Region:Middle East

Author(s):Dev

Product Code:KRAB0448

Pages:90

Published On:August 2025

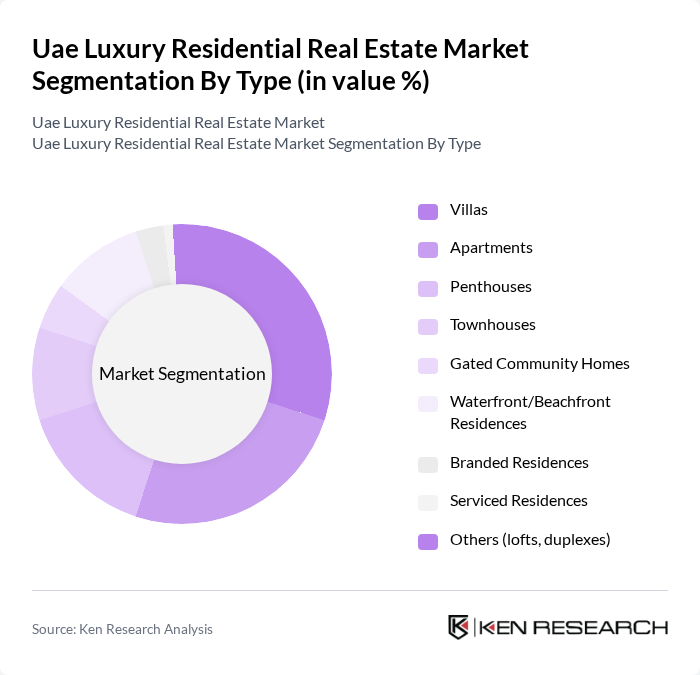

By Type:The luxury residential real estate market in the UAE is segmented into various types, including villas, apartments, penthouses, townhouses, gated community homes, waterfront/beachfront residences, branded residences, serviced residences, and others such as lofts and duplexes. Villas and branded residences are particularly popular, supported by strong price performance in prime villa districts and a surge of branded residence launches across Dubai, often with waterfront positioning and resort-style amenities . Demand for waterfront properties has risen in tandem with lifestyle-driven buying and the prominence of coastal masterplans across Dubai and other emirates .

By Buyer Profile:The buyer profile in the UAE luxury residential real estate market includes UAE residents (end-users), non-resident foreign buyers, institutional/family office investors, and corporate/staff housing. Non-resident foreign buyers remain highly active, supported by visa reforms, tax advantages, and the UAE’s safe?haven status; at the same time, resident HNWIs continue to purchase prime and ultra?prime assets for both lifestyle and wealth preservation . Robust off?plan activity and high transaction volumes in prime areas also reflect strong participation from international buyers and family offices seeking branded and waterfront products .

The UAE luxury residential real estate market is characterized by a dynamic mix of regional and international players. Leading participants such as Emaar Properties PJSC, DAMAC Properties, Aldar Properties PJSC, Nakheel, Sobha Realty, Dubai Properties (DP), Meraas, Omniyat, Azizi Developments, Select Group, Majid Al Futtaim Communities, Al Habtoor Group, Union Properties PJSC, RAK Properties PJSC, Deyaar Development PJSC, Ellington Properties, Emaar Development PJSC, Binghatti, Arada, Seven Tides contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE luxury residential real estate market appears promising, driven by ongoing urbanization and a growing demand for high-end living spaces. As the government continues to invest in infrastructure and promote foreign investment, the market is likely to attract more affluent buyers. Additionally, the integration of smart home technologies and eco-friendly developments will cater to evolving consumer preferences, enhancing the appeal of luxury properties. Overall, the sector is expected to remain resilient and adaptive to changing market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Villas Apartments Penthouses Townhouses Gated Community Homes Waterfront/Beachfront Residences Branded Residences Serviced Residences Others (lofts, duplexes) |

| By Buyer Profile | UAE Residents (End-Users) Non-Resident Foreign Buyers Institutional/Family Office Investors Corporate/Staff Housing |

| By Price Band (AED) | –5 Million –10 Million –20 Million –50 Million Million and Above (Ultra-Luxury) |

| By Prime Location/Emirate | Dubai: Palm Jumeirah, Downtown, Dubai Hills, Dubai Marina, Jumeirah Bay Abu Dhabi: Saadiyat Island, Yas Island, Al Raha Beach Sharjah: Al Khan, Waterfront communities Ras Al Khaimah: Al Marjan Island, Mina Al Arab Ajman & Fujairah Prime Districts Other Emerging Luxury Corridors |

| By Property Features | Smart/Connected Home Features Sustainable/Green-Certified Designs Resort-Grade Amenities (spa, concierge, marina) Custom/Bespoke Fit-outs Large Plot/Privacy & Security |

| By Investment Strategy | Buy-to-Let Primary Residence/Second Home Short-Stay/Serviced Rental Capital Appreciation Focus (Off-plan) |

| By Financing Method | Cash Purchases Mortgages Developer Payment Plans (Installments/Post-Handover) Islamic Finance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apartment Buyers | 140 | High-Net-Worth Individuals, Real Estate Investors |

| Luxury Villa Owners | 100 | High-Net-Worth Individuals, Family Office Representatives |

| Real Estate Agents Specializing in Luxury | 80 | Real Estate Brokers, Market Analysts |

| Luxury Property Investors | 70 | Investment Advisors, Financial Planners |

| Luxury Real Estate Developers | 60 | Project Managers, Business Development Executives |

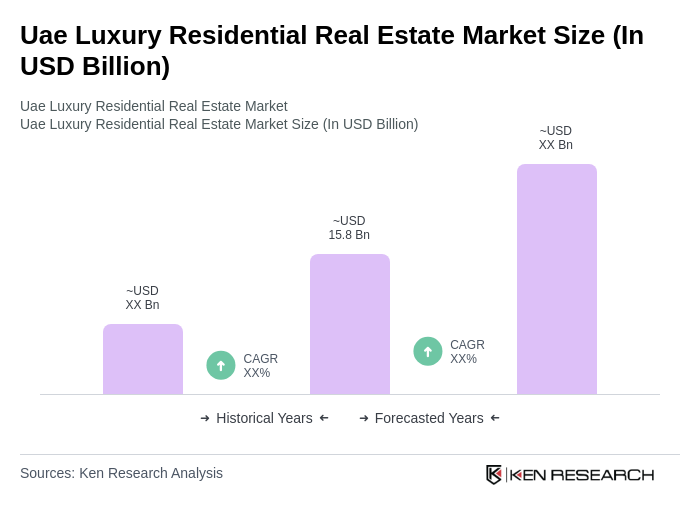

The UAE luxury residential real estate market is valued at approximately USD 15.8 billion, reflecting sustained demand driven by high-net-worth individuals and global investors, alongside favorable policies and a stable macroeconomic environment.