Region:Asia

Author(s):Geetanshi

Product Code:KRAA0140

Pages:81

Published On:August 2025

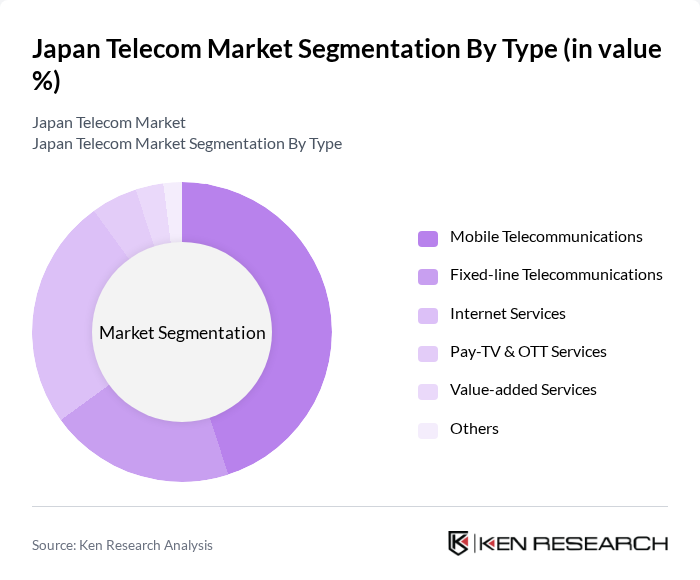

By Type:The segmentation by type includes various services offered in the telecom market. The subsegments are Mobile Telecommunications, Fixed-line Telecommunications, Internet Services, Pay-TV & OTT Services, Value-added Services, and Others. Each of these subsegments plays a crucial role in catering to the diverse needs of consumers and businesses. Mobile telecommunications is particularly dominant due to increasing smartphone penetration, the proliferation of 5G services, and rising demand for high-speed data connectivity. Fixed-line and internet services also remain significant, driven by the adoption of fiber broadband and the need for reliable enterprise solutions .

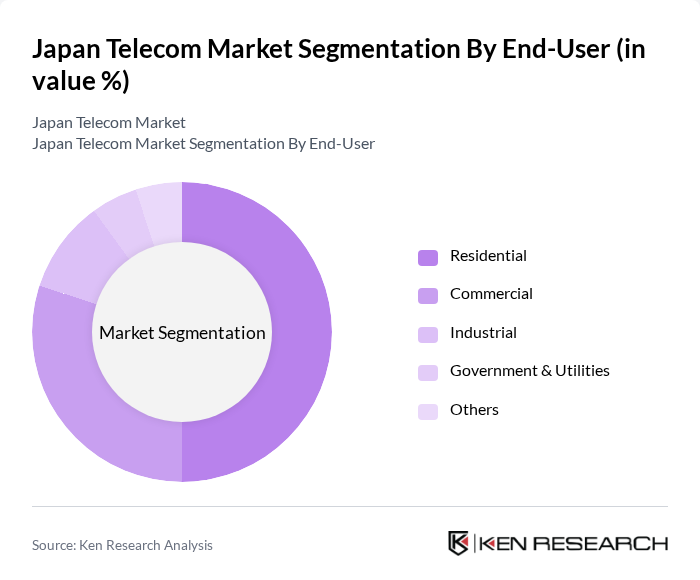

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The residential segment is the largest, driven by the increasing number of households adopting internet and mobile services, as well as the widespread use of streaming and digital platforms. Commercial users also contribute significantly, as businesses seek reliable communication solutions, cloud services, and advanced connectivity to enhance productivity and customer engagement .

The Japan Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as NTT Docomo, Inc., KDDI Corporation (au), SoftBank Corp., Rakuten Mobile, Inc., NTT Communications Corporation, Internet Initiative Japan Inc. (IIJ), Jupiter Telecommunications Co., Ltd. (J:COM), GMO Internet Group, Inc., NEC Corporation, Yahoo Japan Corporation (LY Corporation), Japan Network Information Center (JPNIC), ARTERIA Networks Corporation, BroadBand Tower, Inc., FreeBit Co., Ltd., OPTAGE Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Japan telecom market is poised for significant transformation as it embraces advanced technologies and evolving consumer demands. With the ongoing rollout of 5G networks and the increasing integration of IoT devices, telecom operators are expected to enhance service offerings and improve customer experiences. Additionally, the focus on digital transformation initiatives will likely drive innovation, enabling operators to explore new revenue streams and partnerships. As the market matures, adapting to regulatory changes and competitive pressures will be crucial for sustained growth and profitability.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Telecommunications Fixed-line Telecommunications Internet Services Pay-TV & OTT Services Value-added Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido Others |

| By Technology | 4G LTE 5G Fiber Optic (FTTH/B) Satellite Communication Others |

| By Application | Voice Services Data Services Video & Streaming Services Messaging Services IoT/M2M Communications Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 100 | Consumers aged 18-65, varying income levels |

| Broadband Subscribers | 80 | Households with internet access, diverse geographic locations |

| Enterprise Telecom Solutions | 60 | IT Managers, Procurement Officers in medium to large enterprises |

| 5G Technology Adoption | 50 | Tech-savvy consumers, early adopters of new technology |

| Telecom Regulatory Insights | 40 | Policy Makers, Regulatory Affairs Specialists |

The Japan Telecom Market is valued at approximately USD 117 billion, driven by increasing demand for mobile and internet services, high-speed fiber broadband expansion, and advancements in technology such as 5G.