Region:Africa

Author(s):Dev

Product Code:KRAB6029

Pages:84

Published On:October 2025

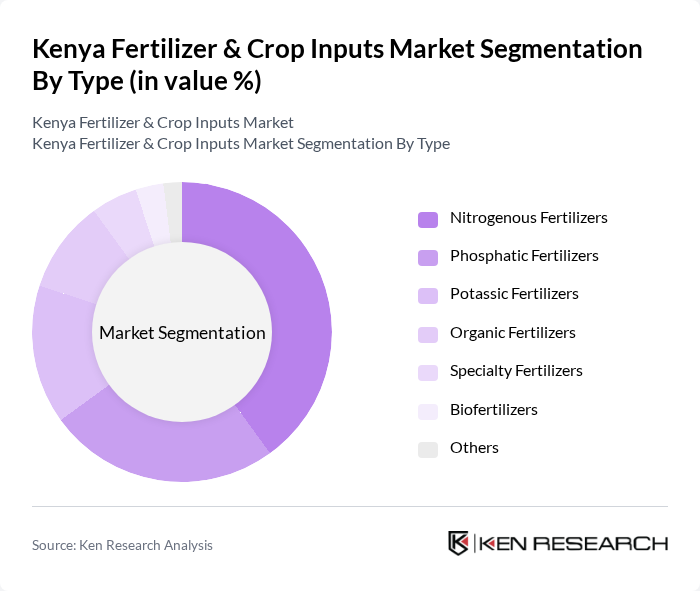

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, organic, specialty, biofertilizers, and others. Among these, nitrogenous fertilizers dominate the market due to their essential role in promoting plant growth and increasing crop yields. The increasing awareness of soil health and the need for balanced nutrition in crops have led to a growing preference for organic and specialty fertilizers as well. The demand for biofertilizers is also on the rise, driven by the shift towards sustainable agricultural practices.

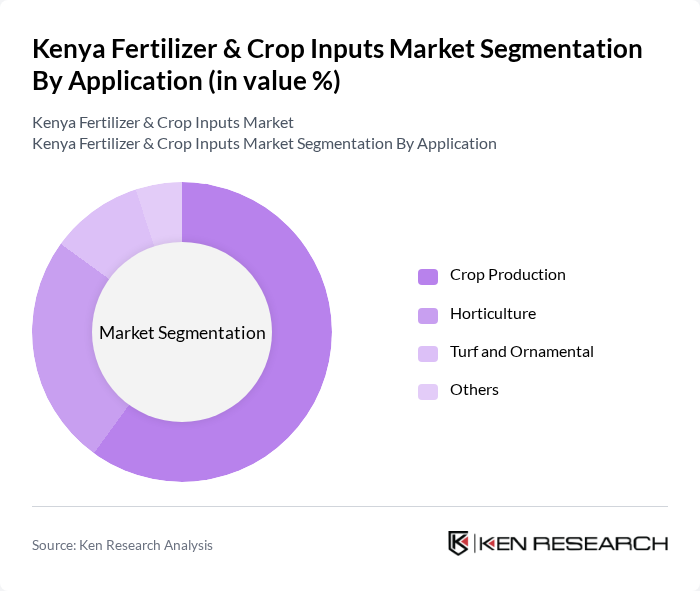

By Application:The application of fertilizers in Kenya is categorized into crop production, horticulture, turf and ornamental, and others. Crop production is the leading application segment, driven by the need to enhance food security and improve yields in staple crops. Horticulture is also gaining traction, with increasing investments in floriculture and vegetable farming. The turf and ornamental segment is growing, particularly in urban areas, as landscaping and gardening become more popular.

The Kenya Fertilizer & Crop Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kenya Agricultural and Livestock Research Organization (KALRO), Yara East Africa, OCP Kenya, Kenya Fertilizer Company, Greenbelt Fertilizers, Elgon Kenya Limited, UPL Kenya, Syngenta East Africa, BASF East Africa, Crop Nutrition Limited, Agri-Input Suppliers, Fertilizer and Chemical Company, Kynoch Fertilizers, Amiran Kenya, KFA (Kenya Farmers Association) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kenya fertilizer and crop inputs market appears promising, driven by increasing investments in agricultural technology and sustainable practices. As the government continues to support smallholder farmers through subsidies and training programs, the adoption of modern farming techniques is expected to rise. Additionally, the growing emphasis on organic farming and soil health will likely lead to innovations in fertilizer formulations, enhancing crop yields while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous Fertilizers Phosphatic Fertilizers Potassic Fertilizers Organic Fertilizers Specialty Fertilizers Biofertilizers Others |

| By Application | Crop Production Horticulture Turf and Ornamental Others |

| By End-User | Smallholder Farmers Commercial Farmers Agricultural Cooperatives Government Agencies |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms Agricultural Shows and Expos |

| By Region | Central Kenya Western Kenya Eastern Kenya Northern Kenya Southern Kenya Coastal Region Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Farmers | 150 | Crop Producers, Agricultural Cooperatives Members |

| Commercial Farmers | 100 | Farm Managers, Agribusiness Owners |

| Fertilizer Distributors | 80 | Supply Chain Managers, Sales Representatives |

| Retailers of Agricultural Inputs | 70 | Store Managers, Procurement Officers |

| Agricultural Policy Makers | 50 | Government Officials, Agricultural Advisors |

The Kenya Fertilizer & Crop Inputs Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing food security demands, agricultural productivity, and government initiatives to enhance fertilizer accessibility for farmers.