Region:Asia

Author(s):Shubham

Product Code:KRAA0699

Pages:85

Published On:August 2025

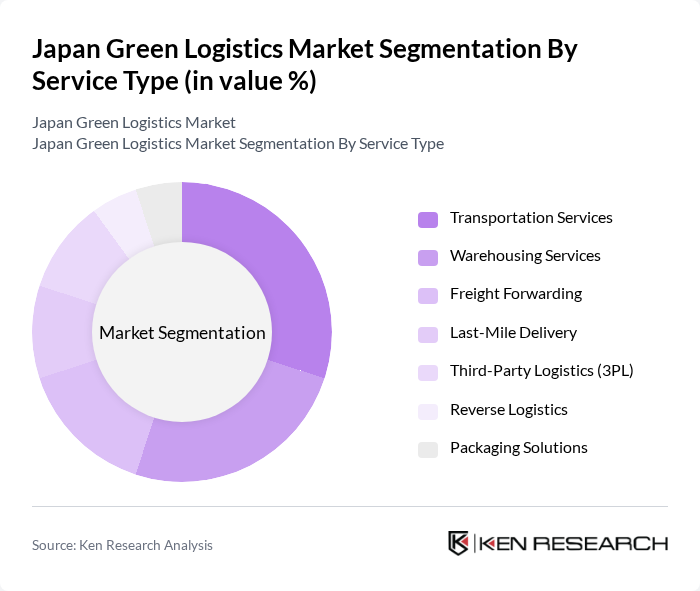

By Service Type:The service type segmentation includes various sub-segments that cater to different logistics needs. The primary sub-segments are Transportation Services, Warehousing Services, Freight Forwarding, Last-Mile Delivery, Third-Party Logistics (3PL), Reverse Logistics, and Packaging Solutions. Each of these sub-segments plays a crucial role in the overall logistics ecosystem, addressing specific challenges and requirements of businesses. Warehousing and distribution are particularly prominent, driven by the need for energy-efficient storage and rapid, sustainable delivery to meet e-commerce and retail demands .

By Industry Vertical:The industry vertical segmentation encompasses various sectors that utilize green logistics solutions. Key sub-segments include Retail & E-commerce, Manufacturing, Healthcare, Food & Beverage, Automotive, and Others. Each sector has unique logistics requirements, driving the demand for tailored green logistics services that enhance efficiency and sustainability. Retail & e-commerce and manufacturing are the largest contributors, reflecting the rapid growth of online shopping and the need for sustainable supply chains in production industries .

The Japan Green Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yamato Holdings Co., Ltd., Nippon Express Holdings, Inc., Sagawa Express Co., Ltd., Seino Holdings Co., Ltd., Hitachi Transport System, Ltd. (Logisteed, Ltd.), Kintetsu World Express, Inc., Japan Post Holdings Co., Ltd., Mitsui-Soko Holdings Co., Ltd., Marubeni Corporation, Asahi Logistics Co., Ltd., Kuehne + Nagel Ltd. (Japan), DHL Supply Chain Japan, Geodis Japan, JIT Logistics Co., Ltd., Rakuten Super Logistics Japan, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's green logistics market appears promising, driven by increasing environmental awareness and technological advancements. The integration of electric vehicles and AI-driven logistics solutions is expected to reshape the industry, enhancing efficiency and sustainability. As consumer preferences shift towards eco-friendly options, logistics providers will need to adapt quickly. Collaborative efforts between government and private sectors will be crucial in overcoming infrastructure challenges and fostering innovation, ultimately leading to a more sustainable logistics ecosystem in Japan.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Services Warehousing Services Freight Forwarding Last-Mile Delivery Third-Party Logistics (3PL) Reverse Logistics Packaging Solutions |

| By Industry Vertical | Retail & E-commerce Manufacturing Healthcare Food & Beverage Automotive Others |

| By Distribution Mode | Road Rail Air Sea Intermodal Others |

| By Application | Supply Chain Management Inventory Management Transportation Management Fleet Management Sustainability Reporting Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Foreign Direct Investment Others |

| By Policy Support | Subsidies Tax Incentives Grants Regulatory Compliance Support Others |

| By Service Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) In-House Logistics Outsourced Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Green Logistics | 60 | Logistics Managers, Sustainability Coordinators |

| Manufacturing Sustainability Practices | 50 | Operations Directors, Environmental Compliance Officers |

| E-commerce Green Initiatives | 45 | eCommerce Operations Managers, Supply Chain Analysts |

| Transportation Emission Reduction Strategies | 40 | Fleet Managers, Logistics Strategy Planners |

| Waste Management in Logistics | 40 | Waste Management Officers, Sustainability Managers |

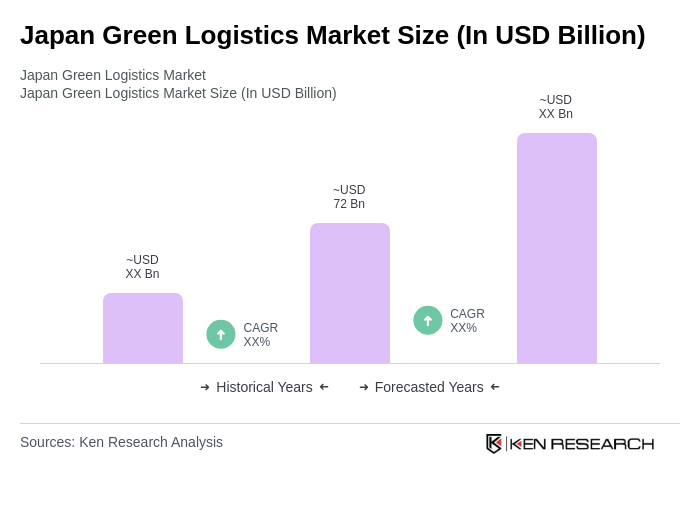

The Japan Green Logistics Market is valued at approximately USD 72 billion, driven by factors such as stringent environmental regulations, increased adoption of green finance incentives, and the growing demand for sustainable delivery solutions in the e-commerce sector.