Region:Middle East

Author(s):Dev

Product Code:KRAC4760

Pages:89

Published On:October 2025

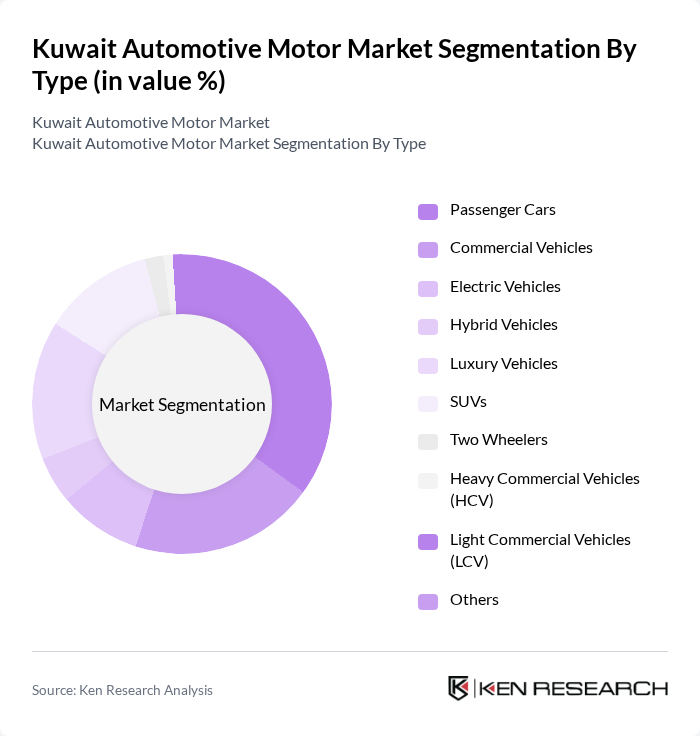

By Type:The market is segmented into passenger cars, commercial vehicles, electric vehicles, hybrid vehicles, luxury vehicles, SUVs, two-wheelers, heavy commercial vehicles (HCV), light commercial vehicles (LCV), and others. Passenger cars and SUVs are especially popular due to their versatility, comfort, and suitability for both urban and desert environments. The electric vehicle segment is rapidly expanding, supported by government incentives and infrastructure investments, while luxury vehicles maintain strong demand among high-income consumers.

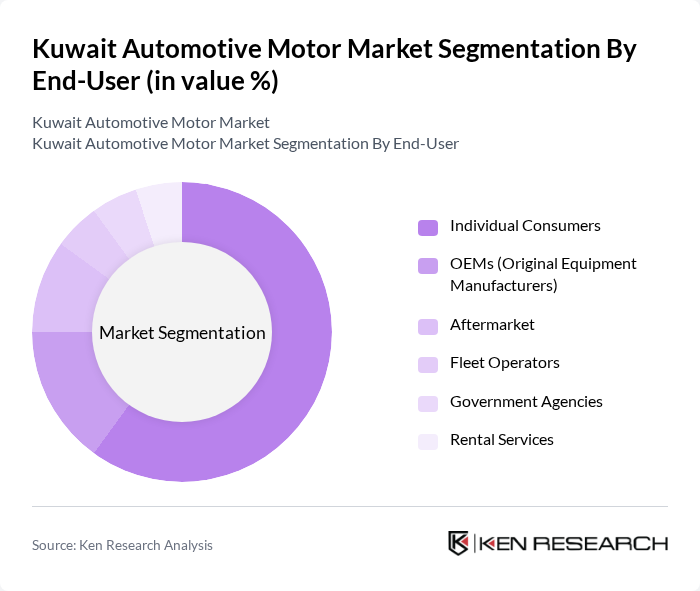

By End-User:The end-user segmentation includes individual consumers, OEMs (Original Equipment Manufacturers), aftermarket services, fleet operators, government agencies, and rental services. Individual consumers are the largest segment, reflecting the strong culture of personal vehicle ownership and the increasing availability of flexible financing. Fleet operators and government agencies are expanding their presence, particularly in the electric and hybrid vehicle categories, as part of sustainability initiatives.

The Kuwait Automotive Motor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alghanim Industries, Abdulmohsen Abdulaziz Al-Babtain Company, Al-Mulla Group, Al-Futtaim Group, Al-Sayer Group, Al-Jazeera Automotive, Al-Mansour Automotive, KIA Motors Kuwait (Al Mutawa Group), Al-Mazaya Holding, Gulf Automotive, Al-Homaizi Group, Al-Qatami Global for General Trading, Al-Sabhan Group, Al-Khaldi Group, and Al-Mutawa Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait automotive market appears promising, driven by increasing consumer interest in electric vehicles and advancements in smart transportation technologies. As the government continues to promote sustainable mobility initiatives, the adoption of electric vehicles is expected to rise significantly. Additionally, the integration of advanced driver-assistance systems (ADAS) will enhance vehicle safety and appeal, further stimulating market growth. The overall landscape is set for transformation, with innovative solutions paving the way for a more connected and efficient automotive ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Cars Commercial Vehicles Electric Vehicles Hybrid Vehicles Luxury Vehicles SUVs Two Wheelers Heavy Commercial Vehicles (HCV) Light Commercial Vehicles (LCV) Others |

| By End-User | Individual Consumers OEMs (Original Equipment Manufacturers) Aftermarket Fleet Operators Government Agencies Rental Services |

| By Sales Channel | Direct Sales Dealerships Online Platforms Auctions |

| By Price Range | Budget Vehicles Mid-Range Vehicles Premium Vehicles |

| By Fuel Type | Petrol Diesel Electric Hybrid |

| By Vehicle Age | New Vehicles Used Vehicles |

| By Region | Urban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Market | 100 | Car Owners, Dealership Managers |

| Commercial Vehicle Sector | 60 | Fleet Managers, Logistics Coordinators |

| Electric Vehicle Adoption | 40 | Environmental Advocates, Automotive Engineers |

| Aftermarket Services | 50 | Service Center Owners, Parts Suppliers |

| Consumer Preferences and Trends | 80 | General Consumers, Automotive Enthusiasts |

The Kuwait Automotive Motor Market is valued at approximately USD 3.6 billion, reflecting a robust growth driven by increasing consumer demand for personal vehicles, rising disposable incomes, and urbanization trends.