Region:Europe

Author(s):Rebecca

Product Code:KRAB4096

Pages:87

Published On:October 2025

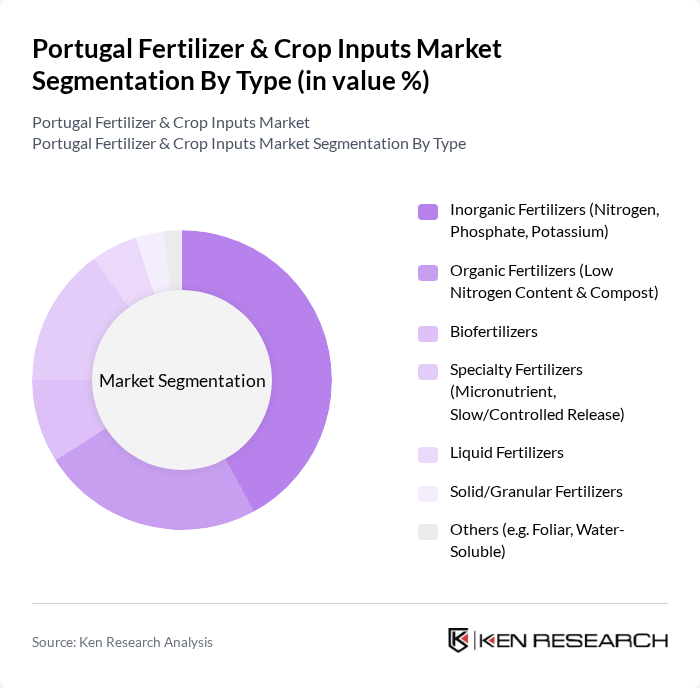

By Type:The market is segmented into various types of fertilizers, including inorganic fertilizers, organic fertilizers, biofertilizers, specialty fertilizers, liquid fertilizers, solid/granular fertilizers, and others. Each type serves different agricultural needs and preferences, with varying levels of adoption among farmers and agricultural businesses .

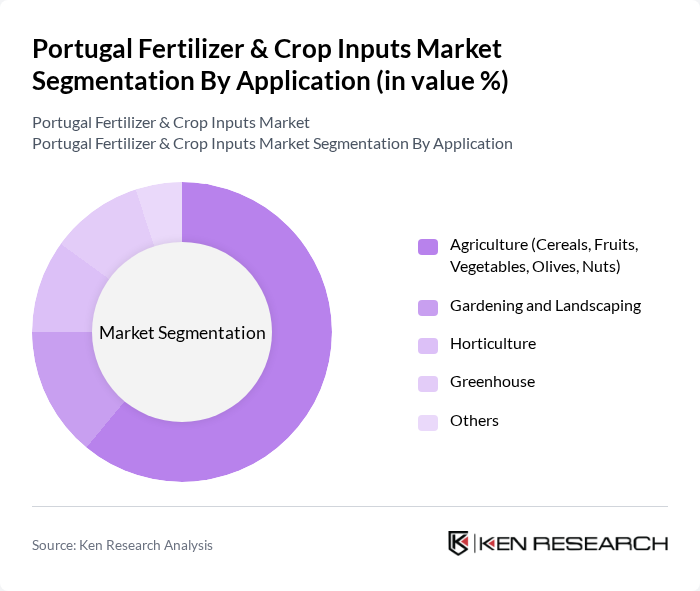

By Application:The application segment includes agriculture, gardening and landscaping, horticulture, greenhouse, and others. Each application area has distinct requirements and preferences for fertilizer types, influencing market dynamics and growth .

The Portugal Fertilizer & Crop Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, Fertipor – Fertilizantes de Portugal, S.A., ADP Fertilizantes (Adubos de Portugal), Fertiberia S.A., Nutrien Ltd., BASF SE, Syngenta AG, Corteva Agriscience, Haifa Group, ICL Group Ltd., Solvay S.A., K+S AG, UPL Limited, EuroChem Group AG, Compo Expert GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fertilizer and crop inputs market in Portugal appears promising, driven by technological advancements and a growing emphasis on sustainability. As farmers increasingly adopt precision agriculture techniques, the demand for tailored fertilizers is expected to rise. Additionally, the shift towards bio-based fertilizers will likely gain momentum, supported by government initiatives and consumer preferences for organic products. These trends indicate a transformative phase for the industry, fostering innovation and enhancing productivity.

| Segment | Sub-Segments |

|---|---|

| By Type | Inorganic Fertilizers (Nitrogen, Phosphate, Potassium) Organic Fertilizers (Low Nitrogen Content & Compost) Biofertilizers Specialty Fertilizers (Micronutrient, Slow/Controlled Release) Liquid Fertilizers Solid/Granular Fertilizers Others (e.g. Foliar, Water-Soluble) |

| By Application | Agriculture (Cereals, Fruits, Vegetables, Olives, Nuts) Gardening and Landscaping Horticulture Greenhouse Others |

| By End-User | Farmers Agricultural Cooperatives Distributors Retailers Others |

| By Distribution Channel | Direct Sales Online Sales Retail Outlets Agricultural Shows and Expos Others |

| By Region | Central Portugal Northern Portugal Southern Portugal (Alentejo, Algarve) Azores and Madeira |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Product Formulation | Granular Fertilizers Liquid Fertilizers Soluble Fertilizers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retailers | 60 | Store Managers, Sales Representatives |

| Farmers (Cereal Crops) | 100 | Crop Farmers, Agricultural Advisors |

| Agrochemical Distributors | 50 | Distribution Managers, Supply Chain Coordinators |

| Research Institutions | 40 | Agricultural Researchers, Policy Analysts |

| Government Agricultural Officials | 40 | Policy Makers, Regulatory Officers |

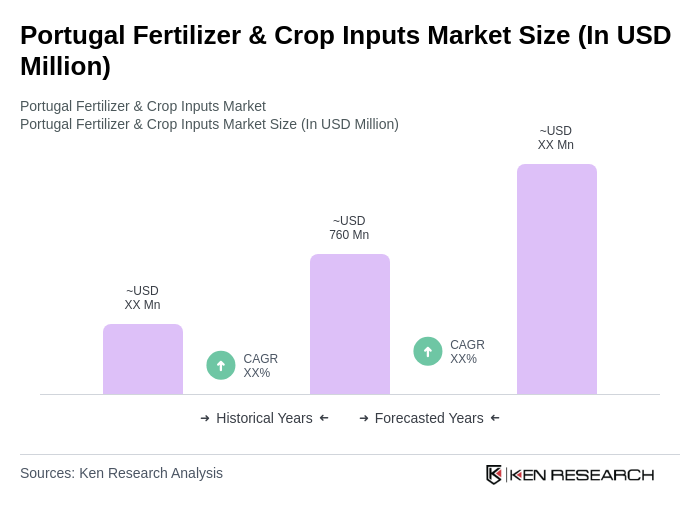

The Portugal Fertilizer & Crop Inputs Market is valued at approximately USD 760 million, reflecting a significant growth driven by increased food production demands, sustainable agricultural practices, and advanced farming technologies.