Region:Asia

Author(s):Shubham

Product Code:KRAD2654

Pages:88

Published On:January 2026

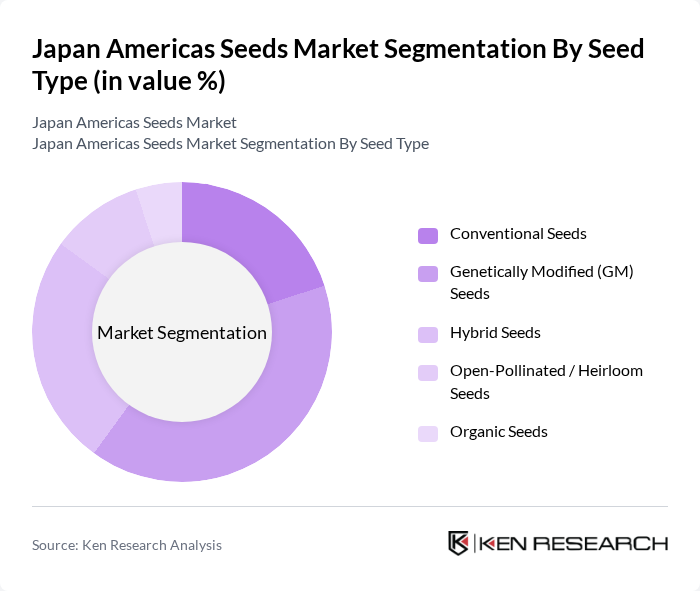

By Seed Type:The seed type segmentation includes various categories such as Conventional Seeds, Genetically Modified (GM) Seeds, Hybrid Seeds, Open-Pollinated / Heirloom Seeds, and Organic Seeds. This structure aligns with common segmentation used in seed industry analyses for both Japan and the Americas, where conventional, GM, hybrid, and specialty/organic seed types are standard categories. In practice, Hybrid Seeds and GM Seeds (especially GM hybrids in major row crops) account for the largest share of commercial seed sales in the Americas, while Japan combines strong demand for high-quality hybrid vegetable and rice seeds with selective use of GM seeds in feed and processing chains. Organic and open-pollinated / heirloom seeds represent a smaller but rapidly growing niche, supported by rising consumer interest in organic and locally adapted varieties, particularly in Japan’s organic segment and specialty markets across North and Latin America.

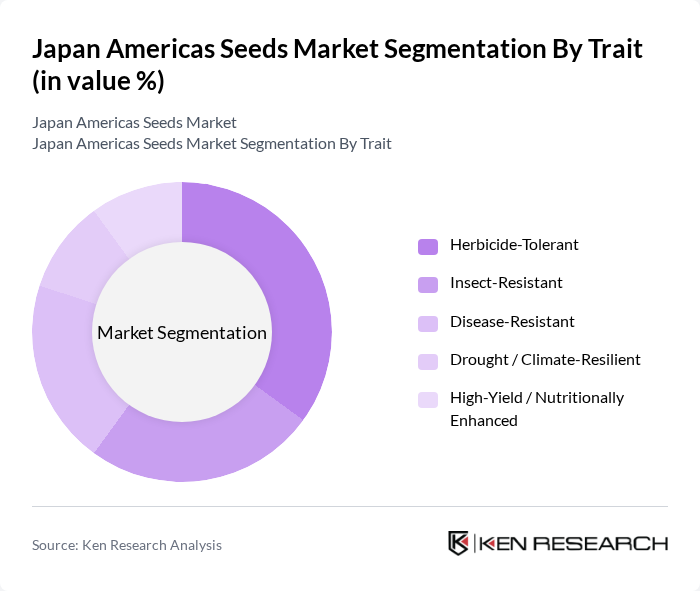

By Trait:The trait segmentation encompasses Herbicide-Tolerant, Insect-Resistant, Disease-Resistant, Drought / Climate-Resilient, and High-Yield / Nutritionally Enhanced seeds. This trait-based breakdown is consistent with how commercial GM and conventionally bred traits are categorized globally, with herbicide-tolerant and insect-resistant traits dominating in major field crops such as soybean, maize, and cotton in the Americas. Disease-resistant and climate-resilient traits are increasingly important in both Japan and the Americas as producers respond to disease pressure, extreme weather, and sustainability requirements, while high-yield and nutritionally enhanced traits are gaining traction in premium and value-added segments.

The Japan Americas Seeds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience AG, Syngenta AG, Corteva Agriscience (Pioneer, Brevant, etc.), BASF SE, KWS SAAT SE & Co. KGaA, Groupe Limagrain (Vilmorin & Cie), Sakata Seed Corporation, Takii & Co., Ltd., Nippon Norin Seed Co., Ltd., East-West Seed, Rijk Zwaan Zaadteelt en Zaadhandel B.V., Bejo Zaden B.V., Seminis Vegetable Seeds (Bayer), AgReliant Genetics LLC, Regional & Local Seed Companies in the Americas (e.g., UPL Advanta, Longping High-Tech’s Americas Operations) contribute to innovation, geographic expansion, and service delivery in this space.

The Japan Americas Seeds Market is poised for transformation, driven by technological advancements and a growing emphasis on sustainability. As precision agriculture becomes more prevalent, farmers are expected to adopt digital farming solutions, enhancing productivity and resource efficiency, consistent with Japan’s promotion of smart agriculture and data-driven farming under its digital and smart agriculture policies. Additionally, the focus on climate-resilient crops will shape research priorities, ensuring that seed varieties can withstand environmental challenges. This evolving landscape presents opportunities for collaboration and innovation, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Seed Type | Conventional Seeds Genetically Modified (GM) Seeds Hybrid Seeds Open-Pollinated / Heirloom Seeds Organic Seeds |

| By Trait | Herbicide-Tolerant Insect-Resistant Disease-Resistant Drought / Climate-Resilient High-Yield / Nutritionally Enhanced |

| By Crop Type | Cereals and Grains (e.g., Rice, Wheat, Maize) Oilseeds and Pulses (e.g., Soybean, Canola) Fruits and Vegetables Forage, Turf and Ornamental Crops Other Commercial Crops |

| By Application / End-User | Commercial Farms Smallholder / Family Farms Agricultural Cooperatives Research & Breeding Institutions Government & Public Sector Programs |

| By Distribution Channel | Direct Sales (B2B) Agri-Input Retailers & Dealers Cooperatives & Producer Organizations Online & Digital Platforms Other Channels |

| By Seed Treatment | Treated Seeds Non-Treated Seeds |

| By Region | Japan North America Latin America Other Americas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seed Distribution Channels | 120 | Distributors, Retail Managers, Agronomists |

| Crop-Specific Seed Usage | 90 | Farmers, Crop Consultants, Agricultural Researchers |

| Seed Innovation and Technology Adoption | 60 | R&D Managers, Product Development Specialists |

| Market Trends and Consumer Preferences | 110 | Market Analysts, Retail Buyers, Agricultural Economists |

| Regulatory Impact on Seed Market | 50 | Policy Makers, Compliance Officers, Industry Experts |

The Japan Americas Seeds Market is valued at approximately USD 27 billion, combining the seed markets of Japan and the Americas. This figure reflects the growing demand for high-quality seeds and advancements in agricultural technology.