Region:Asia

Author(s):Rebecca

Product Code:KRAA2175

Pages:86

Published On:August 2025

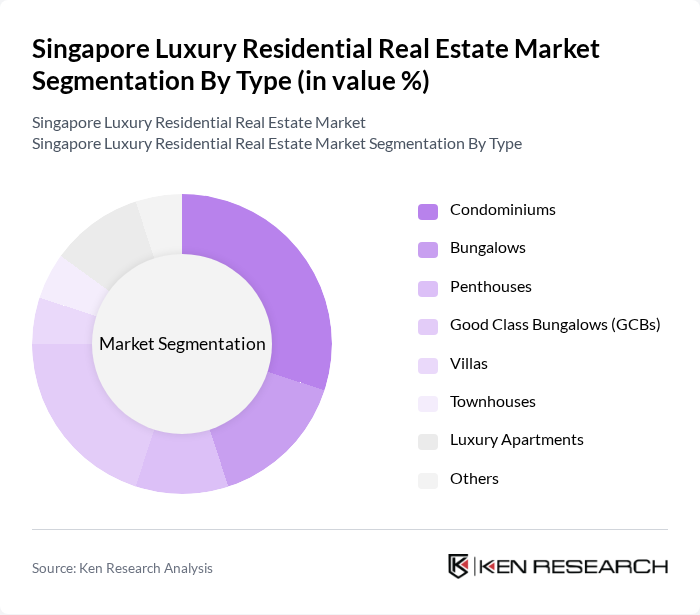

By Type:The luxury residential real estate market is segmented into condominiums, bungalows, penthouses, Good Class Bungalows (GCBs), villas, townhouses, luxury apartments, and others. Among these,condominiumsandGood Class Bungalows (GCBs)are especially popular, reflecting demand from both local and foreign buyers for prime locations, exclusive amenities, and privacy. The appeal of GCBs is heightened by their scarcity and the prestige associated with ownership, while luxury condominiums attract buyers seeking modern facilities and proximity to business districts .

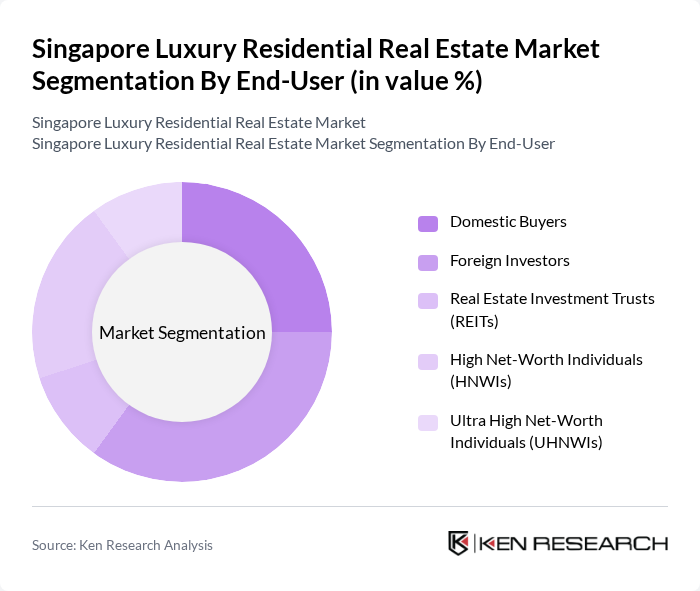

By End-User:The end-user segmentation comprises domestic buyers, foreign investors, Real Estate Investment Trusts (REITs), high-net-worth individuals (HNWIs), and ultra-high-net-worth individuals (UHNWIs).Foreign investorsandUHNWIsremain the dominant segments, attracted by Singapore’s economic stability, transparent regulatory environment, and potential for capital appreciation. The city’s growing population of millionaires and the proliferation of family offices further support sustained demand in the luxury segment .

The Singapore Luxury Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as CapitaLand Limited, City Developments Limited, Oxley Holdings Limited, UOL Group Limited, Frasers Property Limited, Hongkong Land Holdings Limited, GuocoLand Limited, SingHaiyi Group Ltd., Tuan Sing Holdings Limited, Roxy-Pacific Holdings Limited, Keppel Land Limited, Mapletree Investments Pte Ltd, SC Global Developments Pte Ltd, Pontiac Land Group, and Bukit Sembawang Estates Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore luxury residential real estate market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As smart home technologies become more prevalent, properties equipped with automation and energy-efficient systems will attract discerning buyers. Additionally, the increasing focus on wellness and lifestyle amenities will shape new developments, catering to the growing demand for holistic living experiences. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the luxury segment.

| Segment | Sub-Segments |

|---|---|

| By Type | Condominiums Bungalows Penthouses Good Class Bungalows (GCBs) Villas Townhouses Luxury Apartments Others |

| By End-User | Domestic Buyers Foreign Investors Real Estate Investment Trusts (REITs) High Net-Worth Individuals (HNWIs) Ultra High Net-Worth Individuals (UHNWIs) |

| By Price Range | Below SGD 2 Million SGD 2 Million - SGD 5 Million SGD 5 Million - SGD 10 Million SGD 10 Million - SGD 20 Million Above SGD 20 Million |

| By Location | Orchard Road Marina Bay Sentosa Cove Bukit Timah Holland Village Nassim Road Tanglin Others |

| By Amenities | Swimming Pools Fitness Centers Smart Home Features Security Services Parking Facilities Concierge Services |

| By Development Status | New Developments Under Construction Completed Projects |

| By Investment Purpose | Primary Residence Investment Property Vacation Home Rental Income Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apartment Buyers | 120 | High-net-worth Individuals, Real Estate Investors |

| Luxury Property Developers | 60 | Development Managers, Project Directors |

| Real Estate Agents Specializing in Luxury | 50 | Senior Agents, Brokerage Owners |

| Financial Advisors for High-net-worth Clients | 40 | Wealth Managers, Investment Advisors |

| Luxury Property Management Firms | 40 | Property Managers, Operations Directors |

The Singapore luxury residential real estate market is valued at approximately USD 15.8 billion, driven by a strong economy, an increase in high-net-worth individuals, and sustained foreign investment in prime districts like Orchard Road and Marina Bay.