Region:Global

Author(s):Shubham

Product Code:KRAA1081

Pages:92

Published On:August 2025

By Transportation Mode:The transportation mode segment includes various methods of moving goods, which are essential for efficient logistics operations. The subsegments include Road Transport, Rail Freight, Air Cargo, and Sea Freight. Each mode has distinct advantages: road transport offers flexibility and last-mile connectivity, rail freight is cost-effective for bulk and long-distance transport, air cargo provides speed for high-value or time-sensitive goods, and sea freight is optimal for international and large-volume shipments .

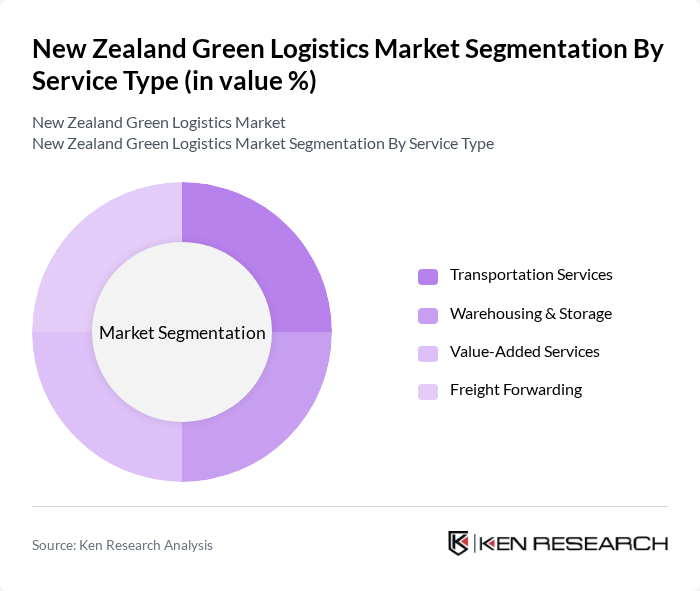

By Service Type:This segment encompasses various services within the logistics framework, including Transportation Services, Warehousing & Storage, Value-Added Services, and Freight Forwarding. Transportation services are the backbone of logistics, ensuring goods move efficiently across the supply chain. Warehousing & storage support inventory management and order fulfillment. Value-added services—such as packaging, labeling, and returns management—enhance operational efficiency and customer satisfaction. Freight forwarding coordinates the movement of goods across international borders, optimizing routes and compliance .

The New Zealand Green Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight Limited, Freightways Limited, NZ Post (New Zealand Post Limited), Fliway Group Limited, Toll Group (New Zealand), Coda Group, PBT Transport Limited, TIL Logistics Group Limited, DHL Express (New Zealand), Kuehne + Nagel New Zealand, C3 Limited, Z Energy Limited, Waste Management NZ Limited, EnviroWaste Services Limited, and Owens Transport contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand green logistics market appears promising, driven by increasing consumer demand for sustainable practices and supportive government policies. As more companies invest in green technologies, the logistics sector is expected to see enhanced efficiency and reduced emissions. Furthermore, the integration of renewable energy sources and the adoption of circular economy principles will likely reshape logistics operations, fostering a more sustainable industry landscape that aligns with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Transport Rail Freight Air Cargo Sea Freight |

| By Service Type | Transportation Services Warehousing & Storage Value-Added Services Freight Forwarding |

| By Industry Vertical | Manufacturing Retail & E-commerce Agriculture Healthcare Automotive Others |

| By Application | Last-Mile Delivery Freight Transportation Supply Chain Management Inventory Management Others |

| By Technology | Fleet Management Systems Route Optimization Software Energy-Efficient Vehicles Renewable Energy Integration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Green Logistics | 60 | Logistics Managers, Sustainability Coordinators |

| Manufacturing Sustainability Practices | 50 | Operations Managers, Environmental Compliance Officers |

| E-commerce Green Initiatives | 45 | eCommerce Managers, Supply Chain Analysts |

| Transport Sector Emission Reduction | 40 | Fleet Managers, Sustainability Directors |

| Logistics Technology Adoption | 40 | IT Managers, Innovation Leads |

The New Zealand Green Logistics Market is valued at approximately USD 18 billion, reflecting a significant shift towards sustainable logistics practices driven by environmental awareness, government regulations, and the growth of e-commerce.