Region:Middle East

Author(s):Rebecca

Product Code:KRAD7399

Pages:88

Published On:December 2025

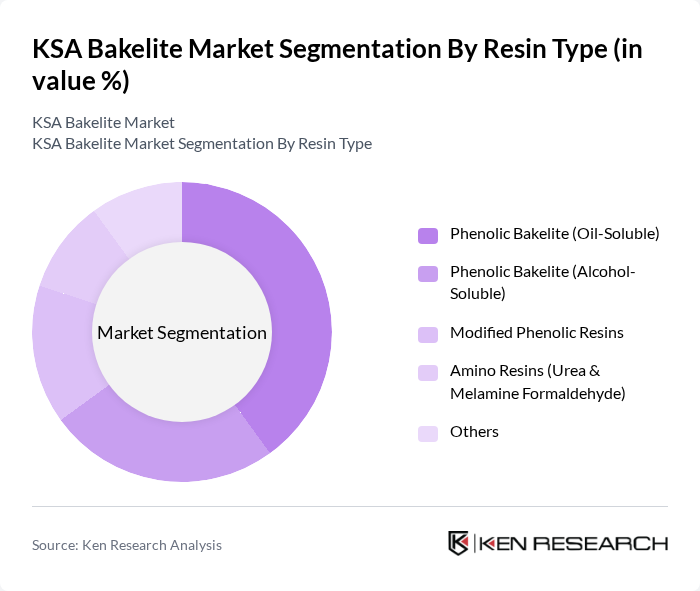

By Resin Type:The Bakelite market can be segmented into various resin types, including Phenolic Bakelite (Oil-Soluble), Phenolic Bakelite (Alcohol-Soluble), Modified Phenolic Resins, Amino Resins (Urea & Melamine Formaldehyde), and Others. Among these, Phenolic Bakelite (Oil-Soluble) is the leading subsegment due to its extensive use in electrical insulation and automotive applications, driven by its superior thermal stability and mechanical properties.

By Application:The Bakelite market is also segmented by application, which includes Electrical Insulation Components, Automotive Parts & Under-the-Hood Components, Molding Compounds & Laminates, Adhesives & Binders, Coatings & Surface Finishes, and Others. The Electrical Insulation Components subsegment is currently leading the market due to the increasing demand for high-performance insulation materials in the electrical and electronics sectors.

The KSA Bakelite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Hexion Inc., Sumitomo Bakelite Co., Ltd., Bakelite Synthetics, AOC LLC, Saudi Arabian Oil Company (Aramco) – Chemicals Division, Advanced Petrochemical Company, Saudi Kayan Petrochemical Company, Al-Jubail Petrochemical Company (KEMYA), Yanbu National Petrochemical Company (YANSAB), Nama Chemicals Company, Tasnee (Saudi Arabia), Petro Rabigh, Juffali Chemical Products Co., and Riyadh Resin Factory contribute to innovation, geographic expansion, and service delivery in this space.

The KSA Bakelite market is poised for growth, driven by increasing demand across various sectors, including automotive and construction. As sustainability becomes a priority, manufacturers are likely to innovate in eco-friendly Bakelite production methods. Additionally, the rise of e-commerce platforms will facilitate broader market access, enabling companies to reach new customers. Overall, the market is expected to adapt to changing consumer preferences and regulatory landscapes, ensuring continued relevance and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Resin Type | Phenolic Bakelite (Oil-Soluble) Phenolic Bakelite (Alcohol-Soluble) Modified Phenolic Resins Amino Resins (Urea & Melamine Formaldehyde) Others |

| By Application | Electrical Insulation Components Automotive Parts & Under-the-Hood Components Molding Compounds & Laminates Adhesives & Binders Coatings & Surface Finishes Others |

| By End-User Industry | Automotive & Transportation Electrical & Electronics Building & Construction Industrial Machinery & Equipment Consumer Appliances & Consumer Goods Others |

| By Distribution Channel | Direct Sales to OEMs Direct Sales to Tier-1/Tier-2 Converters & Molders Industrial Distributors & Traders Online & E-Tendering Platforms Others |

| By Region | Central Region (Including Riyadh) Eastern Region (Including Jubail & Dammam) Western Region (Including Jeddah & Makkah) Southern Region Northern Region |

| By Product Form | Bakelite Molding Powder Bakelite Sheets & Laminates Bakelite Rods & Blocks Liquid Resins (Varnishes & Binders) Others |

| By Customer Type | OEMs (Automotive, Electrical, Appliances) Contract Molders & Fabricators Distributors & Trading Companies Government & Large Industrial Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Components Manufacturers | 60 | Production Managers, Quality Assurance Heads |

| Electrical Insulation Suppliers | 50 | Technical Directors, Product Managers |

| Consumer Goods Producers | 40 | Procurement Managers, R&D Specialists |

| Construction Material Suppliers | 40 | Sales Managers, Operations Directors |

| Research Institutions and Academia | 40 | Research Analysts, Professors in Material Science |

The KSA Bakelite Market is valued at approximately USD 100 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for durable and heat-resistant materials across various industries, including automotive, electrical, and construction.