Region:Asia

Author(s):Geetanshi

Product Code:KRAA1212

Pages:85

Published On:August 2025

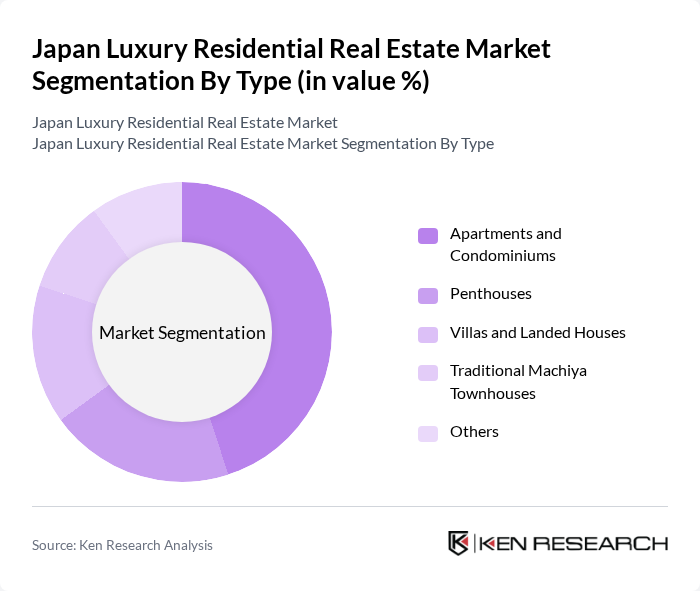

By Type:The luxury residential real estate market can be segmented into various types, including apartments and condominiums, penthouses, villas and landed houses, traditional Machiya townhouses, and others. Among these, apartments and condominiums are the most popular due to their modern amenities and prime locations, appealing to both local and foreign buyers. Penthouses, while fewer in number, command high prices and are sought after for their exclusivity and views. Villas and landed houses attract affluent families looking for spacious living environments, while traditional Machiya townhouses appeal to those interested in cultural heritage.

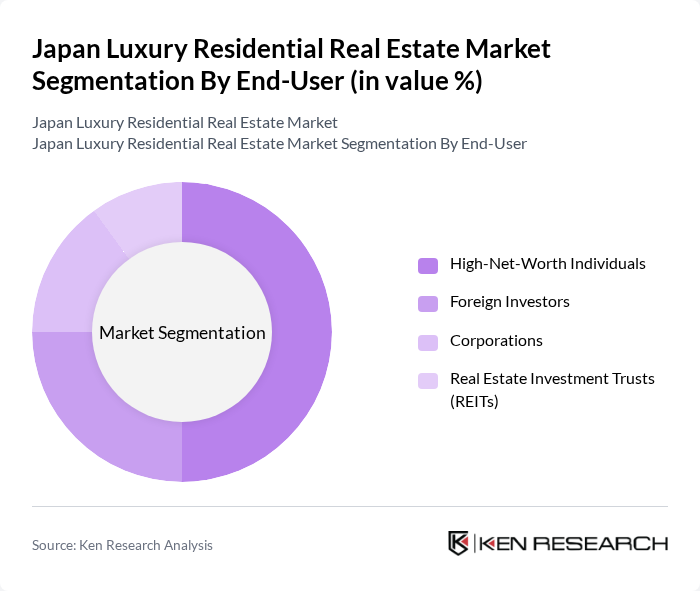

By End-User:The end-user segmentation includes high-net-worth individuals, foreign investors, corporations, and real estate investment trusts (REITs). High-net-worth individuals dominate the market, driven by their desire for luxury living and investment opportunities. Foreign investors are increasingly attracted to Japan's stable economy and favorable property laws. Corporations often seek luxury residences for executives, while REITs are becoming more active in acquiring premium properties to enhance their portfolios.

The Japan Luxury Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsui Fudosan Co., Ltd., Sumitomo Realty & Development Co., Ltd., Tokyu Land Corporation, Daiwa House Industry Co., Ltd., Nomura Real Estate Holdings, Inc., Sekisui House, Ltd., Mitsubishi Estate Co., Ltd., MORI TRUST CO., LTD., Urban Renaissance Agency, Kenedix, Inc., Japan Real Estate Investment Corporation, Tokyu Corporation, Japan Property Management Center Co., Ltd., Aoyama Zaisan Networks Co., Ltd., Haseko Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Japan luxury residential real estate market is poised for continued growth, driven by increasing affluence and urbanization trends. As the population in urban areas expands, demand for high-end living spaces will likely rise, particularly in Tokyo and Osaka. Additionally, the integration of technology and sustainability in new developments will attract discerning buyers. However, regulatory challenges and economic uncertainties may temper growth, necessitating strategic approaches from developers and investors to navigate this evolving landscape effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Apartments and Condominiums Penthouses Villas and Landed Houses Traditional Machiya Townhouses Others |

| By End-User | High-Net-Worth Individuals Foreign Investors Corporations Real Estate Investment Trusts (REITs) |

| By Price Range | Below ¥100 Million ¥100 Million - ¥300 Million ¥300 Million - ¥500 Million Above ¥500 Million |

| By Location | Tokyo (Central Wards: Chiyoda, Chuo, Minato, Shinjuku, Shibuya) Osaka Kyoto Yokohama Fukuoka Other Cities (e.g., Sapporo, Kanazawa, Chiba) |

| By Amenities | Concierge Services Swimming Pools Fitness Centers Smart Home Features Security Systems Spa and Wellness Facilities Parking Facilities Others |

| By Construction Type | New Constructions Renovated Properties Historical Properties |

| By Sales Channel | Direct Sales Real Estate Agents Online Platforms Auctions Short-term Rental/Serviced Apartment Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apartment Buyers | 100 | High-net-worth Individuals, Real Estate Investors |

| Luxury Villa Owners | 80 | Property Developers, Wealth Managers |

| Real Estate Agents | 60 | Luxury Property Specialists, Market Analysts |

| Foreign Investors in Japanese Real Estate | 70 | International Investors, Financial Advisors |

| Luxury Property Developers | 40 | Project Managers, Business Development Executives |

The Japan Luxury Residential Real Estate Market is valued at approximately USD 35 billion, driven by increasing demand from high-net-worth individuals and robust foreign investment, particularly in urban areas like Tokyo, Osaka, and Kyoto.