdaFlorist, KP Holland, Kwekerij J. van der Kooij, Greenhouse Holland, Hortech, Kwekerij De Vries, Kwekerij De Lier, Kwekerij Van der Meer, Kwekerij Van der Wal, Kwekerij Van der Zanden contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands floriculture market appears promising, driven by increasing consumer awareness of sustainability and the growing trend of online shopping. As the market adapts to these changes, innovations in technology and cultivation practices will likely enhance productivity and efficiency. Additionally, the expansion of export markets, particularly in Asia, presents significant growth potential. The industry is expected to continue evolving, focusing on eco-friendly practices and digital transformation to meet consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Cut Flowers (e.g., Roses, Tulips, Chrysanthemums) Potted Plants (e.g., Orchids, Succulents, Flowering Houseplants) Bedding Plants (e.g., Petunias, Marigolds) Bulbs and Tubers (e.g., Tulip Bulbs, Daffodil Bulbs) Foliage Plants (e.g., Ferns, Tropical Foliage) Dried Flowers Other Ornamental Plants |

| By End-User | Retail Consumers Event Planners Florists Corporate Clients Hospitality & Event Industry Landscaping Gifting & Personal Use |

| By Sales Channel | Flower Auctions (e.g., Royal FloraHolland) Wholesalers Retailers (Brick-and-Mortar Stores, Online Platforms) Direct Sales to Florists and Event Planners Specialty Stores Franchises Florists and Kiosks Supermarkets/Hypermarkets Independent Small Stores |

| By Distribution Mode | Direct Sales Third-Party Logistics E-commerce Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Occasion | Weddings Funerals Corporate Events Holidays |

| By Seasonality | Spring Summer Autumn Winter |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cut Flower Producers | 100 | Farm Owners, Production Managers |

| Potted Plant Retailers | 60 | Store Managers, Merchandising Directors |

| Floriculture Exporters | 50 | Export Managers, Logistics Coordinators |

| Floriculture Wholesalers | 40 | Sales Directors, Supply Chain Managers |

| Floriculture Industry Experts | 40 | Market Analysts, Academic Researchers |

The Netherlands Floriculture Market is valued at approximately USD 4.9 billion, reflecting a robust growth driven by increasing consumer demand for ornamental plants, cut flowers, and potted plants, alongside the expansion of e-commerce and specialty retail channels.