Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1200

Pages:80

Published On:November 2025

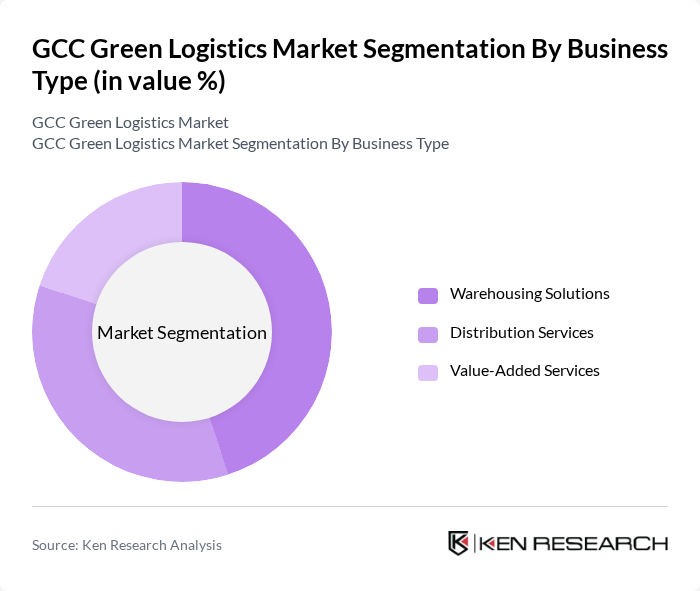

By Business Type:The business type segmentation includes Warehousing, Distribution, and Value-Added Services. Each segment is integral to the logistics framework: warehousing solutions support inventory management and energy-efficient storage, distribution services enable the movement of goods with optimized routing and lower emissions, and value-added services—such as packaging, labeling, and reverse logistics—enhance customer satisfaction while supporting sustainability objectives.

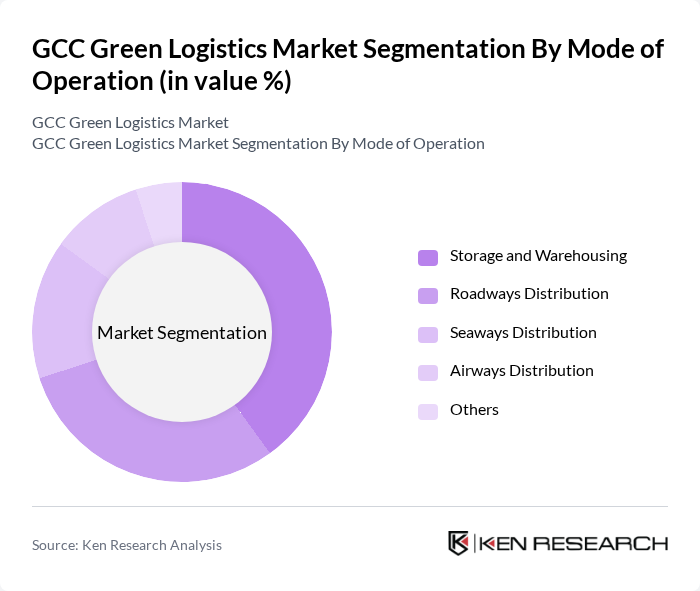

By Mode of Operation:The mode of operation segmentation encompasses Storage and Warehousing, Roadways Distribution, Seaways Distribution, Airways Distribution, and Others. This categorization reflects the diversity of logistics operations in the GCC, with storage and warehousing emphasizing energy efficiency and renewable integration, roadways focusing on electrification and route optimization, seaways leveraging eco-friendly vessels, and airways adopting carbon offsetting and fuel-efficient aircraft.

The GCC Green Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, DB Schenker, Kuehne + Nagel, Agility Logistics, Aramex, CEVA Logistics, Maersk, CMA CGM, MSC Mediterranean Shipping Company, Volkswagen Group Logistics, Hyundai Glovis, Toll Group, Nippon Express, DB Cargo, and GreenLine Mobility Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC green logistics market appears promising, driven by increasing investments in sustainable technologies and a growing emphasis on environmental responsibility. As governments continue to implement supportive policies, businesses are likely to enhance their green logistics strategies. The integration of innovative technologies will further streamline operations, leading to reduced emissions and improved efficiency. Additionally, the rising consumer demand for sustainable practices will compel companies to adapt, ensuring that green logistics becomes a core component of their operational frameworks.

| Segment | Sub-Segments |

|---|---|

| By Business Type (Warehousing, Distribution, Value-Added Services) | Warehousing Solutions Distribution Services Value-Added Services |

| By Mode of Operation (Storage, Roadways Distribution, Seaways Distribution, Airways Distribution) | Storage and Warehousing Roadways Distribution Seaways Distribution Airways Distribution Others |

| By End-Use Industry (Retail & E-Commerce, Semiconductor & Electronics, Chemical & Materials, Automotive, Energy & Utilities, Healthcare, Manufacturing) | Retail and E-Commerce Semiconductor and Electronics Chemical and Materials Automotive Energy and Utilities Healthcare Manufacturing |

| By Technology (Electric Vehicles, Renewable Energy Integration, AI-Driven Logistics, IoT Solutions) | Electric Vehicle Logistics Renewable Energy Integration in Logistics AI-Driven Route Optimization IoT-Based Real-Time Tracking Others |

| By Application (Last-Mile Delivery, Freight Transport, Warehousing, Reverse Logistics) | Last-Mile Delivery Solutions Freight Transport Services Warehousing Solutions Reverse Logistics Others |

| By Region (Saudi Arabia, United Arab Emirates, Qatar, Bahrain, Kuwait, Oman) | Saudi Arabia United Arab Emirates Qatar Bahrain Kuwait Oman |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Green Initiatives | 100 | Logistics Managers, Sustainability Coordinators |

| Manufacturing Supply Chain Optimization | 80 | Operations Directors, Environmental Compliance Officers |

| E-commerce Sustainability Practices | 90 | eCommerce Operations Managers, Supply Chain Analysts |

| Transportation Emission Reduction Strategies | 70 | Fleet Managers, Environmental Strategy Planners |

| Logistics Technology Adoption for Sustainability | 50 | IT Managers, Innovation Leads |

The GCC Green Logistics Market is valued at approximately USD 29 billion, reflecting a significant growth driven by increasing environmental regulations, consumer demand for sustainable practices, and advancements in technology such as AI and IoT for logistics optimization.