Region:Asia

Author(s):Geetanshi

Product Code:KRAA1289

Pages:84

Published On:August 2025

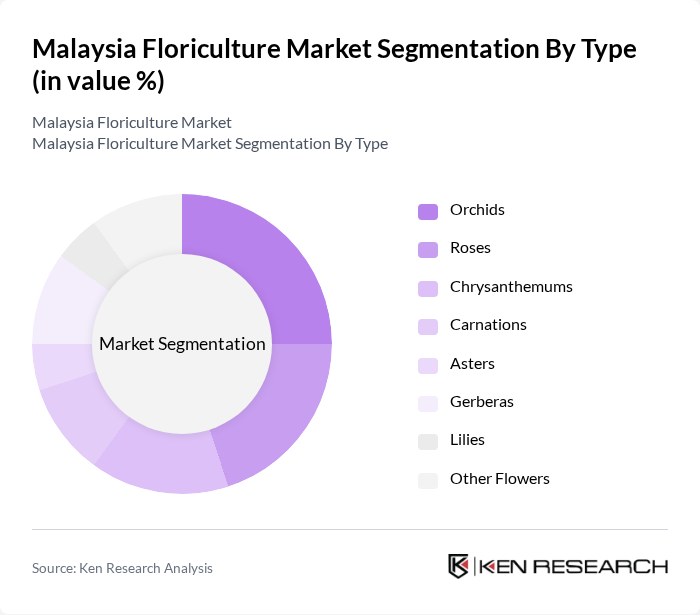

By Type:The floriculture market is segmented into various types of flowers, including orchids, roses, chrysanthemums, carnations, asters, gerberas, lilies, and other flowers. Each type has its unique appeal and consumer base, with certain flowers being preferred for specific occasions or uses. Orchids, roses, and chrysanthemums are among the most popular, reflecting both local preferences and export demand .

The orchids segment is currently dominating the market due to their exotic appeal, versatility in various floral arrangements, and strong demand for both personal and commercial use, especially in events and weddings. The trend of indoor gardening and the popularity of orchids as houseplants have further fueled demand. Unique varieties and colors available in orchids also attract consumers seeking distinctive floral options .

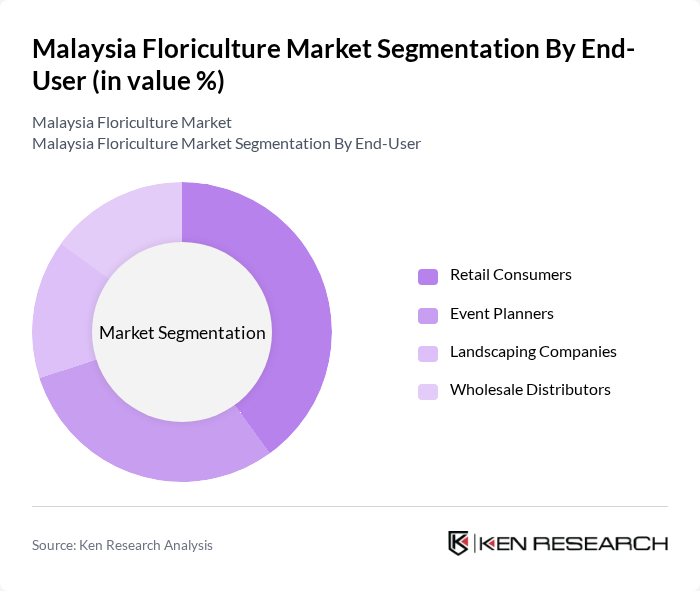

By End-User:The floriculture market is segmented based on end-users, including retail consumers, event planners, landscaping companies, and wholesale distributors. Each segment has distinct needs and purchasing behaviors that influence market dynamics. Retail consumers and event planners are the largest contributors to market demand, driven by gifting, home decoration, and large-scale events .

Retail consumers represent the largest segment in the floriculture market, driven by the increasing trend of gifting flowers, home decoration, and the convenience of online purchasing. The rise of e-commerce platforms has made it easier for consumers to access a wide variety of flowers, further boosting this segment. Event planners also play a significant role, as they require large quantities of flowers for weddings, corporate events, and other celebrations, thus contributing to overall market growth .

The Malaysia Floriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Black Tulip Group, Dümmen Orange, Floristika.com.my Sdn Bhd, Paling Horticulture Sdn Bhd, Splendid Floriculture Sdn Bhd, I-Tech Farming Solution (M) Sdn Bhd, Waltex Biotec Sdn. Bhd., Yayasan Sabah Group, Syngenta Crop Protection AG, Weeds and More Pte Ltd., Flory Flora Sdn Bhd, Green World Genetics Sdn Bhd, Flora Maju Sdn Bhd, FloraWorld Sdn Bhd, and Orchid Culture Sdn Bhd contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Malaysian floriculture market appears promising, driven by increasing consumer interest in sustainable and organic products. As the market evolves, technological advancements in cultivation and distribution are expected to enhance efficiency and product quality. Additionally, the rise of online sales channels will facilitate broader access to floral products, catering to a tech-savvy consumer base. These trends indicate a dynamic market landscape that is likely to adapt to changing consumer preferences and environmental considerations.

| Segment | Sub-Segments |

|---|---|

| By Type | Orchids Roses Chrysanthemums Carnations Asters Gerberas Lilies Other Flowers |

| By End-User | Retail Consumers Event Planners Landscaping Companies Wholesale Distributors |

| By Sales Channel | Domestic Export Online Retail Garden Centers Supermarkets Florists |

| By Distribution Mode | Direct Sales Wholesale E-commerce |

| By Price Range | Premium Mid-Range Budget |

| By Application | Residential Commercial Institutional |

| By Region | Peninsular Malaysia East Malaysia Kuala Lumpur Penang Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Floriculture Sales | 120 | Retail Managers, Florists, Store Owners |

| Wholesale Flower Distribution | 90 | Wholesale Distributors, Supply Chain Managers |

| Consumer Preferences in Floriculture | 140 | End Consumers, Event Planners, Wedding Coordinators |

| Nursery Operations Insights | 80 | Nursery Owners, Horticulturists, Agricultural Experts |

| Market Trends and Innovations | 60 | Industry Analysts, Market Researchers, Academic Professionals |

The Malaysia Floriculture Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by rising disposable incomes, increased consumer interest in gardening, and the popularity of floral decorations for events and gifting.