Region:Middle East

Author(s):Shubham

Product Code:KRAD2650

Pages:94

Published On:January 2026

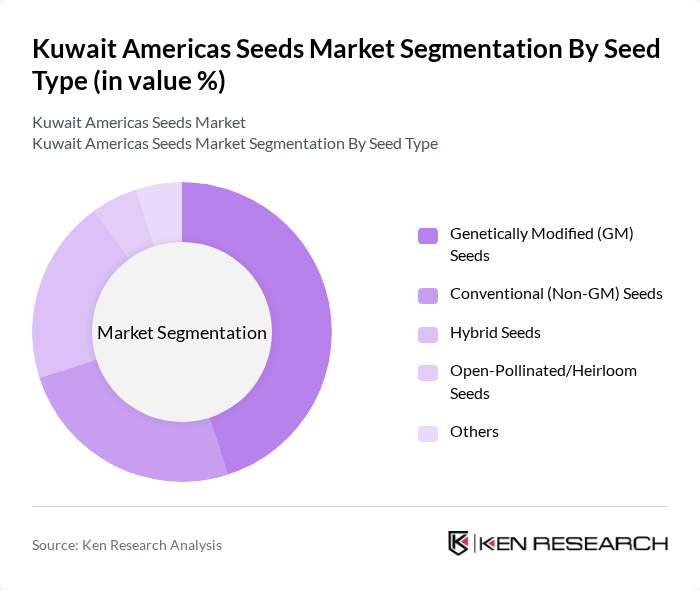

By Seed Type:The seed type segmentation includes various categories such as Genetically Modified (GM) Seeds, Conventional (Non-GM) Seeds, Hybrid Seeds, Open-Pollinated/Heirloom Seeds, and Others. In the broader Americas region, hybrid and traited (including GM) seeds represent the largest share of commercial seed value in major row crops such as corn, soybean, and cotton, as they provide higher yields, uniformity, and improved resistance to pests, diseases, and herbicides. Adoption of these seeds is strongly supported by precision farming, seed-applied technologies, and farm consolidation, as farmers seek to maximize productivity per hectare. Conventional (non-GM) and open-pollinated seeds retain importance in segments such as vegetables, certain cereals, and niche or organic production systems, particularly where certification, consumer preferences, or export-market requirements favor non-GM origins.

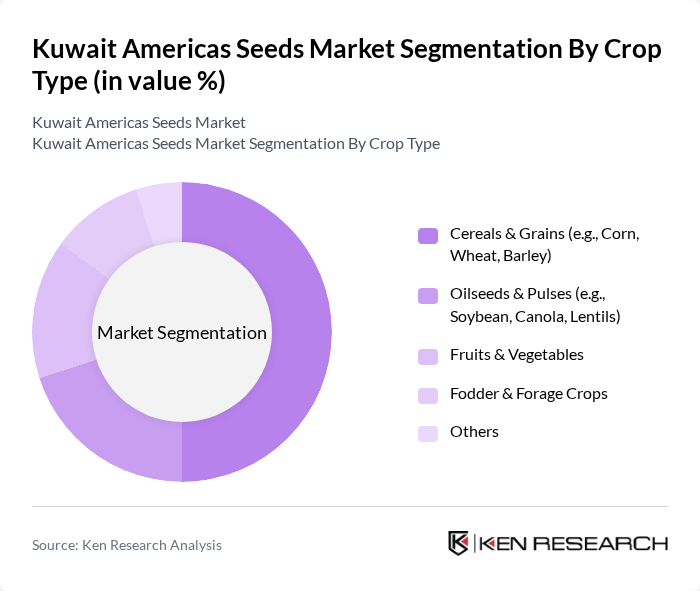

By Crop Type:The crop type segmentation encompasses Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Fodder & Forage Crops, and Others. Across the Americas, cereals and grains (notably corn, wheat, and barley) constitute the largest share of commercial seed demand because of their critical role in food, feed, and industrial uses, and the widespread penetration of hybrid and GM technologies in these crops. Oilseeds and pulses, including soybean and canola, form another major segment, supported by strong export demand, the growth of plant-based protein and edible oils, and continued expansion of biotech traits. Fruits and vegetables account for a growing share of seed value, driven by rising health-conscious consumption, increasing horticulture investments, and higher-priced hybrid and specialty vegetable seeds in both open-field and protected cultivation systems. Fodder and forage crops remain essential for the livestock and dairy sectors, where improved varieties support better feed quality and resilience under variable climatic conditions.

The Kuwait Americas Seeds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Corteva Agriscience, Bayer CropScience, Syngenta Group, BASF SE, Groupe Limagrain (Vilmorin & Cie), KWS SAAT SE & Co. KGaA, Sakata Seed Corporation, Rijk Zwaan Zaadteelt en Zaadhandel B.V., East-West Seed, Seminis Vegetable Seeds (Bayer), Bejo Zaden B.V., Takii & Co., Ltd., Seed Co Limited, AgReliant Genetics, LLC, Regional & Local Players in Kuwait and Americas contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Americas Seeds Market appears promising, driven by increasing investments in agricultural technology and a growing emphasis on sustainable practices. As the population continues to rise, the demand for high-quality seeds will likely escalate, prompting further innovations. Additionally, collaborations between private companies and research institutions are expected to enhance seed development, ensuring that the market adapts to changing agricultural needs and environmental challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Seed Type | Genetically Modified (GM) Seeds Conventional (Non-GM) Seeds Hybrid Seeds Open-Pollinated/Heirloom Seeds Others |

| By Crop Type | Cereals & Grains (e.g., Corn, Wheat, Barley) Oilseeds & Pulses (e.g., Soybean, Canola, Lentils) Fruits & Vegetables Fodder & Forage Crops Others |

| By Trait | Herbicide-Tolerant Insect-Resistant Drought/Stress-Tolerant High-Yielding/Quality-Enhanced Others |

| By Seed Treatment | Treated Seeds Non-Treated Seeds |

| By Distribution Channel | Direct Sales (B2B/B2F) Distributors & Dealers Cooperatives & Aggregators Online & Digital Platforms Others |

| By Application/End-User | Commercial Farms Smallholder Farmers Research & Breeding Institutions Government & Development Programs Others |

| By Region | North America Latin America GCC Countries (incl. Kuwait) Rest of Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vegetable Seed Distribution | 110 | Seed Distributors, Retailers |

| Cereal Seed Usage | 90 | Farmers, Agricultural Cooperatives |

| Fruit Seed Market Insights | 75 | Horticulturists, Agricultural Consultants |

| Organic Seed Adoption | 60 | Organic Farmers, Sustainability Advocates |

| Seed Technology Innovations | 95 | Research Scientists, Agritech Entrepreneurs |

The Kuwait Americas Seeds Market is valued at approximately USD 1.1 billion, reflecting strong growth driven by increasing agricultural productivity and demand for advanced seed technologies, particularly in North and Latin America.