Region:Middle East

Author(s):Rebecca

Product Code:KRAD4242

Pages:81

Published On:December 2025

Market.png)

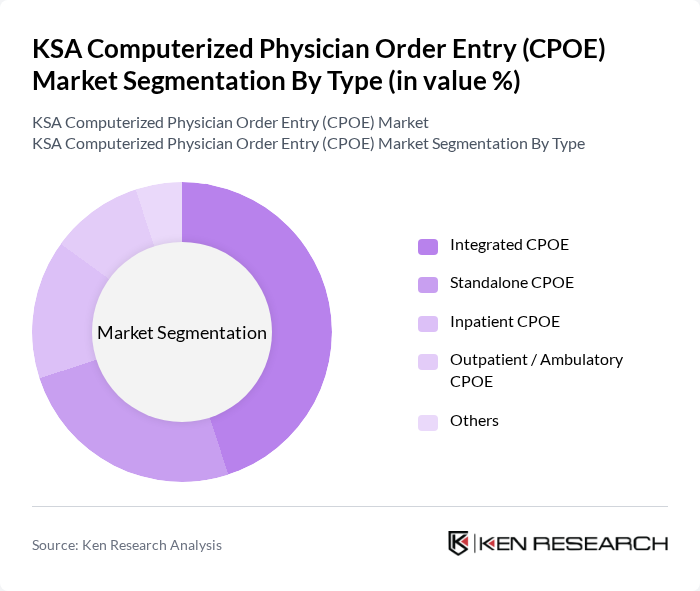

By Type:The KSA CPOE market is segmented into various types, including Integrated CPOE, Standalone CPOE, Inpatient CPOE, Outpatient / Ambulatory CPOE, and Others. This structure is aligned with global CPOE market taxonomies, where integrated and standalone systems are treated as primary types, and inpatient and outpatient use cases are key application settings. Among these, Integrated CPOE systems are gaining traction due to their ability to seamlessly connect with existing healthcare information systems and enterprise-wide EHR platforms, enhancing workflow efficiency, interoperability, and data accuracy. Standalone CPOE systems remain relevant, particularly in smaller or single-specialty facilities that require more modular or phased implementations. The Inpatient CPOE segment is witnessing significant growth as hospitals focus on improving patient safety, reducing medication errors, and complying with hospital accreditation and patient safety standards that encourage or require electronic ordering.

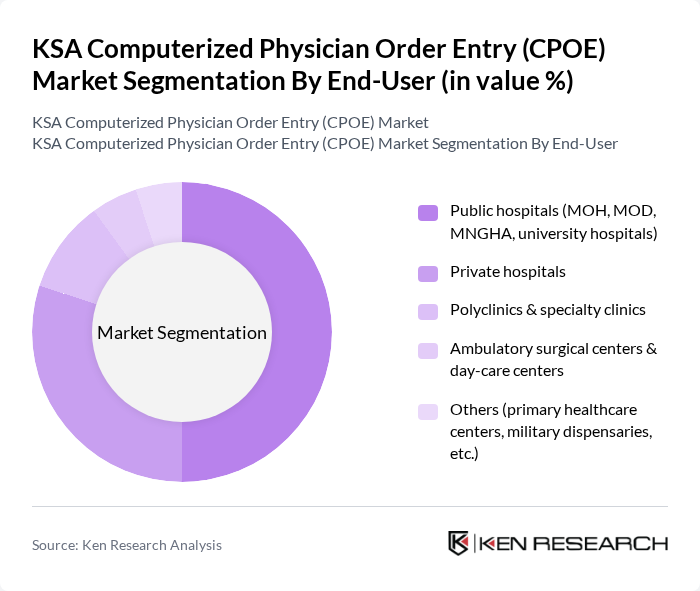

By End-User:The end-user segmentation of the KSA CPOE market includes Public hospitals (MOH, MOD, MNGHA, university hospitals), Private hospitals, Polyclinics & specialty clinics, Ambulatory surgical centers & day-care centers, and Others. This end?user structure is consistent with international CPOE and healthcare IT market analyses, where hospitals are the primary adopters, followed by clinics, ambulatory centers, and other care settings. Public hospitals are the leading end-users due to strong government funding for digital health, national cloud-health and e-health programs, and institutional mandates to implement interoperable EHR and e?prescribing across Ministry of Health, Ministry of Defense, National Guard, and university hospital networks. Private hospitals are also significant contributors, driven by the need for competitive differentiation, international accreditation requirements, and patient expectations for digital services. Polyclinics and specialty clinics are increasingly adopting CPOE or CPOE?enabled EHR systems to streamline operations, support chronic disease management, and enhance care coordination with hospitals and diagnostic centers.

The KSA Computerized Physician Order Entry (CPOE) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Health (former Cerner Corporation), Epic Systems Corporation, MEDITECH, Dedalus Group, InterSystems Corporation, Philips Healthcare, Siemens Healthineers, GE HealthCare, Allscripts Healthcare Solutions (Altera Digital Health), athenahealth, eClinicalWorks, Wipro GE Healthcare IT & regional implementation partners, Saudi German Health (as a key reference adopter of advanced CPOE/EHR), King Faisal Specialist Hospital & Research Centre (as a flagship CPOE user), Local & regional HIS/CPOE vendors active in KSA (e.g., Altakhsis for Health Information Technology, ISEHA / Lean Business Services platforms) contribute to innovation, geographic expansion, and service delivery in this space.

The KSA CPOE market is poised for transformative growth, driven by technological advancements and a strong governmental push towards digital health solutions. As healthcare providers increasingly adopt cloud-based CPOE systems, operational efficiencies are expected to improve significantly. Furthermore, the integration of artificial intelligence in order management will enhance decision-making processes, leading to better patient outcomes. The focus on patient engagement tools will also play a crucial role in shaping the future landscape of healthcare delivery in the Kingdom.

| Segment | Sub-Segments |

|---|---|

| By Type | Integrated CPOE Standalone CPOE Inpatient CPOE Outpatient / Ambulatory CPOE Others |

| By End-User | Public hospitals (MOH, MOD, MNGHA, university hospitals) Private hospitals Polyclinics & specialty clinics Ambulatory surgical centers & day-care centers Others (primary healthcare centers, military dispensaries, etc.) |

| By Deployment Model | On-premise Cloud-based (SaaS) Web-based / hosted Hybrid |

| By Functionality | Medication order entry & management Laboratory & diagnostic test ordering Clinical decision support & alerts Reporting, analytics & audit trails Others |

| By Region | Central Region (including Riyadh) Western Region (including Makkah & Madinah) Eastern Region Southern & Northern Regions |

| By Integration Level | Fully integrated with HIS/EHR, pharmacy & LIS/RIS Partially integrated Standalone Others |

| By User Type | Physicians Nurses Pharmacists Allied health professionals Administrative & billing staff |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital CPOE Implementation | 45 | IT Directors, Chief Medical Officers |

| Private Healthcare Facility CPOE Usage | 40 | Healthcare Administrators, Clinical Managers |

| Pharmaceutical Integration with CPOE | 50 | Pharmacy Directors, IT Integration Specialists |

| Training and Support for CPOE Systems | 45 | Training Coordinators, User Experience Designers |

| Impact of CPOE on Patient Outcomes | 55 | Clinical Researchers, Quality Assurance Managers |

The KSA Computerized Physician Order Entry (CPOE) Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by digital health adoption and investments under national strategies like Saudi Vision 2030.