Region:Central and South America

Author(s):Rebecca

Product Code:KRAB4070

Pages:81

Published On:October 2025

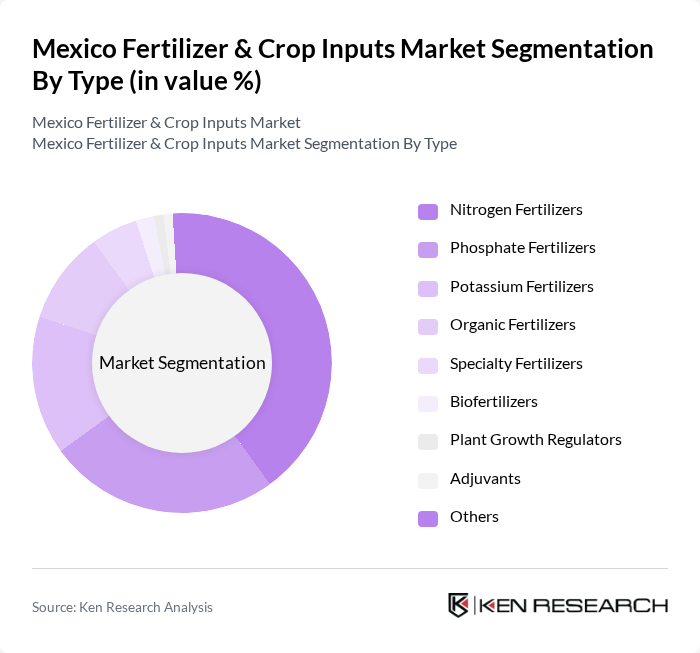

By Type:The market is segmented into nitrogen fertilizers, phosphate fertilizers, potassium fertilizers, organic fertilizers, specialty fertilizers, biofertilizers, plant growth regulators, adjuvants, and others. Nitrogen fertilizers remain the most widely used due to their essential role in crop growth and yield enhancement. The increasing focus on high-yield crops and the need for efficient nutrient management have driven the demand for nitrogen fertilizers, making them a dominant segment. Specialty fertilizers, including controlled-release and coated products, are gaining traction for their ability to improve soil health and reduce environmental impact, reflecting a broader shift toward sustainable agriculture.

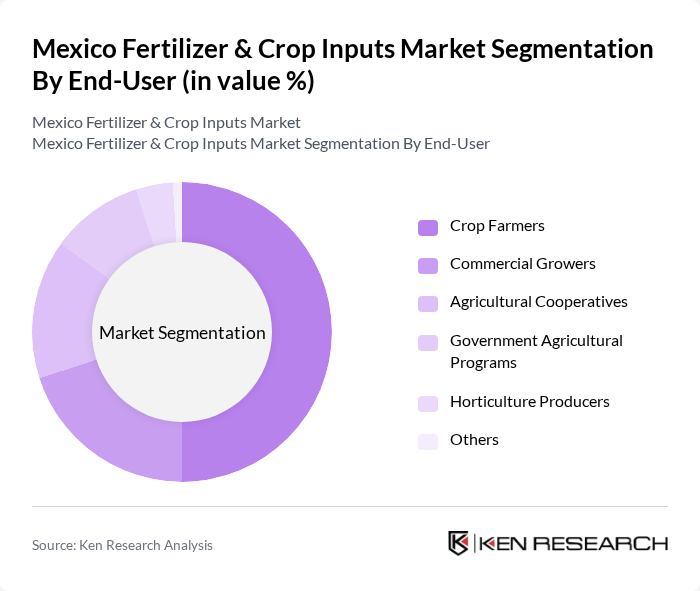

By End-User:The end-user segmentation includes crop farmers, commercial growers, agricultural cooperatives, government agricultural programs, horticulture producers, and others. Crop farmers represent the largest segment, driven by the need for increased productivity and crop quality. The growing trend of sustainable farming practices and the adoption of advanced agricultural technologies among farmers have further solidified their position as the primary end-users of fertilizers and crop inputs. Agricultural cooperatives and commercial growers are also significant contributors, benefiting from government incentives and technical support for sustainable input adoption.

The Mexico Fertilizer & Crop Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutrien Ltd., Yara International ASA, CF Industries Holdings, Inc., The Mosaic Company, OCP Group, Grupo Fertinal, S.A. de C.V., BASF SE, Syngenta AG, FMC Corporation, K+S AG, Haifa Group, ICL Group, UPL Limited, Sumitomo Chemical Co., Ltd., Adama Agricultural Solutions Ltd., Industrias Sulfamex, S.A. de C.V., Biofábrica Siglo XXI, S.A. de C.V., Agroenzymas, S.A. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico fertilizer and crop inputs market appears promising, driven by technological advancements and a growing emphasis on sustainability. As farmers increasingly adopt precision agriculture and bio-based fertilizers, the market is likely to witness significant transformations. Additionally, government initiatives aimed at enhancing agricultural productivity and environmental stewardship will further shape the landscape. The integration of digital tools in farming practices will also play a crucial role in optimizing fertilizer use and improving overall crop health.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen Fertilizers Phosphate Fertilizers Potassium Fertilizers Organic Fertilizers Specialty Fertilizers Biofertilizers Plant Growth Regulators Adjuvants Others |

| By End-User | Crop Farmers Commercial Growers Agricultural Cooperatives Government Agricultural Programs Horticulture Producers Others |

| By Application | Soil Application Foliar Application Fertigation Seed Treatment Greenhouse Application Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Agricultural Supply Stores Cooperatives & Associations Others |

| By Region | Northern Mexico Central Mexico Southern Mexico Baja California Gulf Coast Pacific Coast Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Premium Price Range Others |

| By Packaging Type | Bulk Packaging Bagged Packaging Liquid Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Fertilizer Usage | 100 | Farmers, Agronomists |

| Vegetable and Fruit Inputs | 80 | Horticulturists, Agricultural Retailers |

| Fertilizer Distribution Channels | 60 | Distributors, Supply Chain Managers |

| Organic Fertilizer Adoption | 50 | Organic Farmers, Sustainability Advocates |

| Government Policy Impact | 40 | Policy Makers, Agricultural Economists |

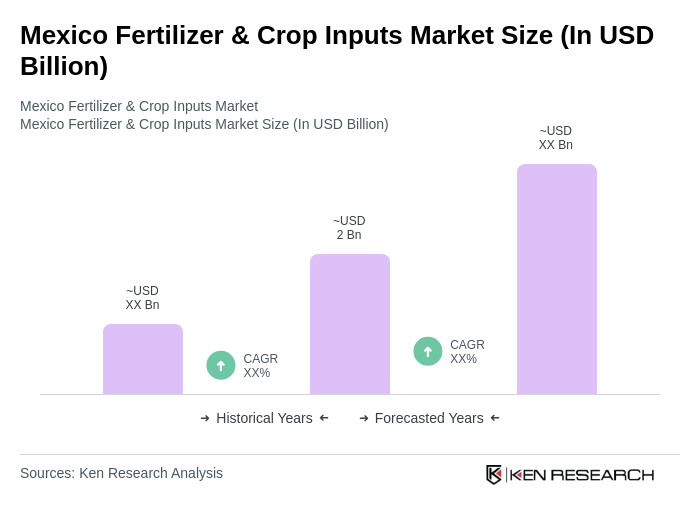

The Mexico Fertilizer & Crop Inputs Market is valued at approximately USD 2 billion, driven by increasing food production demands, advancements in agricultural technology, and the adoption of precision farming techniques.