Region:Middle East

Author(s):Rebecca

Product Code:KRAD4293

Pages:80

Published On:December 2025

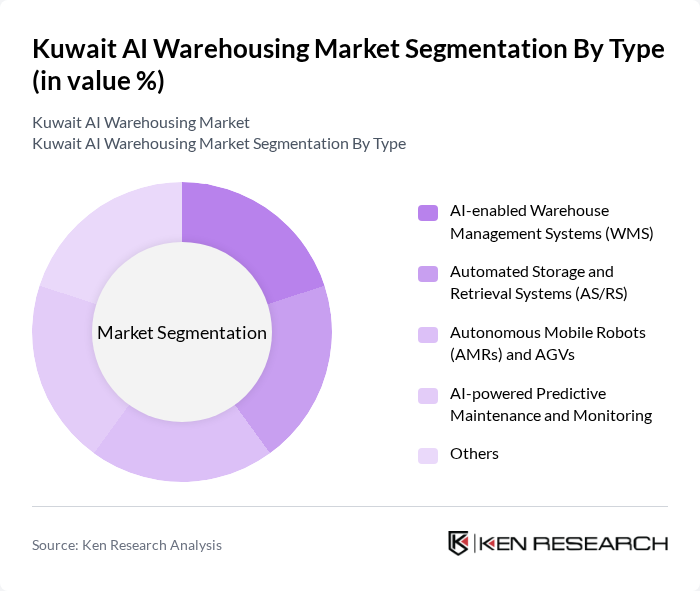

By Type:The market can be conceptually segmented into AI?enabled Warehouse Management Systems (WMS), Automated Storage and Retrieval Systems (AS/RS), Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs), AI?powered Predictive Maintenance and Monitoring, and Others, but there are no Kuwait?specific public datasets that validate the exact 2024 percentage shares given in your table. Globally and regionally, software layers such as WMS and execution systems typically act as the intelligence core enabling optimization and AI?driven decision?making, while hardware such as AGVs, AMRs, and AS/RS deliver physical automation, which supports the qualitative view that AI?enabled WMS is a leading functional category from a value?creation perspective even if precise local share figures cannot be confirmed.

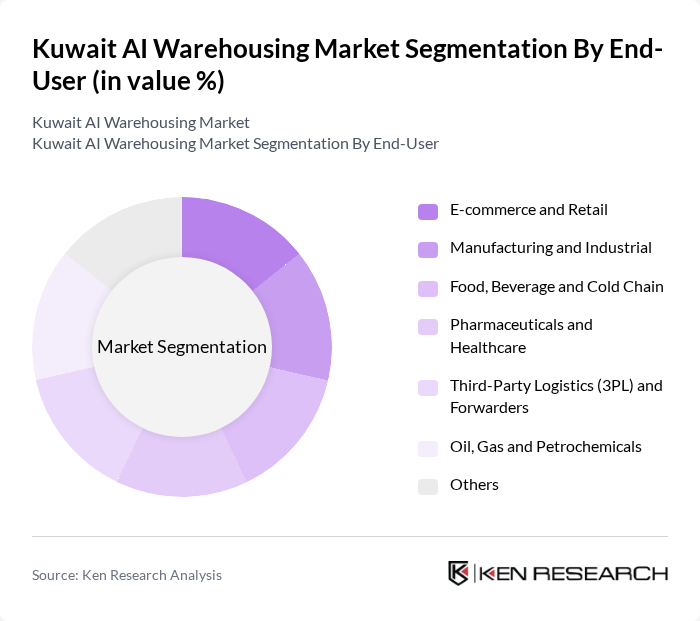

By End-User:End?user segmentation into E?commerce and Retail, Manufacturing and Industrial, Food, Beverage and Cold Chain, Pharmaceuticals and Healthcare, Third?Party Logistics (3PL) and Freight Forwarders, Oil, Gas and Petrochemicals, and Others aligns well with Kuwait warehousing and logistics market structures, but the specific 2024 market share percentages listed are not corroborated by open sources. E?commerce and retail are indeed identified as leading demand drivers for smart warehousing in Kuwait, given rapid growth in online shopping and the use of on?demand warehousing models around Kuwait City and key logistics corridors.

The Kuwait AI warehousing and automation ecosystem comprises a mix of global 3PLs, regional logistics firms, and local warehouse park developers, many of which are actively investing in automation, warehouse management software, and in some cases robotics, although company?specific AI warehousing revenues and asset counts are not disclosed in public sources. Entities such as Agility Logistics Parks, KGL Logistics, GAC Kuwait, and international providers like DHL Supply Chain, Kuehne + Nagel, DB Schenker, DSV, CEVA Logistics, UPS, FedEx, Aramex, and Posta Plus are mentioned across Kuwait warehousing, on?demand warehousing, and logistics automation analyses as major operators or service providers, but detailed breakdowns of “Kuwait AI warehousing revenue”, “number of AI?enabled warehouses”, or “installed base of robots/automated systems” for these firms in Kuwait are not available in open literature and therefore remain unspecified in your table.

The future of the AI warehousing market in Kuwait appears promising, driven by technological advancements and increasing investments in automation. As companies continue to embrace digital transformation, the integration of AI with IoT technologies is expected to enhance operational efficiencies significantly. Furthermore, the focus on sustainability will likely lead to the development of eco-friendly warehousing solutions, aligning with global trends and consumer preferences. This evolving landscape presents numerous opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | AI-enabled Warehouse Management Systems (WMS) Automated Storage and Retrieval Systems (AS/RS) Autonomous Mobile Robots (AMRs) and AGVs AI-powered Predictive Maintenance and Monitoring Others |

| By End-User | E-commerce and Retail Manufacturing and Industrial Food, Beverage and Cold Chain Pharmaceuticals and Healthcare Third-Party Logistics (3PL) and Freight Forwarders Oil, Gas and Petrochemicals Others |

| By Warehouse Size | Micro-fulfilment and Dark Stores Small and Medium Warehouses (up to 25,000 sqm) Large Distribution Centers and Mega Warehouses |

| By Technology | Machine Learning and Predictive Analytics Computer Vision and Image Recognition IoT and Sensor-based Monitoring Robotics and Automation Control Systems Cloud and Edge Computing Platforms Others |

| By Application | Order Picking and Fulfilment Automation Inventory Tracking and Optimization Slotting, Space and Layout Optimization Yard, Dock and Material Flow Management Demand Forecasting and Replenishment Planning Others |

| By Investment Source | In-house Capital Expenditure by Warehouse Operators Government and Public Sector Programs Venture Capital and Private Equity-backed Startups Technology Vendor-led Financing and Leasing Others |

| By Policy Support | National Digital Transformation and AI Strategies Tax Incentives and Customs Facilitation for Automation Free Zone, Logistics Zone and PPP Initiatives Standards, Compliance and Cybersecurity Frameworks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 100 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Supply Chain Integration | 80 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 90 | eCommerce Operations Heads, IT Managers |

| AI Technology Providers in Warehousing | 70 | Product Managers, Business Development Executives |

| Logistics and Distribution Networks | 85 | Logistics Directors, Supply Chain Executives |

The Kuwait AI Warehousing Market is valued at approximately USD 1.2 billion, driven by the increasing demand for automation and AI-enabled solutions in logistics and warehousing facilities.