Region:Asia

Author(s):Geetanshi

Product Code:KRAD0046

Pages:90

Published On:August 2025

By Type:The freight logistics market is segmented intoRoad Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Express Delivery Services, Third-Party Logistics (3PL) Services, Cold Chain Logistics, and Others. Road freight remains the largest segment, driven by domestic distribution needs, while air and sea freight support international trade. Express delivery and 3PL services are expanding rapidly due to rising e-commerce volumes and demand for integrated logistics solutions. Cold chain logistics is increasingly important for pharmaceuticals and food, reflecting Japan’s focus on quality and safety in temperature-sensitive supply chains.

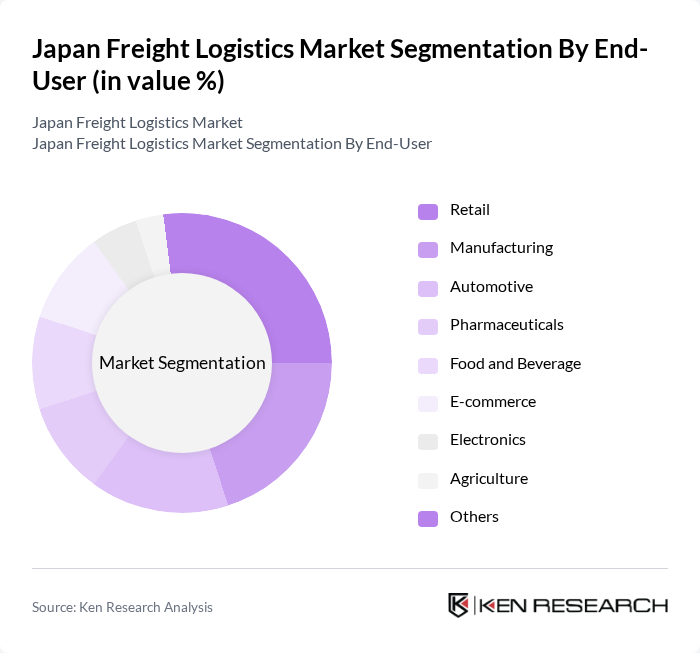

By End-User:The end-user segmentation of the freight logistics market includesRetail, Manufacturing, Automotive, Pharmaceuticals, Food and Beverage, E-commerce, Electronics, Agriculture, and Others. Retail and e-commerce sectors are the largest consumers of logistics services, reflecting the rapid growth of online shopping and omnichannel retailing. Manufacturing, automotive, and electronics sectors require robust logistics networks for both inbound raw materials and outbound finished goods. Pharmaceuticals and food & beverage segments increasingly rely on cold chain and specialized logistics to ensure product integrity.

The Japan Freight Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Holdings, Inc., Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd. (SG Holdings Co., Ltd.), Kintetsu World Express, Inc., Seino Holdings Co., Ltd., Hitachi Transport System, Ltd., Japan Post Co., Ltd., Mitsui-Soko Holdings Co., Ltd., Marubeni Corporation, Mitsui O.S.K. Lines, Ltd., Nippon Yusen Kabushiki Kaisha (NYK Line), Kuehne + Nagel Ltd., DB Schenker, DSV Panalpina A/S, CEVA Logistics, XPO Logistics, Inc., Hanjin Shipping contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's freight logistics market appears promising, driven by ongoing technological advancements and infrastructure investments. As e-commerce continues to thrive, logistics providers are expected to enhance their service offerings through automation and smart logistics solutions. Additionally, the focus on sustainability will likely lead to the adoption of greener practices, aligning with global trends. Overall, the market is poised for growth, adapting to evolving consumer demands and regulatory pressures while leveraging innovation to improve efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express Delivery Services Third-Party Logistics (3PL) Services Cold Chain Logistics Others |

| By End-User | Retail Manufacturing Automotive Pharmaceuticals Food and Beverage E-commerce Electronics Agriculture Others |

| By Service Type | Freight Forwarding Warehousing Distribution Customs Brokerage Supply Chain Management Value-Added Services (Packaging, Labeling, Inventory Management) Others |

| By Delivery Mode | Standard Delivery Expedited Delivery Same-Day Delivery Scheduled Delivery Others |

| By Packaging Type | Bulk Packaging Unit Packaging Custom Packaging Others |

| By Geographic Coverage | Kanto Region (Tokyo, Yokohama) Kansai/Kinki Region (Osaka, Kyoto) Chubu Region (Nagoya) Kyushu-Okinawa Region Tohoku Region Hokkaido Region Domestic Logistics International Logistics Cross-Border Logistics Others |

| By Customer Type | B2B B2C C2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Freight Logistics | 60 | Logistics Managers, Supply Chain Managers |

| Retail Supply Chain Operations | 50 | Operations Managers, Inventory Control Specialists |

| Electronics Distribution Networks | 40 | Warehouse Managers, Logistics Coordinators |

| Food and Beverage Logistics | 40 | Quality Assurance Managers, Distribution Supervisors |

| E-commerce Fulfillment Strategies | 50 | E-commerce Managers, Logistics Analysts |

The Japan Freight Logistics Market is valued at approximately USD 322 billion, driven by the growth of e-commerce, advanced supply chain technologies, and infrastructure development. This valuation reflects a comprehensive analysis over the past five years.