Region:Global

Author(s):Shubham

Product Code:KRAD2653

Pages:84

Published On:January 2026

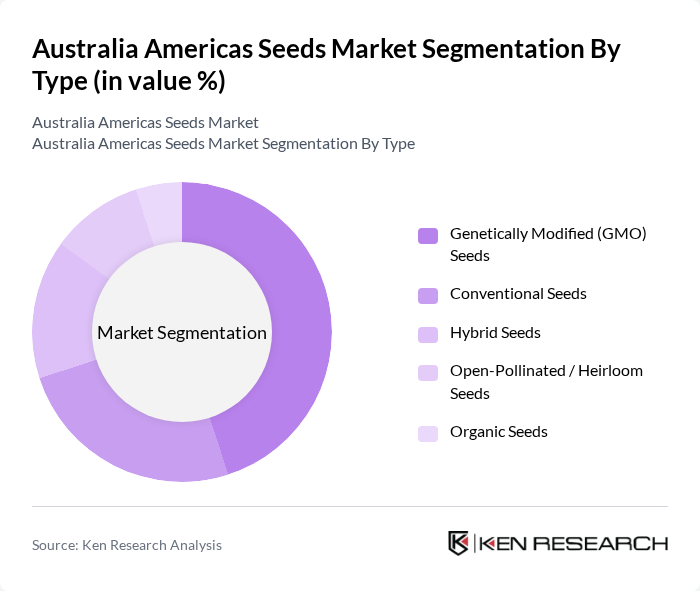

By Type:The market is segmented into various types of seeds, including Genetically Modified (GMO) Seeds, Conventional Seeds, Hybrid Seeds, Open-Pollinated / Heirloom Seeds, and Organic Seeds. Each type serves different agricultural needs and consumer preferences, with GMO and hybrid seeds holding a substantial share in large-scale commercial farming due to their high yield potential and pest or herbicide tolerance, while conventional and open-pollinated seeds remain important in regions and crops where traditional breeding and seed saving practices are prevalent.

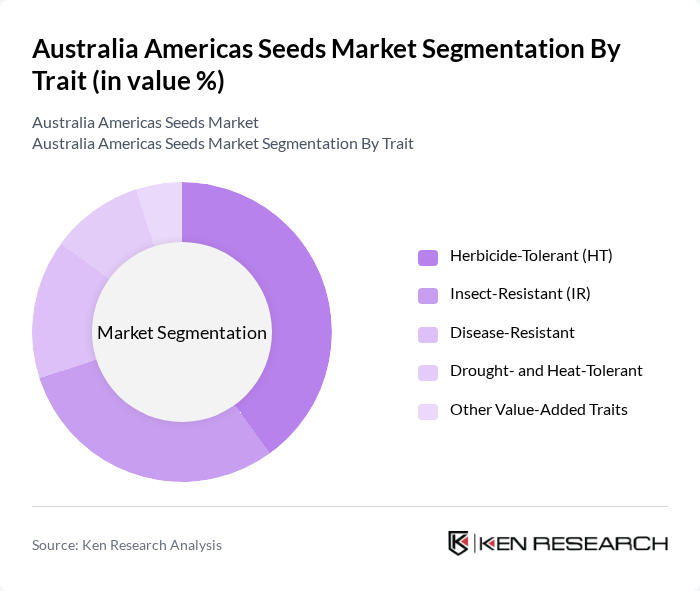

By Trait:The market is also segmented by traits, including Herbicide-Tolerant (HT), Insect-Resistant (IR), Disease-Resistant, Drought- and Heat-Tolerant, and Other Value-Added Traits. The demand for traits that enhance crop resilience and yield is driving the growth of this segment, with HT and IR traits being particularly popular among farmers cultivating broadacre crops such as soybeans, maize, cotton, and canola, while stress-tolerant and disease-resistance traits are gaining importance due to climate variability and the need to stabilize yields.

The Australia Americas Seeds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Corteva Agriscience, Bayer CropScience, Syngenta Group, BASF SE, Dow AgroSciences (Corteva business), Groupe Limagrain, KWS SAAT SE & Co. KGaA, Seed Co Limited, Pacific Seeds (Advanta Seeds), AgReliant Genetics LLC, Allied Seed LLC, Rijk Zwaan Zaadteelt en Zaadhandel B.V., Sakata Seed Corporation, East-West Seed Company, Seminis Vegetable Seeds (Bayer) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Americas seeds market appears promising, driven by ongoing advancements in agricultural technology and a growing emphasis on sustainability. As farmers increasingly adopt precision agriculture techniques, the demand for high-quality seeds is expected to rise. Additionally, the collaboration between seed companies and research institutions will likely foster innovation, leading to the development of resilient seed varieties. This dynamic environment will create opportunities for growth and adaptation in the face of evolving agricultural challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Genetically Modified (GMO) Seeds Conventional Seeds Hybrid Seeds Open-Pollinated / Heirloom Seeds Organic Seeds |

| By Trait | Herbicide-Tolerant (HT) Insect-Resistant (IR) Disease-Resistant Drought- and Heat-Tolerant Other Value-Added Traits (nutrition, shelf life, quality) |

| By Crop Type | Cereals and Grains (corn, wheat, rice, sorghum) Oilseeds (soybean, canola/rapeseed, sunflower, cotton) Pulses Fruits and Vegetables Forage and Pasture Seeds Other Specialty and Horticultural Crops |

| By Seed Availability | Commercial / Certified Seeds Farm-Saved Seeds |

| By Seed Treatment Method | Chemical Seed Treatment Biological Seed Treatment Physical Seed Treatment Untreated Seeds |

| By End-User | Commercial Farms Smallholder and Family Farms Government and Research Institutions Home Gardening and Urban Farming Others |

| By Region | Australia North America Latin America Intra-regional Trade Flows (Australia–Americas) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seed Retailers in Australia | 120 | Store Managers, Sales Representatives |

| Agricultural Producers in the Americas | 100 | Farm Owners, Crop Managers |

| Seed Technology Innovators | 60 | Research Scientists, Product Development Managers |

| Government Agricultural Policy Makers | 50 | Policy Analysts, Regulatory Affairs Specialists |

| Seed Distributors and Wholesalers | 80 | Distribution Managers, Supply Chain Coordinators |

The Australia Americas Seeds Market is valued at approximately USD 1 billion, reflecting a five-year historical analysis of the combined commercial seed markets in Australia and key countries in the Americas, driven by demand for high-yield and disease-resistant crops.