Region:Global

Author(s):Shubham

Product Code:KRAA8834

Pages:98

Published On:November 2025

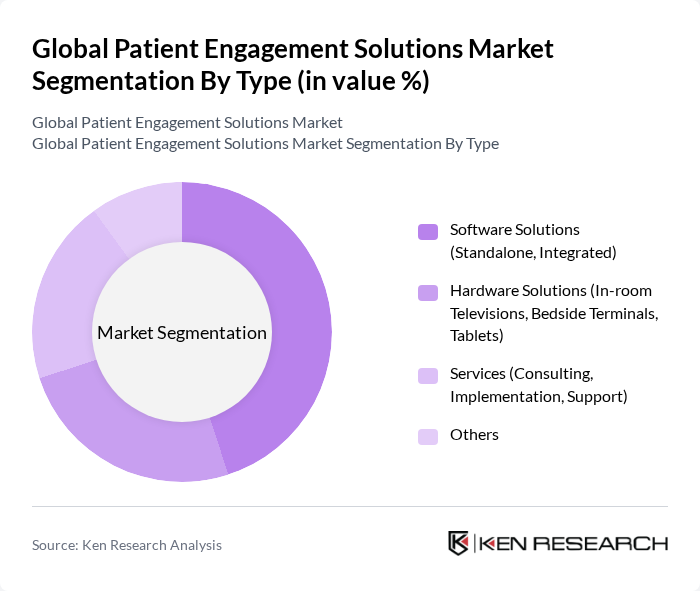

By Type:The market is segmented into Software Solutions (Standalone, Integrated), Hardware Solutions (In-room Televisions, Bedside Terminals, Tablets), Services (Consulting, Implementation, Support), and Others. Among these, Software Solutions are the most dominant, driven by the increasing demand for integrated healthcare systems, the proliferation of telehealth platforms, and the need for efficient patient management tools.

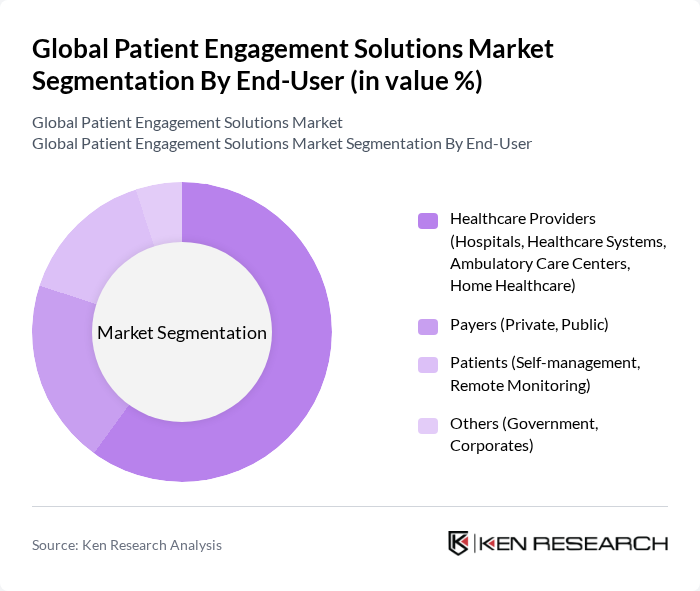

By End-User:The market is categorized into Healthcare Providers (Hospitals, Healthcare Systems, Ambulatory Care Centers, Home Healthcare), Payers (Private, Public), Patients (Self-management, Remote Monitoring), and Others (Government, Corporates). Healthcare Providers are the leading end-users, as they increasingly adopt patient engagement solutions to enhance care delivery, improve patient satisfaction, and comply with regulatory requirements for digital health information access.

The Global Patient Engagement Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cerner Corporation, Allscripts Healthcare Solutions, Epic Systems Corporation, Medidata Solutions, Health Catalyst, Philips Healthcare, IBM Watson Health, McKesson Corporation, Salesforce Health Cloud, WellSky, PatientPing, Zocdoc, Doximity, MyChart (Epic Systems), Medtronic, Athenahealth, Orion Health, AdvancedMD contribute to innovation, geographic expansion, and service delivery in this space.

The future of patient engagement solutions is poised for significant transformation, driven by technological advancements and evolving healthcare paradigms. As telehealth services expand, more patients will seek digital engagement tools, enhancing their healthcare experience. Additionally, the integration of artificial intelligence and machine learning will enable personalized patient interactions, improving adherence to treatment plans. These trends indicate a robust growth trajectory for patient engagement solutions, fostering a more connected and efficient healthcare ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions (Standalone, Integrated) Hardware Solutions (In-room Televisions, Bedside Terminals, Tablets) Services (Consulting, Implementation, Support) Others |

| By End-User | Healthcare Providers (Hospitals, Healthcare Systems, Ambulatory Care Centers, Home Healthcare) Payers (Private, Public) Patients (Self-management, Remote Monitoring) Others (Government, Corporates) |

| By Patient Type | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Delivery Mode | Web-Based Solutions Mobile Applications On-Premise Solutions Cloud-Based Solutions Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Functionality | Appointment Scheduling Medication Management Health Tracking & Insights Patient Education Billing & Payments Communication (Telehealth, Messaging, Virtual Consultations) Document Management Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Digital Health Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Engagement | 100 | Healthcare Administrators, Patient Engagement Coordinators |

| Patient Experience Surveys | 120 | Patients, Caregivers, Patient Advocacy Groups |

| Technology Adoption Insights | 100 | IT Managers, Health Tech Developers |

| Telehealth Utilization Studies | 80 | Telehealth Providers, Clinical Staff |

| Mobile Health App Feedback | 120 | App Users, Health Coaches, Digital Health Experts |

The Global Patient Engagement Solutions Market is valued at approximately USD 27 billion, reflecting significant growth driven by the adoption of digital health technologies and the increasing focus on patient-centric care models.