Region:Asia

Author(s):Shubham

Product Code:KRAA1886

Pages:91

Published On:August 2025

By Type:The luxury residential real estate market in South Korea is segmented into various types, including apartments and condominiums, villas and landed houses, branded residences, luxury officetels, and other prime formats. Among these, apartments and condominiums, particularly high-rise and ultra-luxury towers, dominate the market due to their appeal to urban dwellers seeking modern amenities and convenience. The trend towards vertical living in metropolitan areas has led to a significant demand for these properties, making them the leading sub-segment.

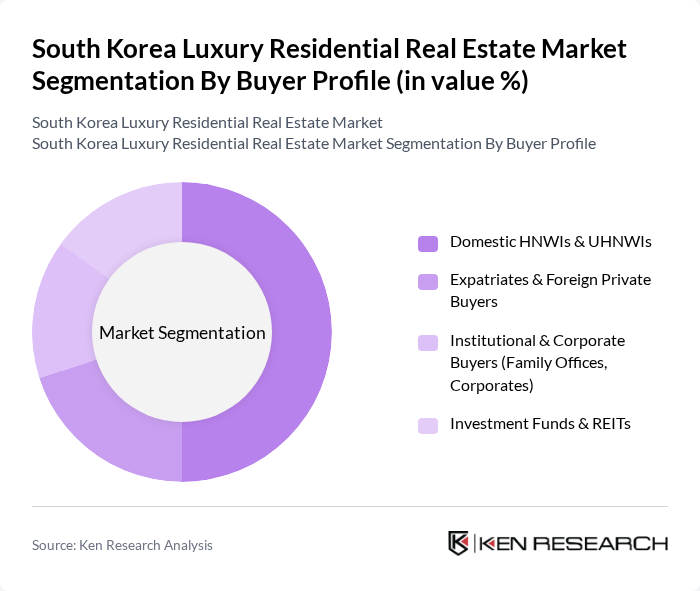

By Buyer Profile:The buyer profile in the luxury residential real estate market is diverse, encompassing domestic high-net-worth individuals (HNWIs), expatriates, institutional buyers, and investment funds. Domestic HNWIs and UHNWIs represent the largest segment, driven by a growing affluent class seeking luxury properties for personal use and investment. Expatriates and foreign private buyers are also significant, attracted by South Korea's stable economy and lifestyle offerings.

The South Korea Luxury Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung C&T Corporation (Raemian, Raemian One Bailey), Hyundai Engineering & Construction Co., Ltd. (The H, Hillstate), Daewoo Engineering & Construction Co., Ltd. (Prugio Summit), GS Engineering & Construction Corp. (Xi), SK ecoplant Co., Ltd. (SK View), Lotte E&C Co., Ltd. (Lotte Castle, Signiel Residences), Hanwha Engineering & Construction Corp. (Forena), POSCO E&C (POSCO E&C, The Sharp), HDC Hyundai Development Company (IPARK, HDC Lab), Hoban Construction Co., Ltd. (Taeyoung • Hoban Maison, De View), DL E&C Co., Ltd. (Acro by Daelim), SH Corporation (Seoul Housing & Communities Corp.), Korea Land & Housing Corporation (LH), KB Kookmin Bank (Real Estate Finance & Wealth Management), Shinhan Bank (Private Banking & Mortgage for HNWIs) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korea luxury residential real estate market is poised for continued growth, driven by increasing urbanization and a rising affluent population. As consumer preferences shift towards eco-friendly and technologically advanced living spaces, developers are likely to adapt their offerings accordingly. Additionally, the ongoing interest from foreign investors will further stimulate market dynamics. However, regulatory challenges and competition will require strategic positioning and innovation to capitalize on emerging opportunities in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Apartments & Condominiums (High-Rise, Ultra-Luxury Towers, Penthouse Units) Villas & Landed Houses (Luxury Detached, Townhouses) Branded Residences (Hotel-Managed & Serviced Luxury Residences) Luxury Officetels & Mixed-Use Residences Other Prime Formats (Heritage/Low-Rise Luxury, Gated Compounds) |

| By Buyer Profile | Domestic HNWIs & UHNWIs Expatriates & Foreign Private Buyers Institutional & Corporate Buyers (Family Offices, Corporates) Investment Funds & REITs |

| By Price Band (KRW) | –3 Billion –5 Billion –10 Billion Above 10 Billion |

| By Location | Seoul (Gangnam, Seocho, Songpa, Yongsan, Jongno/Jung) Greater Seoul (Seongnam/Bundang, Hanam, Pangyo) Busan (Haeundae, Suyeong) Jeju & Resort Destinations Other Tier-1 Cities (Incheon, Daegu, Daejeon, Gwangju) |

| By Amenities & Specifications | Wellness & Sports (Pools, Spas, Fitness, Golf Simulators) Security & Services (24/7 Concierge, Valet, Smart Access) Parking & Mobility (EV Charging, Private Garages) Sustainability & Smart Home (Green Certifications, Home Automation) Community & Lifestyle (Lounges, Rooftop Gardens, Kids/Pet Facilities) |

| By Tenure/Ownership | Freehold/Strata Long-Term Leasehold Co-Ownership/Fractional |

| By Investment Channel | Direct Private Purchases Foreign Direct Purchases REITs & Private Funds Developer Sales & Pre-Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apartment Buyers | 120 | High-net-worth Individuals, Real Estate Investors |

| Luxury Villa Owners | 90 | Property Developers, Wealth Managers |

| Real Estate Agents Specializing in Luxury | 70 | Real Estate Brokers, Market Analysts |

| Foreign Investors in South Korean Real Estate | 60 | International Investors, Financial Advisors |

| Luxury Property Management Firms | 50 | Property Managers, Operations Directors |

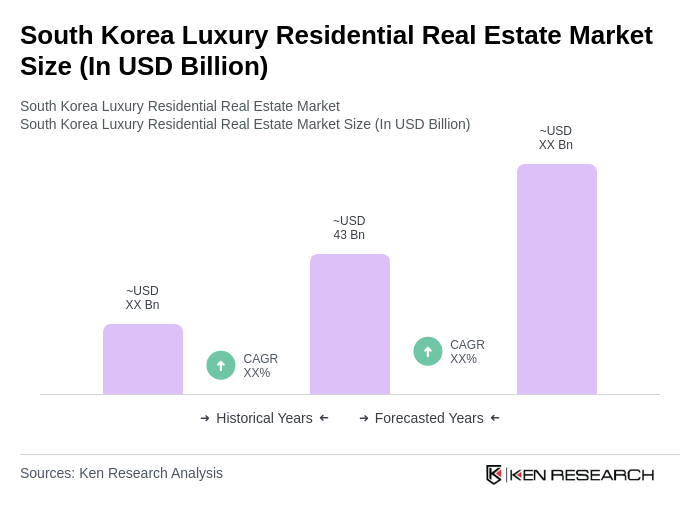

The South Korea luxury residential real estate market is valued at approximately USD 43 billion, driven by increasing demand from high-net-worth individuals and a robust economy, alongside urbanization trends and rising disposable incomes.