Region:Asia

Author(s):Rebecca

Product Code:KRAB4076

Pages:96

Published On:October 2025

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, compound, organic, biofertilizers, specialty fertilizers, and others. Each type serves specific agricultural needs, withnitrogenous fertilizersbeing the most widely used due to their essential role in plant growth. The dominance of nitrogenous fertilizers is supported by the high demand for urea and ammonium sulfate, especially for staple crops such as rice and corn.

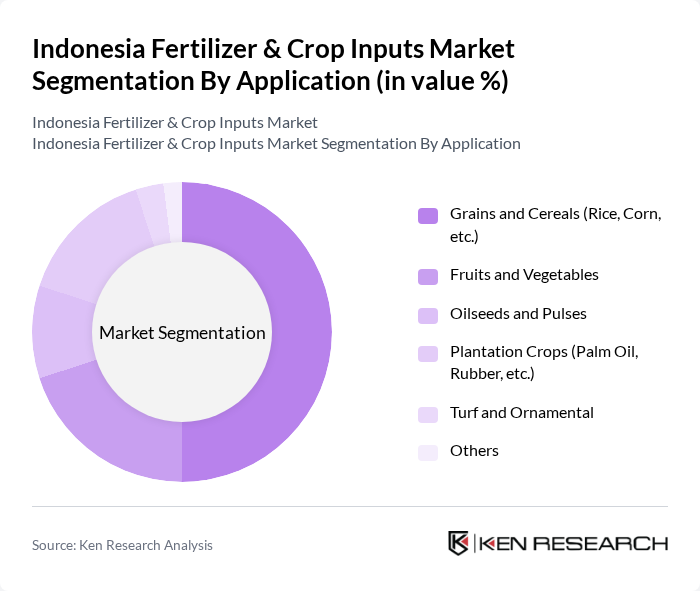

By Application:The application segment includes grains and cereals, fruits and vegetables, oilseeds and pulses, plantation crops, turf and ornamental, and others.Grains and cerealsdominate the application segment due to their critical role in food security and the high demand for rice and corn in Indonesia. The government's rice and corn self-sufficiency programs and the expansion of plantation crops such as palm oil and rubber further drive fertilizer use in these segments.

The Indonesia Fertilizer & Crop Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Pupuk Indonesia (Persero), PT Petrokimia Gresik, PT Pupuk Kalimantan Timur, PT Pupuk Sriwidjaja Palembang, PT Pupuk Iskandar Muda, PT JADI MAS, PT Bisi International Tbk, PT Sumber Agung, Haifa Group Indonesia, Yara International Indonesia, Syngenta Indonesia, Bayer Indonesia, FMC Agricultural Solutions Indonesia, PT Indofarma Tbk, Grupa Azoty S.A. (Compo Expert Indonesia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia Fertilizer & Crop Inputs Market appears promising, driven by increasing agricultural productivity and a shift towards sustainable practices. As the government continues to support farmers through subsidies and initiatives promoting organic farming, the market is likely to witness a significant transformation. Additionally, advancements in technology, such as precision agriculture, will enhance efficiency and yield, positioning the industry for robust growth in the coming years, despite existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous Fertilizers (Urea, Ammonium Sulfate) Phosphatic Fertilizers (DAP, SSP) Potassic Fertilizers (MOP, SOP) Compound Fertilizers (NPK Blends) Organic Fertilizers Biofertilizers Specialty Fertilizers Others |

| By Application | Grains and Cereals (Rice, Corn, etc.) Fruits and Vegetables Oilseeds and Pulses Plantation Crops (Palm Oil, Rubber, etc.) Turf and Ornamental Others |

| By End-User | Individual Farmers Agricultural Cooperatives Plantation Companies Government Agencies Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors/Dealers Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali and Nusa Tenggara Maluku and Papua Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Packaging Type | Bulk Packaging Bagged Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Usage in Rice Cultivation | 100 | Rice Farmers, Agricultural Advisors |

| Crop Input Preferences in Vegetable Farming | 60 | Vegetable Farmers, Input Retailers |

| Distribution Channels for Fertilizers | 50 | Distributors, Supply Chain Managers |

| Impact of Government Subsidies on Fertilizer Adoption | 40 | Policy Makers, Agricultural Economists |

| Trends in Organic Fertilizer Usage | 40 | Organic Farmers, Sustainability Experts |

The Indonesia Fertilizer & Crop Inputs Market is valued at approximately USD 8.3 billion, driven by increasing food production demands due to population growth and urbanization, alongside government initiatives and modernization in agriculture.