Region:Asia

Author(s):Shubham

Product Code:KRAD2649

Pages:99

Published On:January 2026

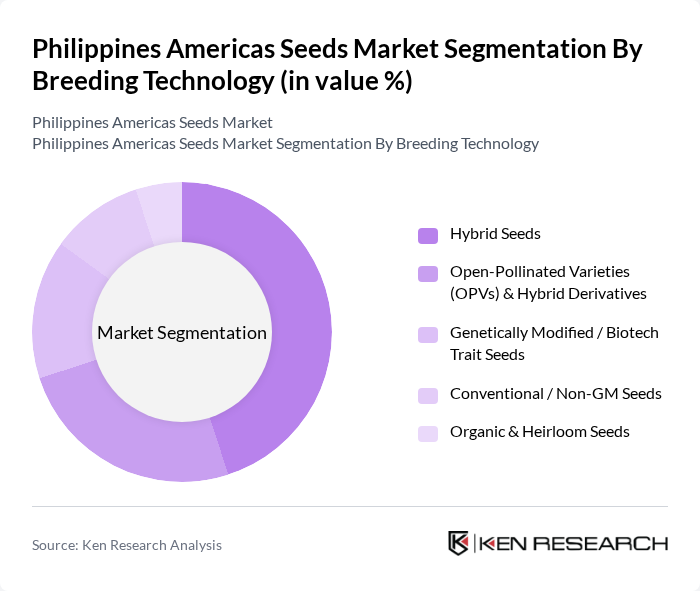

By Breeding Technology:The breeding technology segment includes various methods of seed production, which are crucial for meeting the diverse needs of farmers. The subsegments are Hybrid Seeds, Open-Pollinated Varieties (OPVs) & Hybrid Derivatives, Genetically Modified / Biotech Trait Seeds, Conventional / Non-GM Seeds, and Organic & Heirloom Seeds. Hybrid seeds are particularly popular due to their high yield potential, better uniformity, and resistance or tolerance to key pests, diseases, and abiotic stresses, making them a preferred choice among commercial growers, especially in rice, corn, and vegetables.

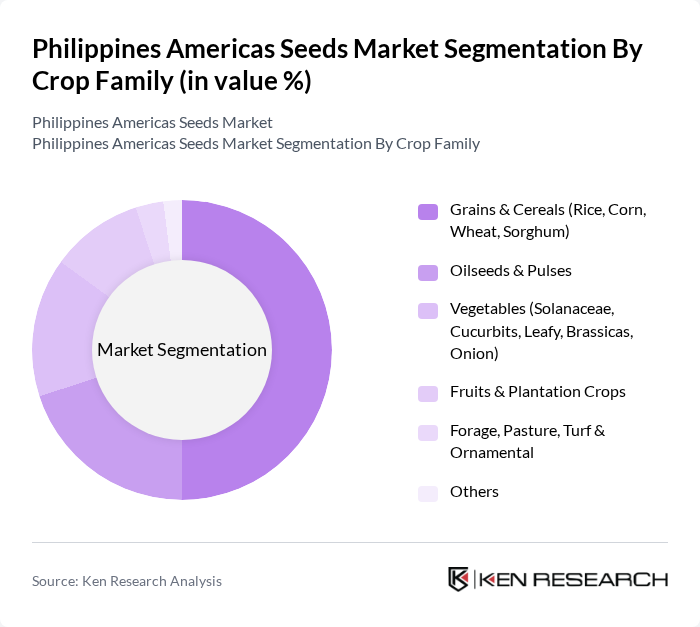

By Crop Family:The crop family segment encompasses various types of crops cultivated in the Philippines, including Grains & Cereals, Oilseeds & Pulses, Vegetables, Fruits & Plantation Crops, Forage, Pasture, Turf & Ornamental, and Others. Grains & Cereals, particularly rice and corn, dominate this segment due to their staple food status and high demand in domestic markets, while vegetable seeds represent a fast-growing segment driven by increasing fresh vegetable consumption and commercial vegetable production; fruits and plantation crops such as banana, coconut, and pineapple further support demand for improved planting materials.

The Philippines Americas Seeds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta Philippines Inc., Bayer CropScience Philippines, Corteva Agriscience Philippines, East-West Seed Philippines, Pioneer Hi-Bred (Corteva), Bioseed Research Philippines, SeedWorks Philippines Inc., Allied Botanical Corporation, Ramgo International Corporation, Condor Seed / Kaneko Seeds Philippines, Advanta Seeds Philippines, Philippine Seed Industry Association (PSIA), International Rice Research Institute (IRRI), Department of Agriculture – National Seed Industry Council (as regulator/ecosystem player), Other Emerging Local Seed Companies contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines seeds market is poised for significant transformation, driven by technological advancements and increasing consumer awareness of sustainable practices. As farmers increasingly adopt precision agriculture and digital platforms for seed distribution, the market is expected to witness enhanced efficiency and productivity. Furthermore, the government's commitment to agricultural innovation will likely foster collaboration between stakeholders, paving the way for new seed varieties that meet the evolving needs of the agricultural sector, ensuring food security and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Breeding Technology | Hybrid Seeds Open-Pollinated Varieties (OPVs) & Hybrid Derivatives Genetically Modified / Biotech Trait Seeds Conventional / Non-GM Seeds Organic & Heirloom Seeds |

| By Crop Family | Grains & Cereals (Rice, Corn, Wheat, Sorghum) Oilseeds & Pulses Vegetables (Solanaceae, Cucurbits, Leafy, Brassicas, Onion) Fruits & Plantation Crops Forage, Pasture, Turf & Ornamental Others |

| By Traits | Herbicide-Tolerant (HT) Insect-Resistant (IR) Stacked Traits Others |

| By Availability | Commercial Seeds Saved / Farm-Saved Seeds |

| By Seed Treatment | Treated Seeds Untreated Seeds Film-Coated & Pelleted Seeds |

| By Distribution Channel | Direct-to-Farmer / Company Field Teams Agro-Dealers & Retail Outlets Cooperatives & Farmers’ Associations Government Procurement & Subsidy Programs Online & Digital Platforms Others |

| By Region | Luzon Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Seed Distributors | 90 | Sales Managers, Regional Distributors |

| Smallholder Farmers | 140 | Farmers, Agricultural Cooperatives Members |

| Agricultural Extension Officers | 80 | Extension Workers, Agronomists |

| Seed Retailers | 70 | Store Managers, Retail Buyers |

| Research Institutions | 60 | Researchers, Agricultural Scientists |

The Philippines Americas Seeds Market is valued at approximately USD 210 million, reflecting a significant growth driven by the demand for high-yield and disease-resistant seed varieties, as well as government initiatives aimed at enhancing agricultural productivity.