Region:Middle East

Author(s):Shubham

Product Code:KRAA0904

Pages:80

Published On:August 2025

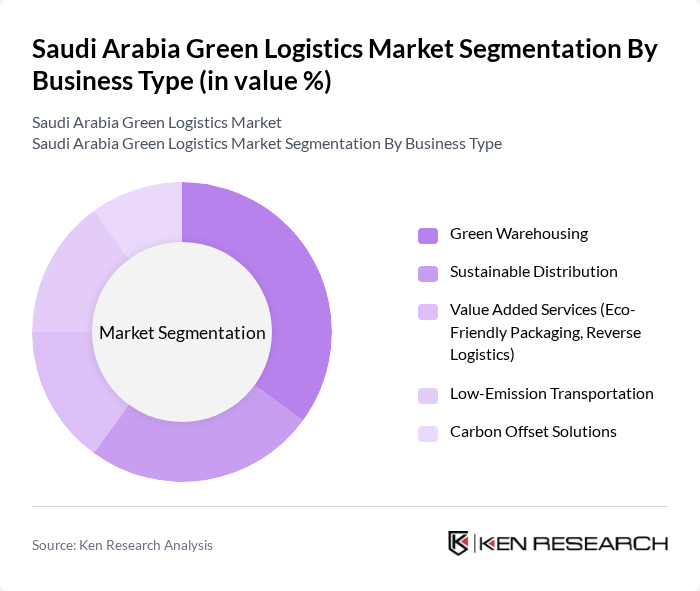

By Business Type:The business type segmentation includes Green Warehousing, Sustainable Distribution, Value Added Services (such as Eco-Friendly Packaging and Reverse Logistics), Low-Emission Transportation, and Carbon Offset Solutions. Green Warehousing is currently the leading subsegment, driven by the demand for energy-efficient storage, automation, and sustainable building practices. Companies are increasingly investing in solar-powered warehouses, advanced insulation, and waste reduction technologies, making this subsegment a focal point for growth .

By End-User Industry:The end-user industry segmentation includes Retail & E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals & Healthcare, Oil & Gas, and Others. Retail & E-commerce is the dominant subsegment, supported by rapid e-commerce expansion and rising consumer demand for sustainable delivery. Companies in this sector are adopting green logistics practices, such as electric vehicle fleets and recyclable packaging, to meet evolving environmental expectations and regulatory requirements .

The Saudi Arabia Green Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, Agility Logistics, Saudi Post (SPL), Bahri (National Shipping Company of Saudi Arabia), Naqel Express, Kuehne + Nagel, DB Schenker, CEVA Logistics, FedEx, UPS, Maersk, Al Majdouie Logistics, Gulf Agency Company (GAC Saudi Arabia), Almajdouie De Rijke Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the green logistics market in Saudi Arabia appears promising, driven by increasing government support and a growing consumer base that prioritizes sustainability. As companies adapt to new regulations and consumer demands, investments in green technologies and infrastructure are expected to rise. The integration of smart logistics solutions will enhance operational efficiency, while the expansion of renewable energy sources will further support the transition to sustainable logistics practices, positioning the market for significant growth.

| Segment | Sub-Segments |

|---|---|

| By Business Type | Green Warehousing Sustainable Distribution Value Added Services (Eco-Friendly Packaging, Reverse Logistics) Low-Emission Transportation Carbon Offset Solutions |

| By End-User Industry | Retail & E-commerce Manufacturing Food and Beverage Pharmaceuticals & Healthcare Oil & Gas Others |

| By Mode of Transport | Road Rail Air Sea |

| By Application | Last-Mile Delivery Freight Forwarding Supply Chain Management Inventory Management Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships |

| By Technology Adoption | IoT & Telematics AI & Machine Learning Blockchain for Supply Chain Automation & Robotics Renewable Energy Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Green Logistics | 100 | Logistics Managers, Sustainability Coordinators |

| Manufacturing Waste Management | 80 | Operations Managers, Environmental Compliance Officers |

| E-commerce Sustainable Practices | 90 | eCommerce Directors, Supply Chain Analysts |

| Transportation Emission Reduction | 70 | Fleet Managers, Logistics Strategy Planners |

| Recycling and Recovery Initiatives | 50 | Recycling Program Managers, Product Lifecycle Analysts |

The Saudi Arabia Green Logistics Market is valued at approximately USD 15 billion, driven by national strategies like Vision 2030, infrastructure investments, and the adoption of sustainable practices across the logistics sector.