Region:Middle East

Author(s):Rebecca

Product Code:KRAA0363

Pages:83

Published On:August 2025

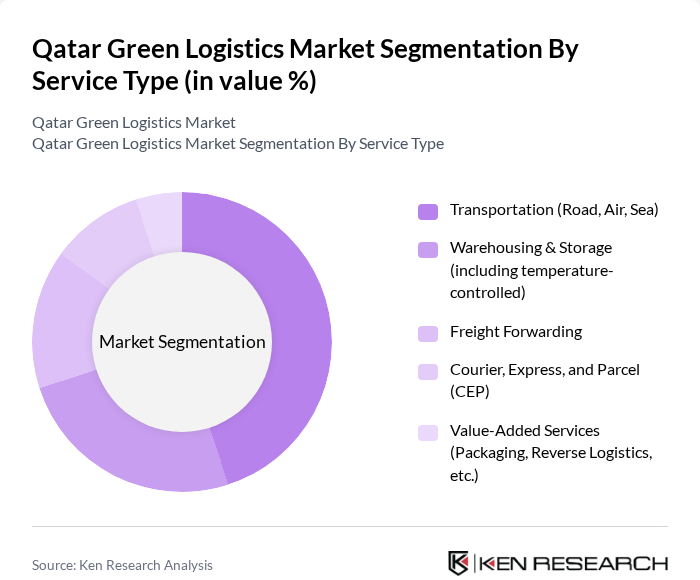

By Service Type:The service type segmentation includes various sub-segments such as Transportation (Road, Air, Sea), Warehousing & Storage (including temperature-controlled), Freight Forwarding, Courier, Express, and Parcel (CEP), and Value-Added Services (Packaging, Reverse Logistics, etc.). Among these, Transportation is the dominant sub-segment due to the increasing demand for efficient and sustainable transport solutions. The rise in e-commerce and the need for rapid delivery have further fueled the need for reliable transportation services, making it a critical component of the logistics market .

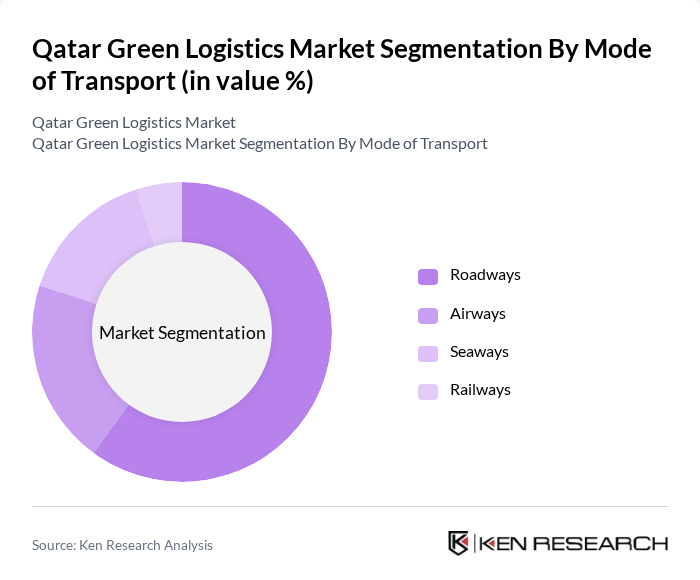

By Mode of Transport:The mode of transport segmentation includes Roadways, Airways, Seaways, and Railways. Roadways dominate this segment due to their flexibility and efficiency in delivering goods across various distances. The increasing urbanization and infrastructure development in Qatar have further enhanced the road transport network, making it the preferred choice for logistics operations .

The Qatar Green Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Warehousing Company (GWC), Milaha (Qatar Navigation), Qatar Airways Cargo, DHL Express Qatar, Kuehne + Nagel Qatar, Agility Logistics Qatar, DB Schenker Qatar, Aramex Qatar, Maersk Qatar, CEVA Logistics Qatar, Qatar Post, Al-Futtaim Logistics, Al-Mana Group Logistics, Qatar National Import and Export Co., Qatar Green Logistics Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Green Logistics Market appears promising, driven by increasing government support and technological advancements. As Qatar continues to invest in sustainable infrastructure, the logistics sector is expected to see a shift towards greener practices. In future, it is anticipated that 50% of logistics operations will incorporate renewable energy sources, significantly reducing carbon footprints. This transition will not only enhance operational efficiency but also align with global sustainability goals, positioning Qatar as a leader in green logistics in the region.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation (Road, Air, Sea) Warehousing & Storage (including temperature-controlled) Freight Forwarding Courier, Express, and Parcel (CEP) Value-Added Services (Packaging, Reverse Logistics, etc.) |

| By Mode of Transport | Roadways Airways Seaways Railways |

| By End-User Industry | Retail & E-commerce Oil & Gas / Energy Construction Food & Beverage Pharmaceuticals & Healthcare Others (Automotive, Chemicals, etc.) |

| By Technology Adoption | Electric & Alternative Fuel Vehicles Smart Logistics Technologies (IoT, AI, Automation) Renewable Energy Integration Eco-friendly Packaging Solutions Others |

| By Application | Last-Mile Delivery Freight Transportation Warehousing Solutions Supply Chain Management Others |

| By Investment Source | Domestic Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Region | Doha Al Rayyan Umm Salal Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Green Logistics | 100 | Logistics Managers, Sustainability Coordinators |

| Construction Material Transportation | 80 | Project Managers, Supply Chain Analysts |

| Oil & Gas Supply Chain Management | 70 | Operations Directors, Environmental Compliance Officers |

| Food and Beverage Distribution | 60 | Warehouse Managers, Quality Assurance Managers |

| Technology and Electronics Logistics | 90 | Product Managers, Logistics Coordinators |

The Qatar Green Logistics Market is valued at approximately USD 1.1 billion, driven by government sustainability initiatives, consumer demand for eco-friendly logistics, and the growth of e-commerce. Investments in green technologies and infrastructure are also key contributors to this market's growth.