Region:Middle East

Author(s):Geetanshi

Product Code:KRAB4038

Pages:83

Published On:October 2025

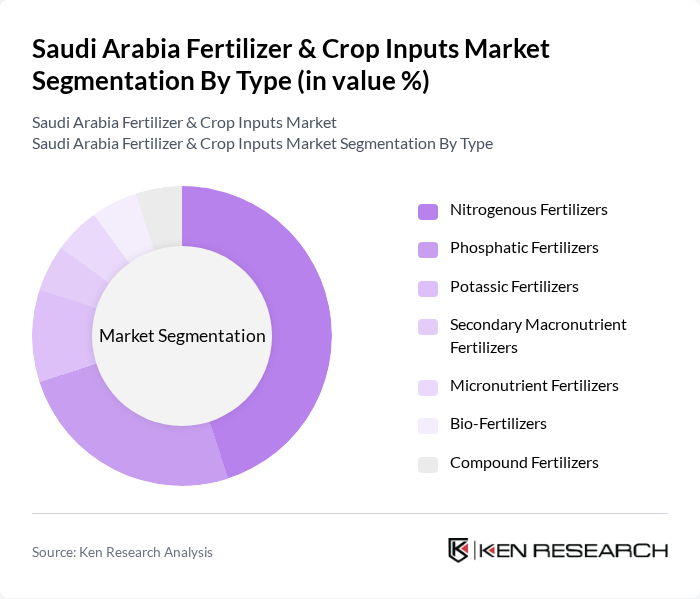

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, secondary macronutrient, micronutrient, bio-fertilizers, and compound fertilizers. Among these, nitrogenous fertilizers are the most widely used due to their essential role in plant growth and high demand in the agricultural sector. The increasing focus on enhancing crop yields and the growing awareness of soil health are driving the adoption of these fertilizers. Phosphatic fertilizers also hold a significant share, as they are crucial for root development and overall plant health .

By Application:The application segment includes grains and cereals, pulses and oilseeds, fruits and vegetables, horticulture, and industrial applications. Grains and cereals dominate this segment due to their staple food status and high consumption rates in the region. The increasing population and demand for food are driving the need for enhanced production in this category. Fruits and vegetables also represent a growing segment as consumer preferences shift towards healthier diets, leading to increased fertilizer use in these crops .

The Saudi Arabia Fertilizer & Crop Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Arabian Fertilizer Company (SAFCO), Ma'aden (Saudi Arabian Mining Company), Al-Jouf Agricultural Development Company, National Agricultural Development Company (NADEC), Arabian Agricultural Services Company (ARASCO), Gulf Fertilizers & Chemicals Company (GFC), Al-Faisaliah Group, United Fertilizer Company Limited (UFC), Al-Munajem Group, Al-Babtain Group, Al-Rajhi International for Investment, Al-Muhaidib Group, Al-Safi Danone, Al-Hokair Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia fertilizer and crop inputs market appears promising, driven by government initiatives and technological advancements. The focus on sustainable agriculture and food security will likely lead to increased investments in organic fertilizers and precision agriculture technologies. Additionally, collaborations with international agribusiness firms are expected to enhance local capabilities, fostering innovation and improving product offerings. As the market evolves, adapting to these trends will be crucial for stakeholders aiming to capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous Fertilizers Phosphatic Fertilizers Potassic Fertilizers Secondary Macronutrient Fertilizers Micronutrient Fertilizers Bio-Fertilizers Compound Fertilizers |

| By Application | Grains and Cereals Pulses and Oilseeds Fruits and Vegetables Horticulture Industrial Applications |

| By End-User | Agriculture Horticulture Landscaping Government and Utilities Industrial Applications |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| By Packaging Type | Bulk Packaging Bagged Packaging Liquid Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Fertilizer Usage | 100 | Farmers, Agronomists |

| Fruit and Vegetable Input Preferences | 80 | Horticulturists, Agricultural Extension Officers |

| Fertilizer Distribution Channels | 60 | Distributors, Retailers |

| Impact of Subsidies on Fertilizer Adoption | 50 | Policy Makers, Agricultural Economists |

| Technological Innovations in Crop Inputs | 40 | Research Scientists, Product Development Managers |

The Saudi Arabia Fertilizer & Crop Inputs Market is valued at approximately USD 1.7 billion, reflecting a significant growth driven by increasing food security demands, advancements in fertilizer manufacturing, and government initiatives to enhance agricultural productivity.