Region:Middle East

Author(s):Rebecca

Product Code:KRAD7433

Pages:95

Published On:December 2025

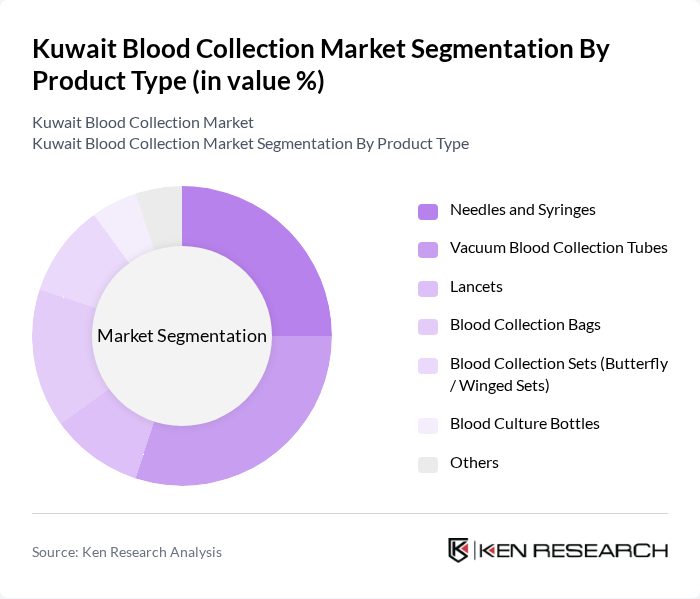

By Product Type:The product type segmentation includes various essential items used in blood collection. The leading sub-segment is vacuum blood collection tubes, which are widely used due to their efficiency and safety in sample collection. Needles and syringes also hold a significant share, driven by their necessity in both clinical and home settings. The demand for blood collection bags and culture bottles is growing, particularly in hospitals and research facilities.

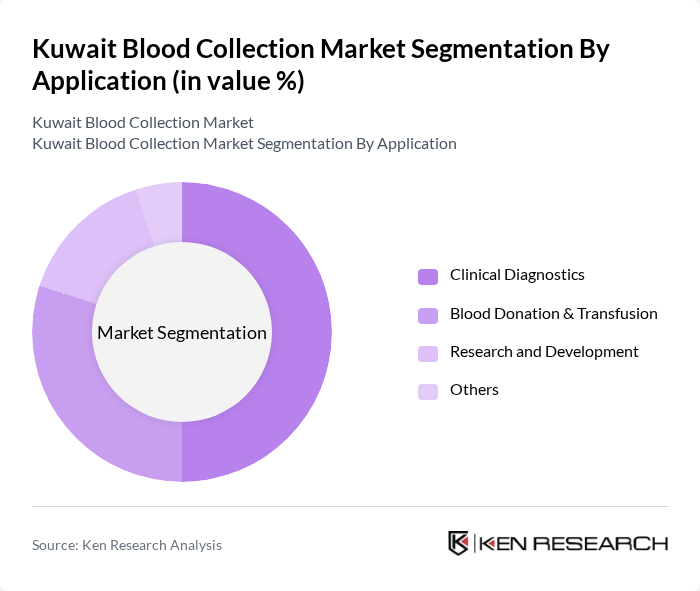

By Application:The application segmentation highlights the various uses of blood collection products. Clinical diagnostics is the leading application, driven by the increasing number of diagnostic tests performed in hospitals and laboratories. Blood donation and transfusion services are also significant, supported by government initiatives to encourage voluntary blood donations. Research and development applications are growing, particularly in academic and clinical research settings.

The Kuwait Blood Collection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), Terumo Corporation, Greiner Bio-One International GmbH, SARSTEDT AG & Co. KG, Medtronic plc, Nipro Corporation, Fresenius Kabi AG, Kawas Consulting & Medical Supplies Co. W.L.L., Al-Ghanim Healthcare (Alghanim Healthcare), Advanced Technology Company K.S.C. (ATC), Kuwait Central Blood Bank (Ministry of Health), Jaber Al-Ahmad Hospital, Mubarak Al-Kabeer Hospital, Al-Amiri Hospital, Kuwait Red Crescent Society contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait blood collection market appears promising, driven by ongoing technological advancements and increased government support. As healthcare expenditure is projected to rise by 6% in future, investments in blood collection infrastructure and training programs are expected to enhance operational efficiency. Additionally, the integration of digital platforms for donor engagement will likely improve donor retention and participation rates, ensuring a more stable blood supply for the healthcare system.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Needles and Syringes Vacuum Blood Collection Tubes Lancets Blood Collection Bags Blood Collection Sets (Butterfly / Winged Sets) Blood Culture Bottles Others |

| By Application | Clinical Diagnostics Blood Donation & Transfusion Research and Development Others |

| By Collection Method | Venous Blood Collection Capillary Blood Collection Automated Blood Collection Manual Blood Collection |

| By End-User | Hospitals and Clinics Diagnostic Laboratories Blood Banks Research and Academic Institutes Others |

| By Material | Glass-Based Devices Plastic / PET-Based Devices Others |

| By Distribution Channel | Direct Sales (Tenders & Contracts) Distributors / Dealers Online Procurement Platforms Others |

| By Region | Capital Governorate (Al Asimah) Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Al Jahra Governorate Mubarak Al-Kabeer Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Blood Collection Practices | 100 | Blood Bank Managers, Hospital Administrators |

| Community Blood Donation Drives | 80 | Event Coordinators, Community Health Workers |

| Public Awareness Campaigns | 60 | Public Health Officials, NGO Representatives |

| Donor Experience Feedback | 120 | Regular Blood Donors, First-time Donors |

| Technological Innovations in Blood Collection | 70 | Medical Device Manufacturers, Healthcare Innovators |

The Kuwait Blood Collection Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is attributed to increased demand for blood transfusions, advancements in collection technologies, and government initiatives promoting blood donation.